As media from around the world gathered outside the Manhattan courthouse ahead of opening arguments in Donald Trump’s hush money trial, one New Yorker summed up the growing mood among many:

“I don’t give a damn,” the young woman said, ignoring questions about what it felt like to witness history.

She had been dragged to the show by a visiting friend from California, who is still fascinated by the novelty of seeing a former president questioned over an alleged affair with a porn star.

While everyone else remains enthralled by the legal disputes surrounding the world’s greatest showman, the city that never sleeps is growing tired of its ongoing circus and would like to move to another city.

Monday marked the first time a court heard legal arguments in a criminal trial against a current or former American president.

But Trump’s appearances in Manhattan courtrooms are piling up.

A handful of protesters showed up outside the downtown Manhattan courthouse Monday morning ahead of opening arguments in Donald Trump’s hush money trial.

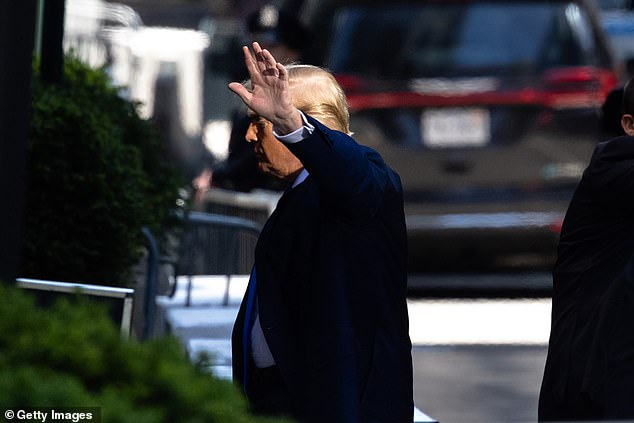

Trump speaks to the media after the first day of opening arguments in his trial in Manhattan Criminal Court for falsifying documents related to hush payments.

Abul Azad, who runs a kiosk on the corner of Center Street and White Street on the northeast side of the court, said sales over the past week had fallen by more than half as customers were locked out.

He has already been convicted in two civil cases in New York – fraud and sexual assault – and the crowds that had turned out to see him today were nothing compared to those that turned out en masse at his arraignment in April of last year. .

Last week, the scene in and around 100 Center Street, the main criminal courts building, was one of chaos.

Potential jurors were vetted and dismissed among crowds of MAGA supporters and police officers in tactical gear.

On Friday, protester Max Azzarello, 37, died after setting himself on fire in Collect Pond Park, just outside the courthouse.

Now, fatigue is starting to set in.

This morning, the police handily outnumbered the few staunch protesters.

Nearby businesses lamented declining sales, as roadblocks stifled foot traffic to hot dog vendors and kiosks.

Abul Azad, who runs a kiosk on the corner of Center Street and White Street on the northeast side of the court, said sales over the past week had fallen by more than half as customers were locked out.

They’ve seen it all before.

“I hate to say this, but in New York it’s not a big deal,” said John Costigan, 63, a retired police officer who had shown up from his apartment in Battery Park City to watch the action unfold.

‘This city is bigger than Trump. He was working on the street when ‘Puff Daddy’ [Sean Combs] was on trial [in 2001, when the rapper was acquitted of toting an illegal handgun into a crowded Manhattan hip-hop club].

“This is like a little bump in the road.”

Former President Donald Trump returns to Trump Tower from Manhattan Criminal Court on April 22, 2024 in New York City

John Costigan, a retired New York police officer, said the trial “wasn’t as big a deal” for New Yorkers as it was for the rest of the world, since Big Apple citizens had seen it all before.

“Pray for Trumpy” is written on a sidewalk in front of Manhattan Criminal Court.

Costigan had struck up a conversation with Rodney, 63, and Nicole Cole, 57, a couple vacationing in Australia, who had decided that the commotion at the downtown courthouse was what they wanted to see above all the other attractions in the city. Big Apple in this beautiful spring. tomorrow.

They admitted to being “disappointed.”

Others had also come from all over. There was Flo and Alex Stone, from Bristol, England, who were hoping to see Trump himself, and a couple from Finland.

Another New Yorker had reluctantly agreed to take her friend from Copenhagen, Denmark, to see the latest installment of the New York case against Donald J. Trump.

But the pair left shortly after 9:30 a.m., realizing there was little on display other than a dozen media crews, bored-looking police officers, and a handful of eccentric protesters.

What did you expect?

There was certainly little of the terrifying drama that unfolded here on Friday.

There were no signs of that horrible fire left (apart from a slight increase in security) as the public continued to mingle in the same place where Azzarello had self-immolated just days before.

Today, the few protesters present were divided into pro- and anti-Trump camps.

But there was a touching moment between two lifelong New Yorkers from opposite sides of the political divide, coming together in unity.

Pro-Trump protester Vinny L was one of a dwindling number of protesters who showed up in court Monday as opening arguments were heard.

Vinny was joined by Richie S, who admitted he didn’t like Trump and wanted him to be held accountable, but the two were able to come together in a show of unity among New Yorkers.

Richie S, 73, and Vinny L, 62, [who declined to give surnames] The two had made the short boat trip from Staten Island to the courthouse.

The pair, who did not know each other, chatted amicably despite Richie admitting he “hated” Trump, while Vinny believed the trial was a case of “government overreach.”

Last week’s jury selection exposed the deep rifts in American society and how difficult it could be to find a dozen New Yorkers who have not yet formed a definitive opinion about Trump’s guilt or innocence.

But as Staten Islanders engaged in a lively debate over the issue, Richie said he was “overwhelmed with joy” to have at least been able to have a civil discussion with someone on the other side of the fence.

Does it show that New Yorkers can put aside their prejudices and give the most divisive man in the world a fair trial?

Richie refrains from speaking for now.

“You just have to hope that people do the right thing,” he said.