A real estate magnate and heir to an Indian diamond fortune tried to downplay his vast real estate empire so he wouldn’t have to pay his brothers more than the $7 billion a jury demanded he disburse.

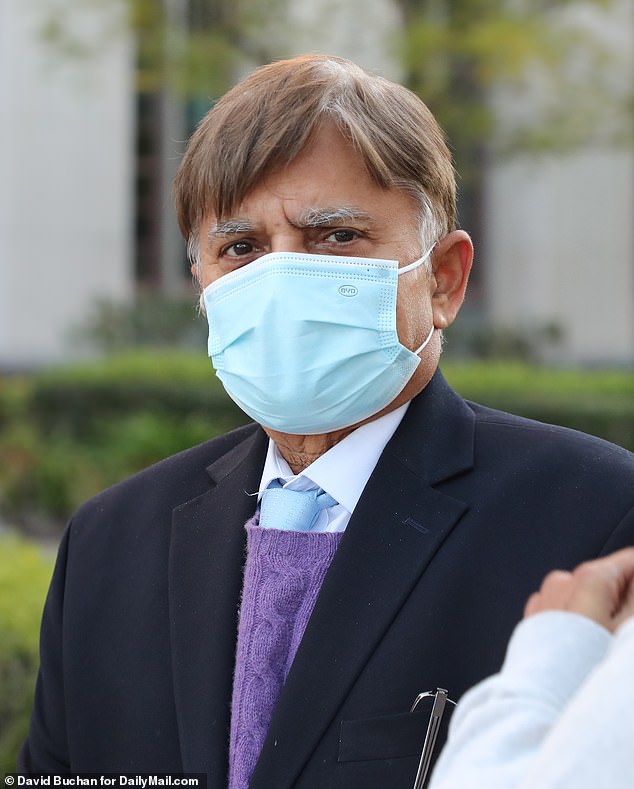

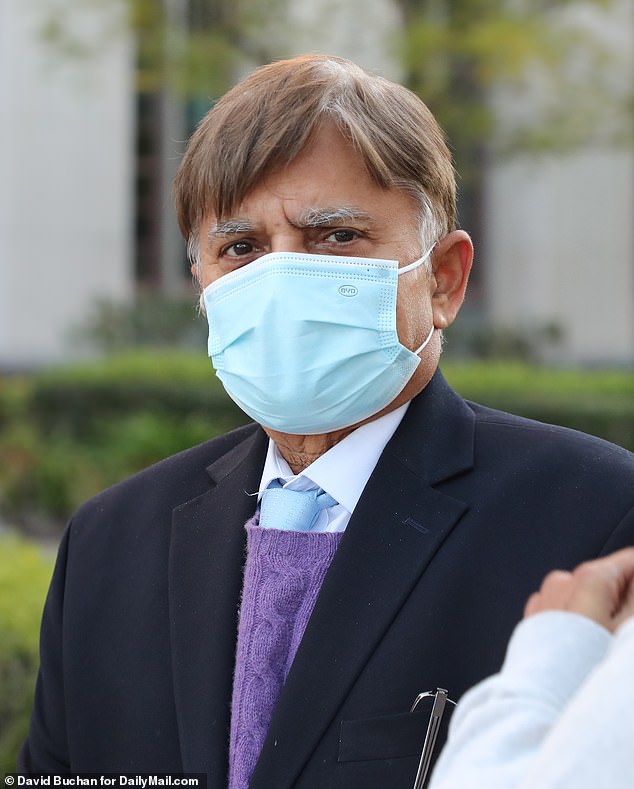

A frustrated Haresh Jogani took the stand in a Los Angeles court on Monday and said he “didn’t know exactly” how much his various investments and real estate assets were worth.

“As I said before, zero…minus,” Jogani said when asked by his lawyer about the value of one of his companies, JK Properties.

Last week, a jury ruled that Jogani must pay his four brothers, Shashikant, Rajesh, Chetan and Shailesh, $7 billion for failing to honor an oral agreement that would divide the family’s extensive real estate portfolio among the brothers. .

The family is back in court to determine punitive damages in the case in which Jogani could give even more money to his siblings.

Haresh Jogani testified in a Los Angeles court on Monday that the value of one of his real estate companies was “zero.” He was testifying after a jury ordered him to pay $7 billion to his brothers in a long-running lawsuit.

The amount you may have to pay could increase significantly after the jury decides on punitive damages this week.

The brothers, who inherited a lucrative diamond fortune from their father, have an extensive real estate portfolio that includes more than 170 apartment buildings and 17,000 units in the San Fernando Valley, as well as properties in Texas and Nevada.

Last week, the jury determined that Haresh should pay $7 billion to his brothers after one of them filed a lawsuit 20 years ago. Now, jurors must decide how much they should be awarded in punitive damages.

Judge Susan Bryant-Deason on Monday told jurors they have to decide whether Haresh caused “physical harm and disregard for the health of others,” including the “weak and vulnerable.”

He also told jurors they could consider “how reprehensible” Haresh’s conduct was in determining the dollar amount of punitive damages.

One of the victimized brothers, Shashikant, testified briefly on Monday and said the companies that owned the family’s real estate interests made about $180 million in 2019 alone.

The five Jogani brothers, who are between 50 and 70 years old, have been embroiled in the nasty lawsuit that dates back to 2003, when Shashikant Jorgani sued brother Haresh for failing to honor their oral agreement.

Haresh Jogani claimed that he was the sole shareholder of the real estate companies, but the other four brothers claimed that they also had a nominal title to the properties.

However, a contract was never signed between the brothers.

The brothers, who inherited a lucrative diamond fortune from their father, have an extensive real estate portfolio that includes more than 170 apartment buildings and 17,000 units in the San Fernando Valley, as well as properties in Texas and Nevada.

Haresh and his lawyers have been directed not to carry out any major transactions related to his properties and assets, such as refinancing any property in the vast portfolio.

Last week, a jury ruled that Haresh must pay Rajesh and Chetan $750 million in damages plus real estate interest valued at more than $1 billion. Shashikant, who initially sued Haresh, was awarded $4.75 million by the jury.

William Akerman, a forensic accountant, testified Monday that he was unable to assess how much Haresh earned from his real estate, asset, investment and trust businesses because Haresh failed to file 32 of his tax returns.

He said Haresh has also failed to hand over documents of his various bank accounts, including accounts in the United Arab Emirates and Israel.

“There were indications that Haresh received $50 million in 2021 and $100 million in 2022, but we don’t know how it was accounted for,” Akerman said. “He may be right in front of me, but they haven’t provided me with the documentation to find the trail.”

The five Jogani brothers, who are between 50 and 70 years old, have been embroiled in the nasty lawsuit that dates back to 2003, when Shashikant Jorgani sued brother Haresh for failing to honor their oral agreement. Pictured: Chetan Jordani leaves a California courtroom on Monday

Last week, a jury ruled that Haresh must pay Rajesh (pictured) and Chetan $750 million in damages plus real estate interest valued at more than $1 billion. Shashikant, who initially sued Haresh, received $4.75 billion from the jury

Haresh Jogani claimed that he was the sole shareholder of the real estate companies, but the other four brothers claimed that they also had a nominal title to the properties.

Akerman said he believed Haresh was “spreading” his cash flow across his various businesses and possibly into foreign bank accounts, even though Haresh claimed his real estate portfolio was worth “negative.”

“Haresh was taking and distributing himself over time,” the forensic accountant testified. “Logic tells me that when you have a negative retained balance on everything you’ve earned for 22 years, it was distributed elsewhere.”

The judge reminded Haresh and his attorneys that he was ordered not to make any major transactions related to his properties and assets, such as refinancing any of the more than 170 properties he owns in California.

“I assume no money comes out of any bank account except for regular expenses,” the judge told Haresh and his lawyers.

Haresh is expected to continue his testimony on Tuesday.