- Openreach is facing increased competition from so-called altnet providers

- UBS believes BT could be forced to increase restructuring and capital spending

<!–

<!–

<!– <!–

<!–

<!–

<!–

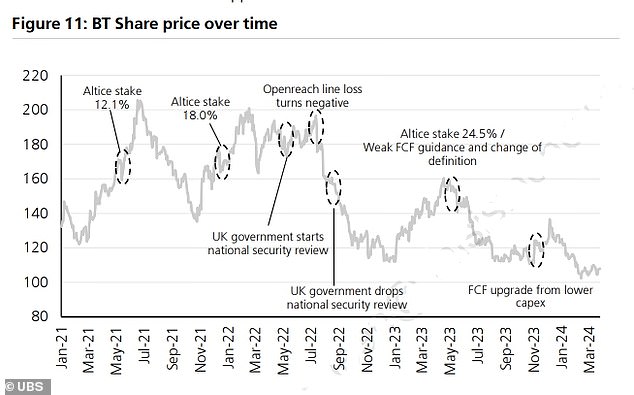

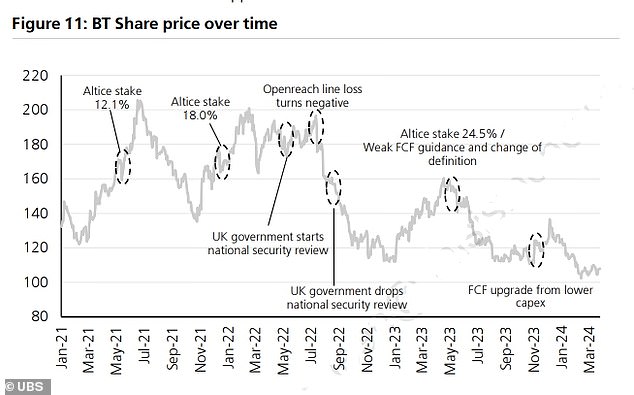

UBS has cut its share price expectations for BT Group amid concerns about the increasing competition facing its Openreach broadband services and the possibility of an impending dividend cut.

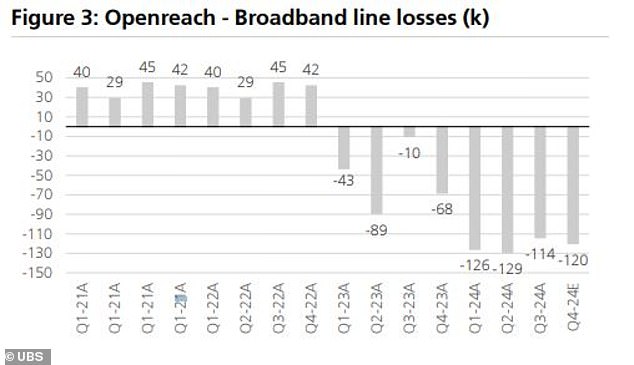

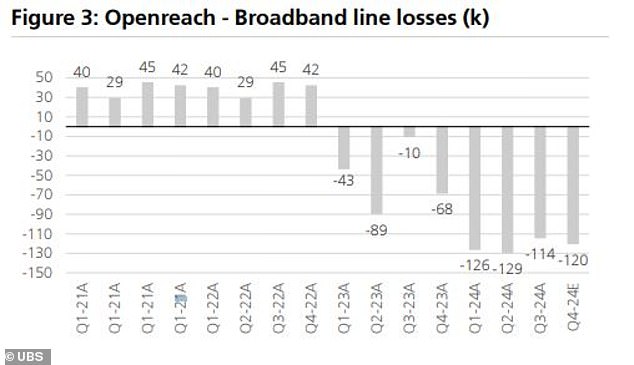

BT’s Openreach suffered its first line loss last year, with around 210,000 lines lost, and UBS believes this number will increase to 489,000 this year ‘and remain high for years to come’.

The investment bank also predicts that BT – whose shares have endured a torrid five years – will face further pressure on free cash flow from higher spending, potentially forcing the company to halve its dividend when the new boss Allison Kirkby presents his full dividend. annual results in May.

Openreach faces increasing competition as BT accelerates the rollout of ultra-fast fiber broadband

UBS maintained its sell rating, which is contrary to market consensus, and cut its price target from 110p to 100p.

BT shares were down 4.3 percent to 105 cents on Wednesday afternoon, bringing one- and five-year losses to 29 and 53.4 percent, respectively.

After replacing Philip Jansen earlier this year, CEO Kirkby will be charged with overseeing Openreach’s rapid rollout of ultra-fast full fiber broadband and 5G network to 25 million homes and businesses by 2026.

The group also has a cost savings target of £3 billion by the end of 2025, with up to 55,000 job losses by the end of the decade.

UBS said: ‘Despite trading at the bottom of its 100p to 200p trading range over the past five years, we are wary that things will get worse before they get better, and the BT story has a lot of moving parts.

‘We see the main share price drivers as reported (free cash flow) (FCF) momentum and broadband line losses at Openreach.

‘However, we believe a new CEO could accelerate the existing strategy, putting pressure on the FCF, (with) higher capital investments (and) more restructuring.

‘Separately, we believe competition in broadband infrastructure is accelerating again, with losses on Openreach’s broadband lines likely to remain high for longer.’

Competition in the UK broadband market has increased significantly in recent years, with so-called ‘altnets’ such as CityFibre commandeering volumes and putting pressure on Openreach prices.

Altnets now cover 9.7 million homes, compared to Openreach’s 12.9 million, according to UBS, while also building faster.

UBS believes BT will have to spend more to continue and finance its strategy, with the bank pricing in more restructuring and capital expenditure in 2025 and 2026, leaving less money to fund shareholder payouts.

“We expect the dividend per share to halve to 3.85p,” the report said.

Tough times for BT shareholders

UBS also highlighted the issue of BT’s ‘high customer risk’, with TalkTalk and Sky spending around £850 million and £950 million a year respectively on Openreach.

It said: ‘Unlike other major (internet providers) who each use multiple broadband infrastructure providers, Sky is unique in that it works exclusively with Openreach.

“While there were logical reasons for this in the short term, we believe this position is less likely to continue in the longer term given increasing competition in broadband infrastructure.”

Britain’s largest broadband provider saw its first line loss last year, with around 210,000 lines lost

What are other brokers saying?

UBS accepts that its position on BT is ‘anti-consensus’, while other major investment banks have a ‘buy’ or ‘hold’ rating.

Among the most bullish are JP Morgan Cazenove with an ‘overweight’ rating and a price target of 290p, and Barclays with a price target of 225p.

A major driving force behind BT’s share price fluctuations in recent times has been the growing stake of its largest investor Patrick Drahi and his firm Altice.

Drahi currently owns just 24.5 percent of BT shares, but has so far been prevented from attempting a full takeover due to the National Security and Investments Act and a frantic campaign to bring the British group to parliament, trade unions and some others. to keep members. shareholders.

BT will update investors on its progress in May, with the group predicting profits of more than £6.1 billion by 2023 after higher prices helped boost its latest quarterly results.

Other brokers are more bullish on UBS