Table of Contents

- Nationwide notebooks will not be available in their current format beyond February

I am a Nationwide customer who uses a passbook and from what I read on this site and was informed by Nationwide bank staff about the changes to the passbooks, I am not impressed.

When I went to my local branch in October, a member of staff couldn’t tell me anything about the changes, other than, and I quote, “they haven’t told us anything yet.”

I have an Isa in a branch and I don’t want to manage it online. I just want to know: do I have to take any action before February 6? Will I be disadvantaged in any way, such as being forced to switch to another account that might earn a lower interest rate?

Helen Kirrane from This is Money responds: Over the summer, we revealed that Nationwide would ditch passbooks in their current form from early February 2025.

Shortly after, Nationwide announced that it would “modernize” passbooks in a process that would take place over seven months until February 2025.

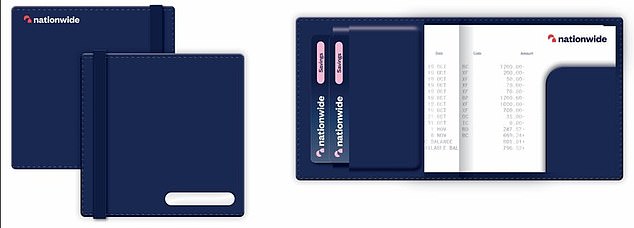

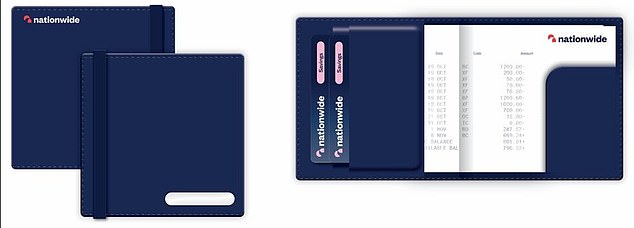

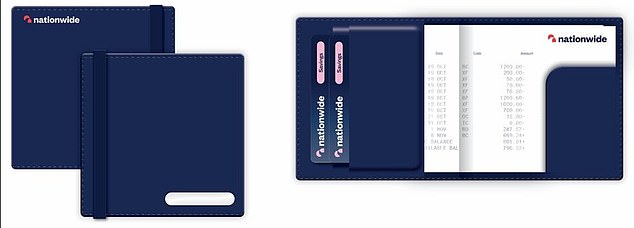

Customers who wish to continue using a passbook will instead receive a ‘savings wallet’, which contains a Nationwide card that can only be used at a Nationwide branch.

Modernisation: Nationwide Building Society will replace current passbooks with a modernized savings wallet from February 2025

The wallet will also contain a space for printed “mini-statements”, which customers will receive when they deposit or withdraw money at a branch.

Nationwide says less than 2 percent of its customers use notebooks. With over 16 million members, that equates to around 320,000 customers.

Customers who have a passbook will not be able to use it in its current form after February 2025.

Those who do not want the new savings portfolio will only be able to use their old passbooks until then.

I asked Nationwide if it would be forced to switch to another account with a lower interest rate due to its passbook being phased out.

Nationwide told me that customers who still want to use branch savings accounts when passbooks in their current version are phased out will be switched to the same type of product they have now and the rate will not change.

He is not the first to point out that Nationwide staff may not be fully aware of the changes, although the building society later told us they have been given full training.

A Nationwide source recently told This is Money that the National Group Staff Union (NGSU) had not been informed in advance about the launch of modernized passbooks.

The source stated: “The NGSU first learned of the ‘deployment’ when several branch staff called the union and complained about the lack of information on how to proceed with this.”

The NGSU said: ‘We were informed about the project around the same time as branch colleagues were being updated. We were able to gather more details about the process once the project started.”

A Nationwide spokesperson said: At the national level, notebooks are not being eliminated, we are modernizing them.

The new savings wallet will maintain all the benefits that passbook customers value: face-to-face branch service and having a physical record of transactions.

It will contain a card, which it is important to note that it can only be used in branches in a similar way to how passbooks are used today.

It will also provide a printed record of the member’s account in the form of securely stored mini-statements.

We have been writing to customers to inform them of the changes and encourage them to visit a branch to discuss their options.

Full training has been provided to branch colleagues on the changes and how they can help customers open the new savings wallet product.

Customers will switch to the same type of product they have now (i.e. Branch Isa customers will move to another Branch Isa account) and their rate will not change as part of this activity.

We remain committed to branches and have the largest banking presence on the high street. Nationwide has also renewed its branch promise, ensuring that all locations that have a branch now will remain there until at least 2028.

Do you use a notebook and are worried about moving before February 2025? Get in touch: editor@thisismoney.co.uk

SAVE MONEY, MAKE MONEY

1% refund

1% refund

About debit card expenses. Maximum £15 per month*

Energy bills

Energy bills

Find out if you could save with a fixed rate

free share offer

free share offer

No account fee and free stock trading

4.5% Isa 1 year

4.5% Isa 1 year

Hampshire confident of Hargreaves Lansdown

Sip Rate Offer

Sip Rate Offer

Get six months free on a Sipp

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence. *Chase: Refund available during the first year. Exceptions apply. Over 18 years of age, resident in the United Kingdom.