I need a haircut. In fact, it’s overdue. So recently, with a free weekend morning, I headed to the hair salon for a much-needed cut.

The barber in question only accepts cash. This is a bit inconvenient for me as I rarely carry physical money, much to the disappointment of This is Money editor and cash champion Lee Boyce.

My usual routine is to stop at a nearby branch of Sainsbury’s where there is an ATM and withdraw the necessary funds (now £21, hardly an ideal sum to pay in notes) before lumbering to the barber’s.

Only two minutes out of my way at most.

Cardless: Cash-only businesses suffer if ATM network fails users

In a bleary-eyed Saturday morning daze, I realized the Sainsbury’s Bank ATM wasn’t accepting my debit card. Strange.

Then I saw the message on the screen that said something like “This ATM is currently unavailable, sorry for the inconvenience.”

Good. I was not that drawback: after all, there was another ATM around the corner.

Imagine my confusion when I arrived at the second ATM, this time at a Halifax branch, to see that it gave the same message as the previous one.

Unlike some places in the UK where there are now few or no ATMs, luckily I had plenty of machines nearby.

A quick check of my phone showed that luckily there was a third, this time with two machines available, just a few hundred meters away.

It couldn’t go wrong again, could it? This time I didn’t even get to the machine to find out it was also out of order. As I approached, I noticed a concerned citizen pacing back and forth between the two machines on either side of the entrance to Santander, with a disappointed look on his face.

Once again: “This ATM is currently unavailable, sorry for the inconvenience.”

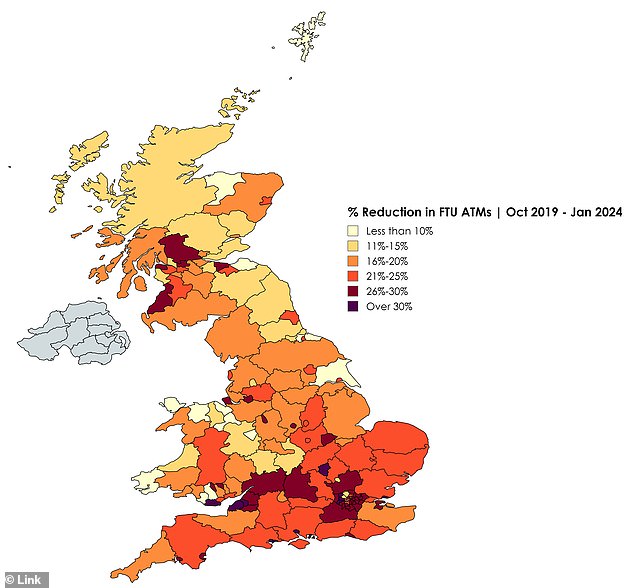

Forgotten: Some areas faced a 30% reduction in ATMs from October 2019 to January 2024

At that point, in the pouring rain without an umbrella and with the assumption that I would probably face the same story again if I detoured to a fourth bank branch, I resigned myself to another week without a new outage.

But what was behind this? Was it a massive blackout or was I just unlucky?

Link, the UK’s ATM network, told This is Money: “We have reviewed the machines mentioned and the incidents do not appear to be related, one ran out of cash, another had been vandalized and another had a fault which required intervention of an engineer.” .

‘Therefore, it appears to be simply an unfortunate coincidence. All ATM operators have a vested interest in keeping their ATMs up and running, not only as a customer service but also for the revenue they generate, and will have local staff to repair the ATMs or engineers on call for more serious faults. ‘

This is confirmed by Halifax, who said their ATM had a fault at the time, while Sainsbury’s said their machine had been vandalized.

Maybe it’s an unfortunate coincidence. But there are many things that can put an ATM out of service, and if their total number is declining, it surely can only mean that more people like me will have difficulty accessing cash.

In the last five years, almost 10,000 ATMs have been closed and another 23,000 are expected to close, leaving only 15,000 ATMs free throughout the country. Five years ago there were 50,000 free machines.

According to Santander, the unavailability of several ATMs in a specific area could be due to fraudsters attempting to install card skimming devices on certain ATMs or deliberately damaging others to push customers to one they have tampered with.

Another possibility, he said, is that multiple banks use the same cash processor or delivery company, which could cause ATMs to fail if demand exceeds expectations. However, he added that this is relatively unlikely.

So, it was probably just bad luck. If I had walked to a fourth ATM, I probably would have been able to make a withdrawal.

However, in areas that do not have such a high number of ATMs, someone looking for cash could be left without machines to use.

Not being able to withdraw £30 was a minor inconvenience for me, but for older people who rely on cash or small businesses that do most of their business with physical money, this crisis could prove debilitating.

Many businesses are loathe to start accepting card payments because of the fees that payment processors like Mastercard and Visa impose on each transaction.

It is for this reason that many companies that accept cards do not accept American Express due to that company’s higher fees.

Sometimes, more simply, they have been accepting cash for generations and are too stubborn or determined to introduce card payments, but in today’s cash-scarce society, they could suffer from this.

It’s also true that some businesses don’t accept cards because they aren’t completely honest with the taxman, but I’d like to think they’re in the minority.

The hairdresser lost my client over the weekend simply because they would not accept the payment methods I had access to.

In 2024, I don’t think it would be wrong for me, or others in similar circumstances, to consider detouring not to another ATM, but to a barbershop that allows card payments.

However, doing so could spell the end for many of these small businesses.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.