The in-car payments market is forecast to surpass £434bn by 2030, bold new market research claims.

In-car payments allow drivers to make transactions automatically and securely through the vehicle’s software, without the need for cards or smartphone payment systems.

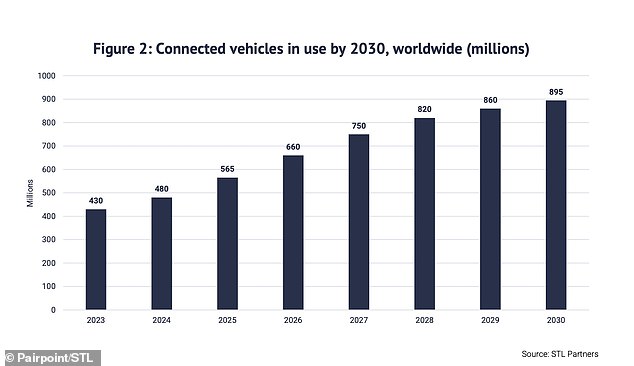

At the same time, the number of connected vehicles on roads globally is expected to reach almost 900 million.

In 2023, Mercedes-Benz has partnered with Mastercard to introduce native in-car payments at the pump, which use fingerprint identification to confirm payments.

Today, your car doesn’t just get you from A to B. Connected vehicles are now a wallet on wheels.

Through your car’s technology, you can automatically and securely pay for a wide range of goods and services, including moving insurance, parking, food and drink or even entertainment.

Drivers don’t need cars or mobile apps – the car software will automatically pay for you.

Pairpoint, together with STL Partners and in collaboration with Vodafone, has analyzed the enormous growth in in-car payments that is expected to occur by the end of the decade in Powering the Future: The $580 Billion In-Car Payment Opportunity.

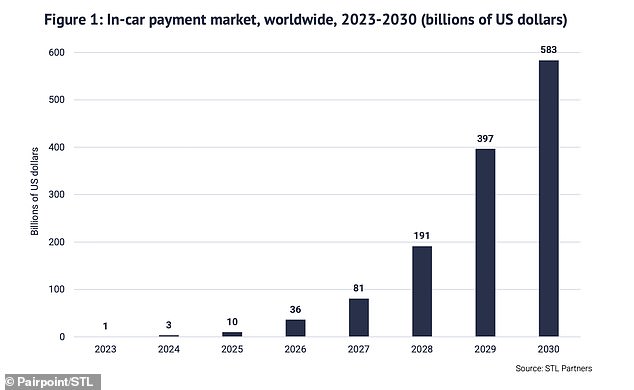

Pairpoint has forecast that by 2030, the global in-car transactional payments market will be worth £434 billion ($580 billion).

This puts the compound annual growth rate over just a seven-year period between 2023 and 2030 at 130 percent.

Franz Reiner, Chairman of the Board of Management of Mercedes-Benz Mobility AG, said that Mercedes Pay+ is “an intuitive payment process and a first-class customer experience that lays the foundation for the success of digital offers.”

Pairpoint has forecast that by 2030, the global in-car transactional payments market will be worth £434 billion.

At the same time, the global connected vehicle market is expected to grow from 430 million to 895 million vehicles.

“Advanced connectivity is a catalyst for new ways to interact with modern vehicles.

“Adding native payment functionality will enable more secure, automatic and real-time use of everyday services such as parking, electric vehicle charging, refueling and more,” said Jorge Bento, CEO of Pairpoint.

Electric vehicles have been a major pioneer in this area and have rapidly accelerated the growth of in-car payments, as the technology used for electric vehicle charging payments has transformed the industry.

By 2030, the global connected vehicle market is expected to grow from 430 million to 895 million vehicles.

Although mass in-car payments began in 2018, the industry faced challenges in creating a seamless and secure experience.

But Pairpoint has noted that recent advances in biometric authentication, artificial intelligence, blockchain and cloud tokenization have accelerated the adoption of in-car payments, and drivers can now use in-car payment in a highly secure and frictionless way. , which allows a better user experience than the traditional one. card payments.

Mastercard’s Joseph Losavio said: “The automotive industry is moving from a car being purely a physical asset to becoming a connected device that enables payments across the ecosystem.”

What are payments in the car?

In-car payments are defined as: “Being able to purchase products or services natively from the car, where the car itself acts as a payment authenticator to create a frictionless experience for the consumer.”

Vehicle-related payments

These are operational and maintenance costs, such as charging or parking, refueling or even automatic tolling.

STL estimates that vehicle-related payments will account for 70 percent of total in-car payment opportunities.

Non-vehicle payments

These are e-commerce transactions that turn your car into a mobile shopping platform; everything from entertainment subscriptions like Netflix to grocery shopping or ordering fast food.

STL estimates that non-vehicle payments will account for 25 percent of total in-car payment opportunities.

On-demand software updates

BMW first revealed its plans to offer a subscription service for features in 2020, although it has only offered monthly rates for heated seats and steering wheel starting in 2022.

We recently covered in more detail what over-the-air software updates are and how they work.

In short, though, over-the-air updates are software downloads that update your car overnight, similar to how a smartphone updates while you sleep.

On-demand software updates are the third category of paid in-car upgrades (add-on in-car upgrades like heated seats and adaptive cruise control), as many of them require additional money, meaning they don’t come as an OTA. free.

More and more manufacturers are asking drivers to pay for additional features via OTA.

STL estimates that non-vehicle payments will account for 5 percent of the total in-vehicle payment opportunity.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.