Table of Contents

An Indian billionaire is set to become BT’s biggest shareholder after agreeing to buy almost 25 per cent of the telecoms group.

Sunil Bharti Mittal’s Bharti Enterprises conglomerate is set to acquire French tycoon Patrick Drahi’s 24.5 percent stake in BT.

The deal will be carried out in two parts: Bharti will initially acquire a 9.99 per cent stake, followed by another 14.51 per cent once it receives national security clearance from the government.

This comes just two months after Mexican billionaire Carlos Slim bought a 3.2 percent stake in BT.

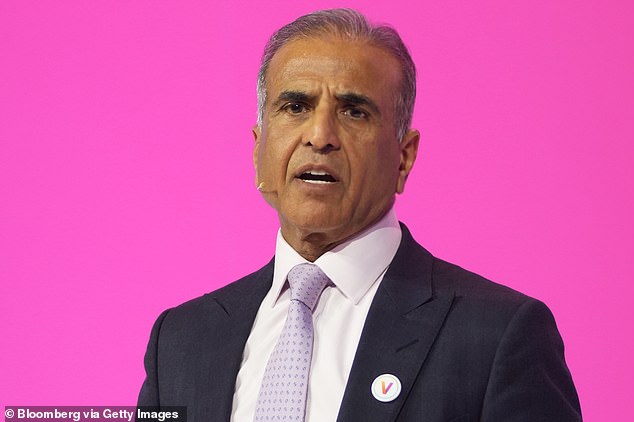

Connection: Sunil Bharti Mittal (pictured) will buy the 24.5% of BT currently held by French tycoon Patrick Drahi through his Bharti Enterprises conglomerate

Mittal, whose telecoms business Bharti Airtel has more than 400 million customers in India and operations in Africa, said he has not applied for a board seat and has no intention of launching a full-blown takeover bid for the company.

“This investment demonstrates the confidence we have in BT and the UK,” he said.

BT shares rose 8.4 percent, or 11 pence, to 141.5 pence. That valued the company at 14 billion pounds and Bharti’s proposed 24.5 percent stake at 3.4 billion pounds, although the shares are still well below recent highs.

The move comes just six months after Allison Kirkby took over as BT’s chief executive from Philip Jansen.

Since then, he has been pushing a recovery plan that includes job cuts and shares have risen 26 percent.

She said yesterday: “We welcome investors who recognise the long-term value of our business, and this scale of investment from Bharti is a major vote of confidence in the future of BT and our strategy.”

The deal marks the end of the seemingly uneasy relationship between BT and Drahi.

His Altice group, one of France’s largest telecoms companies, bought a 12% stake in BT in July 2021 before increasing it to 18% five months later and then to 24.5% last summer.

Lose: French tycoon Patrick Drahi has seen the value of his stake in BT plummet

This sparked speculation that Altice was looking to make a takeover bid for BT. However, the value of the stake plummeted (leaving Drahi with losses of close to £1bn, according to some estimates) and speculation has increased that it was looking to offload the shares.

The Bharti deal comes as Altice sells off assets due to its £48bn debt load.

Last week, Drahi agreed to sell a minority stake in auction house Sotheby’s to Abu Dhabi’s sovereign wealth fund. James Ratzer, an analyst at telecoms research group New Street Research, said: “We think Drahi’s bankers are probably demanding he sell his BT shares.”

He added that “there are probably also concerns on the part of bankers about the rest of the Altice group.”

BT’s relationship with Bharti dates back almost three decades; the company held a 21 per cent stake and two board seats in the Indian telecoms firm’s Airtel subsidiary between 1997 and 2001.

“BT has enjoyed a long-standing partnership with Bharti and I am pleased that they share our ambition and vision for the future of our business,” Kirkby said.

“They have a strong track record of success in the industry and I look forward to continuing to work with them positively in the months and years ahead.”

Mittal is just the latest high-profile investor to join the share register, where he now appears alongside Slim and German group Deutsche Telekom, which has a 12 percent stake.

Paolo Pescatore, a telecoms manager at PP Foresight, said Mittal’s decision to buy BT “reinforces BT’s ongoing strategy for long-term growth”.

Russ Mould, of broker AJ Bell, said: “Management will be pleased to hear that Bharti supports the company’s current strategy, although they will clearly want to see evidence of progress that can revive a share price that has gone nowhere in the past five years.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.