Doctors are warning people under 50 to watch for two symptoms, amid an unprecedented rise in colon cancers in young patients.

Dr. James Cleary, a gastroenterologist and oncologist, said fatigue and unintentional weight loss could be signs of the disease often called the “silent killer.”

He advised people to get a colonoscopy if they experience symptoms, and not to be discouraged by age.

Colon cancer can grow and spread for years without being detected because the symptoms are dismissed like other things.

But cases are expected to double in people under 50 by the end of the decade, and by then it will be the leading cause of cancer death in the United States.

Doctors have warned that if you have anemia and lose weight unintentionally, you should have a colonoscopy to check for colorectal cancer.

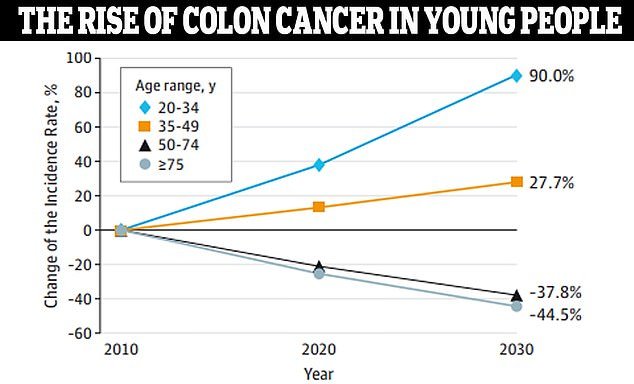

Data from JAMA Surgery showed that colon cancer is expected to increase by 90 percent in people ages 20 to 34 by 2030. Doctors aren’t sure what is driving this mysterious increase.

Doctors are still working to unravel the cause of this mysterious epidemic, although an unhealthy diet, a sedentary lifestyle and alcohol consumption have often been blamed.

Gastroenterologists have now said that although colon cancer screening is not recommended until age 45, young people with symptoms such as anemia and unintentional weight loss should still have a colonoscopy.

Dr. Cleary, of the Dana-Farber Cancer Institute in Boston, said Business Insider: “If you have one symptom, you should consider getting a colonoscopy, but if you have two of these, statistically speaking, your chances are higher and you should really get a colonoscopy.”

A colonoscopy is a test in which a doctor inserts a flexible tube with a camera on the end into the rectum.

The test is intended to look for changes in the colon, such as inflammation and growths called polyps, which are groups of cells that form along the lining of the colon. They are usually harmless, although some can slowly turn into cancer.

Amid concern about the rising rate among younger adults, in 2021, the U.S. Preventive Services Task Force lowered the screening age from 50 to 45.

One of the most surprising symptoms is blood in the stool or when wiping. The bright red blood is “newer” and comes from the end of the colon, near the rectum. This can often be confused with hemorrhoids, especially in young people.

That blood loss can lead to iron deficiency anemia, Dr. Cleary said. Additionally, he said bleeding can occur at a microscopic level, so patients don’t realize it.

Bowel cancer can cause blood in your stool, a change in bowel habit, a lump inside the intestine that can cause blockages. Some people also experience weight loss as a result of these symptoms.

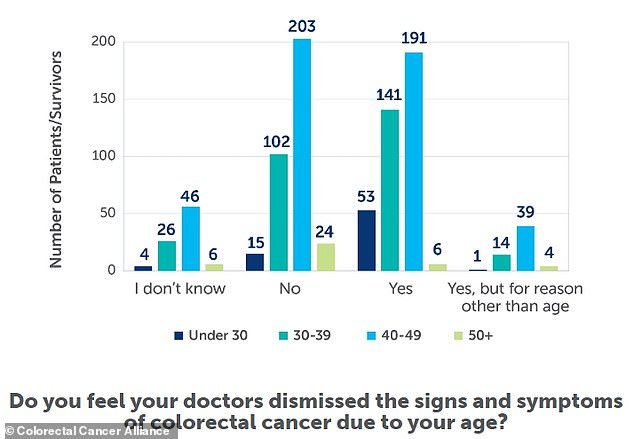

A 2020 survey from the Colorectal Cancer Alliance found that many patients with colorectal cancer symptoms were initially misdiagnosed or ruled out.

Blood loss can cause anemia because the body eliminates red blood cells, which contain iron.

Iron deficiency anemia is more common in menstruating women and vegetarians, as they are less likely to consume enough iron-rich foods. The condition can cause fatigue, weakness, pale skin, chest pain, cold hands or feet, and brittle nails, according to the Mayo Clinic.

“When someone is found to have iron deficiency anemia, I think the important question will always be ‘why does the person have iron deficiency anemia?'” Dr. Cleary said.

“And if you really can’t find a good cause, that person should have a colonoscopy.”

Unintentional weight loss is another sign that you may need a colonoscopy, Dr. Cleary said. This is because colon cancer can cause changes in bowel habits, such as increased diarrhea.

Constant diarrhea means that the body digests food too quickly to absorb calories or nutrients. Additionally, colon cancer can cause nausea and stomach pain, which reduces your appetite and causes you to eat less.

Dr. Cleary said he tends to see unintentional weight loss in late-stage colon cancer. “It’s usually pretty significant, 10 to 20 pounds over a period of six months to a year,” he said.

Experts have also warned that narrow stools may be a sign of cancer, as they could be due to tumors or other obstructions blocking the colon. More commonly, however, occasional pencil-thin poop may simply be a sign of constipation or a condition such as irritable bowel syndrome (IBS).

Colon and rectal cancers are the third most common type in the U.S. and the third leading cause of death in both men and women.

The American Cancer Society (ACS) estimates that about 153,000 cases of colorectal cancer will be detected in 2023, including 19,500 among those under 50 years of age. About 53,000 people are expected to die from the disease this year.

Experts are still not sure what is behind this epidemic, although recent studies have made progress.

Research published earlier this month even found that patients with the KRAS mutation, which makes cancer more aggressive, had higher levels of the bacteria fusobacterium, clostridium and shewanella.

The researchers noted that these bacteria can increase inflammation and make tumors grow faster.