Table of Contents

State pension age: when will it start to rise from 66?

I will turn 66 on April 1, 2026. With the changes the Government is about to make, will I receive my pension or will I have to wait another year?

I have paid nine years more than what you have to pay, which is 35 years according to the Government website. I like that many others find this so unfair.

SCROLL DOWN TO FIND OUT HOW TO ASK STEVE HIS PENSION QUESTION

Steve Webb responds: When the Pensions Act 2014 brought forward the date for the state pension age to rise from 66 to 67, it seemed like a long time away, but that change is now imminent.

In short, the state pension age will only increase for those who turn 66 after April 5, 2026, meaning any increase is avoided in a matter of days.

But even if he had been born a few days later, this would only have affected his retirement age by one month instead of a full year.

In this column I will explain what is changing for those who are affected and address your point about paying over more than the standard 35 years.

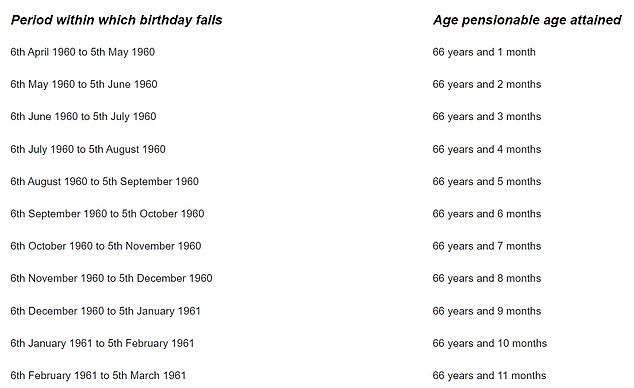

As with previous increases to the state pension age, the increase from 66 to 67 will not happen overnight but will be done in stages.

This means that some people will be entitled to a pension when they turn 66 years and 1 month, others at 66 years and 2 months, and so on.

The table below allows people to look up their state pension age based on their date of birth and comes from Clause 26 of the Pensions Act 2014.

Special provisions apply to those born on July 31, 1960, December 31, 1960 and January 31, 1961. More details can be found at: Pensions Law 2014

For anyone born after March 5, 1961, the retirement age will be at least 67 years old.

A further increase from 67 to 68 is currently scheduled to occur between April 2044 and March 2046, although this schedule may very well be accelerated.

You can check your state pension age under current legislation using the tool on gov.uk at: Check your state pension age.

As we have mentioned previously, a consequence of the increase in the state pension age is that the ‘normal minimum pension age’ (NMPA) for accessing a private pension will also be increased.

However, unlike the state retirement age itself, the NMPA will increase by two years (from 55 to 57) *overnight* on April 6, 2028.

Do you have a question for Steve Webb? Scroll down to find out how to contact you.

Returning now to your point about the number of years you have contributed, you are right in saying that some people will contribute more years into the system than are necessary to generate entitlement to a full state pension.

However, as you no doubt understand, the National Insurance system is not like a private pension fund where all your contributions are received, held in your name, invested and paid out upon retirement.

Instead, National Insurance is more like a tax where you pay according to your means and get paid according to the rules in force at the time.

There is inevitably an element of “redistribution” in such a system, where those with long working lives (like you) and/or higher incomes pay more.

In part, this helps fund NI’s ‘credit’ system for those whose state pension needs to be protected during periods when they are caring for others but cannot contribute to the system themselves.

Meanwhile, some people have also paid a lower (contracted) rate of National Insurance contributions in the past, affecting their state pension even though they paid for more than 35 years.

I’ve covered this in previous columns, such as this one: Why won’t I get a full state pension even though I paid National Insurance for 38 years?

SAVE MONEY, MAKE MONEY

3.75% APR Var.

3.75% APR Var.

Chase checking account required*

4.91% 6 month solution

4.91% 6 month solution

Increase in interest rates at GB Bank

free share offer

free share offer

No account fee and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible Isa now accepting transfers

Trading Fee Refund

Trading Fee Refund

Get £200 back in trading fees

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence. *Chase: 3.69% gross. T&Cs apply. 18+, UK residents