- Always select to pay in local currency when settling an invoice abroad

- Merchants and payment processors will charge higher exchange rates

- The stated margin is a premium applied to an already bad exchange rate.

<!–

<!–

<!–

<!–

<!–

<!–

It may be tempting to say yes if a waiter abroad offers you the chance to pay in dollars, rather than the local currency.

Many assume that it is more cost-effective to eliminate the foreign exchange fees incurred when paying in euros or pounds sterling.

But you should ALWAYS reject it. Paying in dollars will almost always be much more expensive due to a scam known as “dynamic currency conversion.”

The warning comes as Americans increasingly spend vacations in Europe, Britain and the Caribbean, rather than within the United States. One in five say they will do it this year.

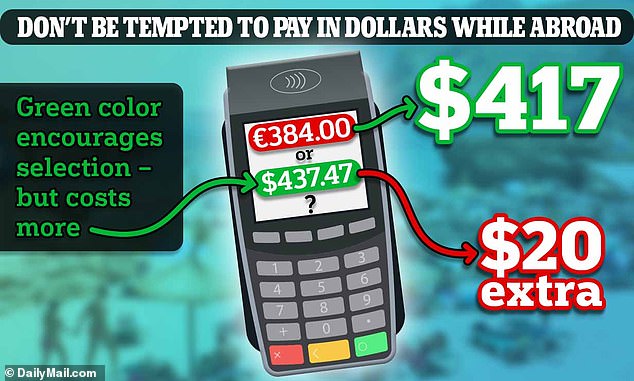

Paying in the local currency while abroad can save you up to 5 percent on predatory and unreasonable exchange rates and fees. The figures above come from a real life example in Spain.

Brian Kelly (pictured) is the founder of credit card and travel website The Points Guy.

With dynamic currency conversion, stores, hotels, restaurants and ATMs abroad often offer two different prices when they hand you a payment terminal.

One is converted to dollars and the other to the local currency.

Experts like Brian Kelly say the dollar option should be avoided. Not only are the exchange rates terrible, but additional fees are added.

“I see this as stealing money from someone’s pocket,” said Kelly, founder of the credit card and travel website The Points Guy.

‘It is a flagrant dispossession of the consumer. They take advantage of someone who is confused in a foreign country.

Kelly described a recent experience at a hotel in Madrid, Spain, while on vacation with her family.

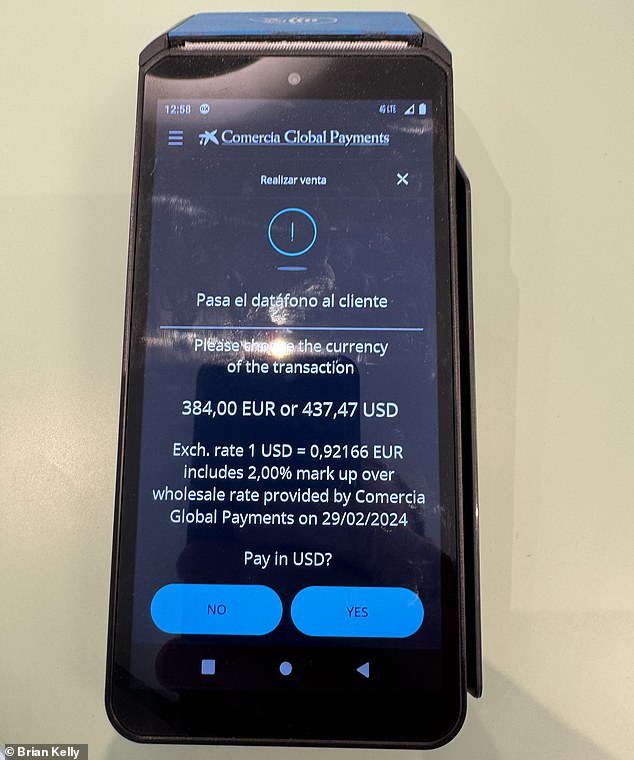

The hotel presented him with a bill for 384.00 euros, but also offered him the option to pay $437.47 through a message at the ATM.

Familiar with the dynamic currency conversion scam, Kelly paid in euros with his travel credit card and ended up being charged $416.64, saving more than $20 in the process.

He said that by paying in dollars, ‘you are giving away money without receiving absolutely anything in return.’

Although his credit card issuer does not charge foreign transaction fees, he noted that even if he were using a card with a 2 or 3 percent fee, it would still be cheaper.

A hotel in Madrid presented Kelly with the option of paying in dollars. Although the indicated margin was 2 percent, she was closer to 5 percent at a fair exchange rate.

In the case of the hotel payment in Madrid, the machine indicated that the dollar conversion only charged a “2 percent margin,” but in reality it was a premium of almost 5 percent over the exchange rate in a fair market .

“They’re marking a terrible kind of change,” Kelly said. “Even if I had a card with 2 percent, it would be a lot cheaper.”

To make matters worse, sometimes the option to pay in dollars is displayed in green, while the top option to pay in local currency is displayed in red.

“It is highly recommended to purchase it in your local currency; all the mind tricks are there to make you make that mistake,” Kelly said.

Sometimes that conversion may even be applied by default, in which case travelers will need to ask the provider to come back and process the payment again.

“And it’s not just Europe,” said Kelly, who has experienced the scam in his travels around the world.

“It is the merchants and payment platforms that scam the consumer,” he said. “It’s the biggest secret known in banking.”

Americans are increasingly choosing to vacation abroad: In August, about 22 percent said they planned to travel abroad in the next six months, according to data from the Conference Board.