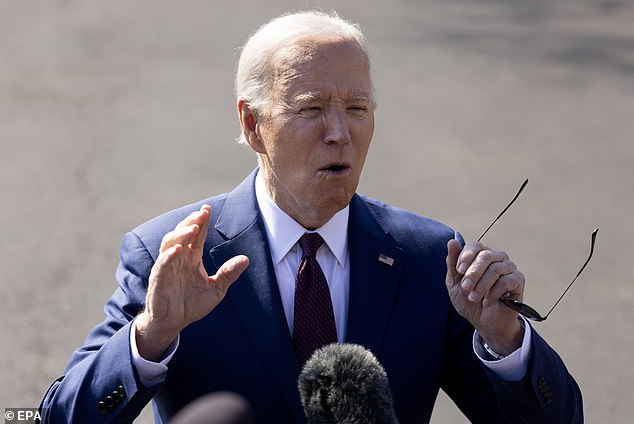

President Joe Biden landed in California on Tuesday for a major fundraising campaign only to discover that the hosts of his glittering first event had tested positive for COVID-19.

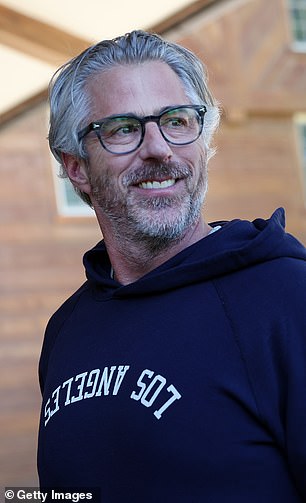

Haim Saban, an Israeli-American media mogul who introduced Power Rangers to the United States, and entertainment executive Casey Wasserman were forced to stay away due to strict testing protocols around the president, according to Deadline.

The details emerged just after Air Force One landed at Los Angeles International Airport.

Their motorcade arrived at billionaire Saban’s home in the Santa Monica Hills as scheduled and the event, for which tickets cost a maximum of $250,000, was still scheduled to take place.

This is his second visit to the state this month to fill the campaign coffers, which are already filled with $130 million, the highest total ever accumulated at this stage of the cycle.

President Joe Biden will make his second trip of the month to California on Tuesday. The three-day trip includes a series of fundraising events, as well as an official speech. Biden is seen here when he traveled to New York to raise money earlier this month.

Haim Saban and Casey Wasserman

Hours before boarding Air Force One for the trip, his campaign and the Democratic Nation announced they had raised $42 million in contributions during January from 422,000 donors.

The trip is his third visit to California in just over two months for political events.

Their first stop is Los Angeles for a fundraising event. There will also be campaign events in San Francisco and Los Altos Hills, and an official policy will be delivered near Los Angeles on Wednesday.

The first event was at Saban’s house. He is a prominent supporter of Israel, raising concerns that he could attract protesters demanding a ceasefire in Gaza.

He Los Angeles Times He said other presenters also have deep ties to the Jewish community, including Leslie Gilbert-Lurie, author of a book about her life as the daughter of a Holocaust survivor, and Nicole Mutchnik, vice president of the Anti-Defamation League, which campaigns against anti-Semitism. . .

He reported that tickets for the event started at $3,300.

In the end, the protests did not materialize because the wet weather kept people indoors.

Instead, the biggest threat was COVID. Anyone who comes into contact with the president must still undergo testing.

Jane Fonda was among the expected guests.

The first stop was Haim Saban’s house, which is worth an estimated $2.8 billion, according to Forbes. However, we were reportedly unable to attend due to COVID.

Saban is famous for buying the rights to the Mighty Morphin Power Rangers and presenting them on American television.

U.S. Rep. Maxine Waters (D-CA) and Los Angeles Mayor Karen Bass greet U.S. President Joe Biden upon his arrival in Los Angeles, California, on Tuesday afternoon.

The repeated swings in California, a state that is not even close to being competitive for Republicans, show how Biden needs to keep raising money for what will be a tough showdown with Trump, who has mastered the art of tapping millions of small donors. .

In its announcement Tuesday, the Biden campaign highlighted the importance of small donations, saying that 97 percent of its three million contributions were less than $200 at a time.

Senior Communications Advisor TJ Ducklo said, “This haul will go directly toward reaching the voters who will decide this election.”

Earlier this month, the president visited the Los Angeles home of Star Wars creator George Lucas, where he tapped wealthy donors who were in town for the Golden Globes.

National polls suggest Biden is about three or four points behind the likely Republican nominee.

He has gone on the offensive over comments made by Trump that appeared to undermine NATO, the alliance of Western nations that pledge mutual defense.

The campaign launched digital ads in the battleground states of Michigan, Pennsylvania and Wisconsin, highlighting the former president’s threat to NATO nations.

And Biden has also criticized House Republicans for blocking a bill that would have sent $60 billion in support to Ukraine for its defense against Russia.

“The idea that we’re going to walk away from Ukraine, the idea that we’re going to let NATO start to break up is totally against the interests of the United States of America and goes against the word that we have given… “All the way back to Eisenhower,” he told reporters Sunday.