I want to buy shares of graphics processing company Nvidia, but I’m not sure where to start.

Its share price has seen a phenomenal rise in 2023, but have I missed the boat? Can it maintain this performance and is it still a good time to buy Nvidia?

And should I try to buy shares directly or perhaps get exposure to them through an ETF or investment trust and which ones, if so?

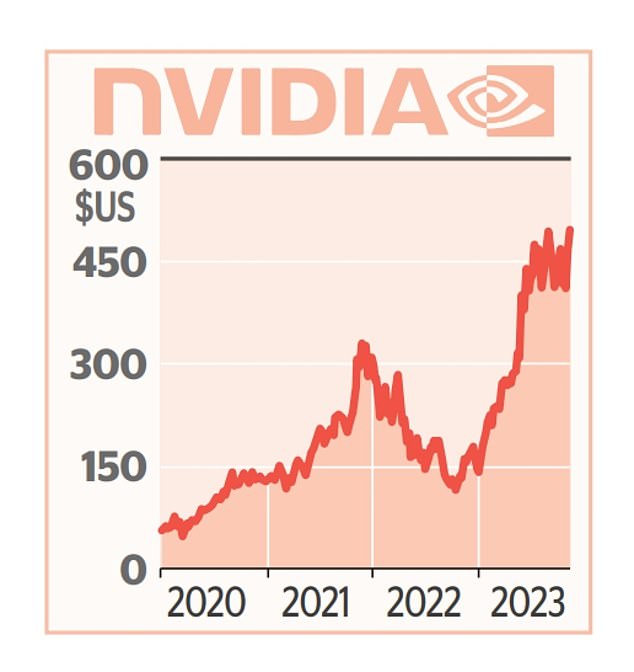

Meteoric rise: The only way has been to raise Nvidia’s share price in 2023. But investors who want to buy now will wonder if this will last.

This is Money’s Helen Kirrane responds: California-based Nvidia certainly had a meteoric rise in 2023.

The company’s share price has risen an extraordinary 230 percent over the past year and 67 percent in the past six months alone.

Nvidia makes the computer chip systems that power much of the world’s artificial intelligence computing applications. It has witnessed explosive growth in demand for these over the last one year.

The chipmaker, whose products already enable video recommendations on TikTok and ad recommendations on Instagram and Facebook, is now seen as a company to watch in the artificial intelligence space.

Nvidia has an earnings update for the fourth quarter of 2023 on February 21, and this should give investors an idea of whether it is still gaining momentum or running out of steam.

Investment experts say the main question investors should consider is: What are Nvidia’s prospects going forward?

Can Nvidia’s stellar run last?

Steve Clayton, head of equity funds at Hargreaves Lansdown, replies: ‘That’s really the trillion dollar question. Can Nvidia continue its meteoric pace of expansion? At the moment, Nvidia’s GPU-based technology has given it an extraordinarily high market share, but, unsurprisingly, others are racing to catch up.

‘Rival chipmaker AMD is making big claims about the capabilities of its next-generation devices, arguing that it will soon have technological leadership in the AI computing space. But it is not enough to have the best designs.

“You have to be able to manufacture in high volumes and here Nvidia appears to have an advantage, with enormous capacity committed by contract manufacturers like Taiwan Semi to deliver Nvidia designs at pace.” Given that semiconductor manufacturing plants cost billions and take years to build, this is not an easy hurdle for Nvidia’s rivals to overcome.’

Laith Khalaf, head of investment analysis at AJ Bell, responds: ‘It is certainly right to be cautious about an area that has received so much publicity recently and where share prices have risen so rapidly. Technology is also an area where things can change very quickly. Nokia was the market leader in mobile phone sales not long ago, but you don’t see many of its phones today.

‘But today’s tech titans are so valuable and have so many resources at their disposal, it’s hard to imagine newcomers taking them down.

‘Perhaps their greatest threats come from the other. The bullish argument for Nvidia is that by providing the chips that are powering the AI revolution, it is similar to traders selling spikes during the gold rush. The meteoric rise in its share price hasn’t been driven exclusively by frothy sentiment either: there have been real, tangible improvements in earnings.

‘The stock’s current price-earnings ratio is 33 times what it was a year ago. This tells you that the share price gain over the last year is due to a big rise in earnings estimates.

‘Those forecasts may turn out to be wrong, but so far Nvidia appears to be surprising on the upside. At 33 times forward earnings, Nvidia is by no means cheap, but it’s also not an outlier among the US stock market’s Magnificent Seven tech companies.

“The premium valuations these companies trade at mean there’s plenty of good news already in the price, and any slippage in earnings growth could be severely punished.”

Richard Hunter, head of markets at Interactive Investor, responds: ‘These stratospheric share price increases may have a downside. The bar has now been raised, meaning shares could be vulnerable to disappointment in further improvements as expectations have risen.

‘Volatility can also be expected, with the possibility of strong share price movements when its latest results are announced next week. For the moment, however, technology stocks in general in the United States are on the rise, and the Nasdaq index is nearing its all-time high after rising 17 percent over the past year.

‘Other potential concerns are rising geopolitical tensions between the United States and China, where both appear reluctant to sell each other their advanced technology products, which could reduce Nvidia’s sales.

“Furthermore, questions remain about appropriate assessments of the technology, while the concerns of many governments around the world about the potential power of AI and its impact on human society deserve deep consideration.”

How to buy shares

Helen Kirrane responds: ‘You can own Nvidia shares directly or through an exchange-traded fund (ETF), trust or investment fund.

‘If you want to buy Nvidia shares directly, you will need to find an investment platform, such as Hargreaves Lansdown or Freetrade, that allows you to access the Nasdaq exchange where they are listed. You can buy Nvidia shares through an Isa, Sipp or general investment account, and almost all brokers operate online.

‘The decision to buy shares outright depends on the rest of your investment portfolio and your level of experience.

‘If this is your first investment, you may want to postpone all your hard-earned money you’ve saved into a single stock.

‘Nvidia is listed on several stock indices, including the S&P 500 and the Nasdaq Composite Index. As a result, Nvidia shares are held by index funds and ETFs that compare their returns to those indices.

“There are some specialized thematic ETFs that will give exposure to Nvidia, such as the VanEck Semiconductor UCITS ETF, For example. It is highly concentrated, the top ten holdings make up three-quarters of the fund, and at 0.35 percent per year it is more expensive than simple ETFs, so only for experienced investors with a high risk tolerance.

Steve Clayton replies: ‘Buying direct means every dollar you invest gives you exposure. The flip side, of course, is that you’re just riding a horse, and emerging technologies are rarely risk-free investments, to put it mildly.

‘Nvidia will only make up a relatively modest proportion of any fund or ETF you are likely to find. But go the latter route and you’ll be exposed to a whole range of other tech names, many of which will also benefit to some extent from the early growth of AI.

“It seems unlikely that demand for technology as a whole will disappear anytime soon, as the world is still digitalizing at a good pace. The usual mantra in the investment world is to always look to diversify your investments. Why should the approach when investing in artificial intelligence be different?

Laith Khalaf responds: ‘Whether you invest directly in Nvidia or through an ETF depends on the rest of your portfolio. You should only consider investing directly if you already have a well-diversified portfolio.

‘I would advise against putting much more than 5 per cent of your total portfolio into a single stock name, to give you an idea of appropriate diversification levels.

Nvidia’s share price has almost tripled in the last 12 months

‘You should also take into account the exposure to Nvidia that is already in your portfolio through the funds you hold. If you don’t have enough diversification in your portfolio to support a direct purchase, you can gain exposure through an index tracker like the iShares Core S&P 500 ETF which follows the US market and has a 3 to 4 percent position in Nvidia, or the Fidelity Index World Fund which follows the global developed stock market and has around 2 percent exposure, although clearly its fate will be determined more by broader stock market movements than by Nvidia alone.

‘To bolster your exposure to Nvidia, you could consider a combined approach, buying a diversified fund alongside the individual stocks.

‘Regardless of how you decide to invest, it’s worth thinking about drip-feeding your money into the market, so that it can match your entry price over a period of time. You should also consider investing within an Isa wrapper to protect future capital gains and tax income.’

Richard Hunter responds: ‘If you’re a more cautious investor, you may prefer some exposure to AI without putting all your eggs in one basket.

‘There are plenty of specialist technology investment funds available that spread risk across many holdings, or even a technology tracker (including ETFs) that does much the same thing but passively.

‘In terms of the interactive investor rating list, for example, exposure to Nvidia is possible through companies like Scottish mortgage, Brown Advisory US Sustainable Growth Fund and GQG Partners Global Equity Fund.’

Tom Lee, head of operations at Hargreaves Lansdown responds: ‘As this is a foreign stock, there is a currency conversion charge as well as a dealing fee, £11.95 in the case of Hargreaves Lansdown, and up to 1 per cent on conversion.

“For US stocks, clients must also complete a W8-Ben form before trading, which reduces tax on dividends, and this can be done online.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.