Table of Contents

Investment scams: Victims lost an average of £26,773, figures from last three years show

Investment scams are not as common as urgent payment scams, but in comparison, the amounts lost are enormous.

Police figures for the last three years reveal that victims lost an average of £26,773.

Victoria Hasler, head of funds research at Hargreaves Lansdown, explains how to avoid getting caught by heartless scammers who want to loot your investments.

Remember how your grandmother always told you that if something seems too good to be true, it probably is?

You would do well to apply this advice to investments as well.

Advertisements that promise tantalizingly high returns, or guaranteed returns, or linear returns make us very nervous. Because? Because they could be scams.

Here are four big clues to keep in mind to check if an investment is too good to be true.

1. Investments that promise returns above historical averages

Investment returns will vary over time and some years will be better than others.

However, we advise caution if someone tells you that you can earn returns much higher than the long-term historical average.

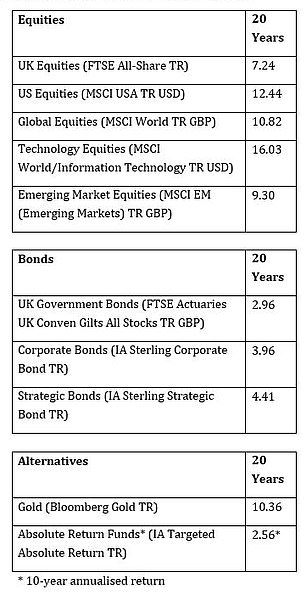

But what is too good to be true? We have calculated 20-year annualized returns for a variety of assets below.

If they show you an investment and tell you that you can achieve much higher returns than these, you may want to ask yourself why.

We’re not saying it’s impossible to get more than history suggests, but higher returns are often a trade-off for higher risk.

You also shouldn’t panic if your investments return much higher or lower than these returns in a given year.

Remember that these are averages over 20-year periods and for any given year, returns are likely to be higher or lower.

Source: Lipper IM as of 09/30/24

Ask exactly where your money will be invested and then take a look at the returns below.

For stocks, long-term returns of around 7-10 percent per year should be expected.

Technology returns have been very high in recent years, skewing the long-term average for the sector, but we wouldn’t necessarily expect that to continue in the coming years.

This has also skewed US profitability a bit, as the US market is technology-heavy.

If your investment is in bonds, then you should probably expect a return of between 3 and 5 percent annually.

As interest rates fall, we may have a couple of better years for bonds, but again you shouldn’t expect that to last forever.

If you’re investing elsewhere, the comparisons get a little more complicated. Gold has enjoyed a good run lately, returning 618 percent over the past 20 years.

Again, we wouldn’t necessarily expect this to continue, so let’s be a little cautious.

As for investment providers who claim they will try not to make you lose money in the long term, you may want to compare their returns with the Investment Association’s absolute return sector.

Funds in this sector will continue to rise and fall in value and may lose money over shorter periods of time, but they are invested in such a way that they attempt to maintain their value over the long term.

This sector is a little newer than others, so we have analyzed the returns of the last 10 years.

2. Investments with promised or guaranteed profitability

In this world nothing can be said to be certain, except death and taxes. That’s what one of the founding fathers of the United States, Benjamin Franklin, said.

He was referring to the US Constitution, but he could easily have been talking about investments.

This is easy: if someone is absolutely adamant about guaranteeing you a return on anything other than cash, my advice would be to politely decline and run in the opposite direction as quickly as you can.

Victoria Hasler: If someone guarantees you a refund with something other than cash, politely decline and run in the opposite direction.

Investments compensate you for taking risks. They are not guaranteed.

The closest you will get is to put money in the bank (as long as it doesn’t go over the £85,000 limit that the government “guarantees” as long as you are solvent).

Even government bonds are known to have defaulted. Investments are not guaranteed.

3. A trip that is too simple

A much maligned phrase that constantly appears in compliance warnings is: Your investments can fall as well as rise in value.

However, I would almost be tempted to change that line and say that your investments should decrease and increase in value.

Of course, we all hope that over the long term our investments will grow, and if you choose your investments wisely, history suggests that they will.

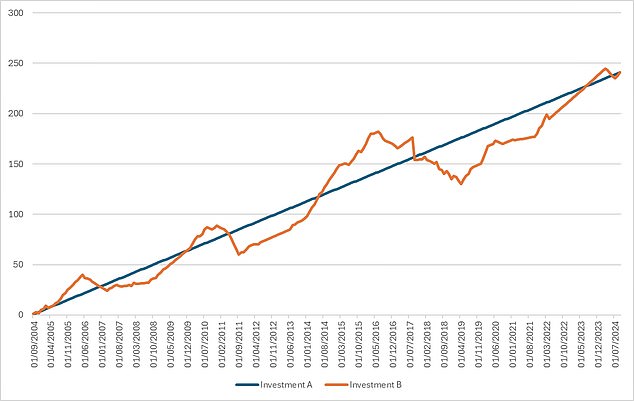

However, this will never be in a straight line. Take a look at the historical performance graph for the investment you are considering.

Does the line rise in a straight or nearly straight path? Markets experience ups and downs and so do your investments.

If the return profile seems too good to be true, it probably is. In the illustrative chart below, investment A may look attractive, but investment B’s path is much more realistic.

There are some investment schemes that artificially smooth out returns to deliberately give investors a better ride (think “with profit” funds, for example), but they are few and far between.

If the line seems smooth, try to understand why and if you have any doubts, move on to the next investment option.

4. Incredibly complicated investments

One of the rules to strictly follow when investing is: do not invest in something terribly complicated when you can get the same result with something simple.

The problem is that if you don’t understand an investment, it is very difficult to know if it is legitimate or a scam.

Does this rule mean that you could sometimes miss out on some good investments? Yeah.

Does that mean you also miss out on some horrible explosions and scams? You bet.

Scammers often present very complicated investment strategies, hoping that you will think they are very smart (and probably feel a little stupid too).

Ask them to explain it in language you can understand. If you can’t, then walk away.

Scammers are becoming more sophisticated and, in fact, it can sometimes be quite difficult to differentiate a scam from a legitimate investment.

Always take your time when considering investments. Don’t let anyone pressure you into making quick decisions with limited-time offers.

And if you are ever in doubt that investment returns seem too good to be true, we strongly recommend that you seek advice. Better safe than sorry.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.