A Gen Z property investor who owns three properties has closed, claiming landlords are to blame for Australia’s current rental crisis.

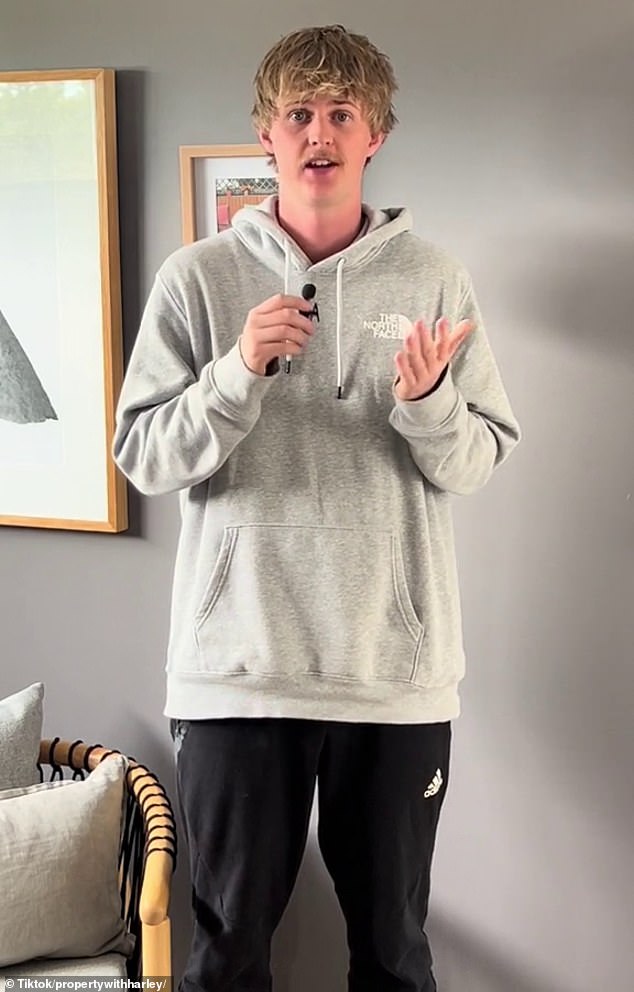

Harley Giddings, 24, has worked hard since his teens and every job “under the sun” to become a homeowner and is now the proud owner of multiple investment properties.

The young investor published a Tik Tok to his thousands of followers saying he often gets comments “all the time” blaming investors for the housing shortage.

The savvy landlord said he can understand Australians’ frustrations but believes this is “wrong”, firmly believing skyrocketing rents and housing shortages are due to high immigration and low building approvals.

“In 2022 and 2023, the government allowed more than a million immigrants to enter the country,” he said.

Harley Giddings, 24, has a property portfolio consisting of three investment properties. He understands people are “suffering” but believes Australians are “wrong” to blame landlords for the rental crisis.

‘Basic supply and demand’ is reason for Australia’s housing crisis, says 24-year-old

‘According to the Australian Bureau of Statistics, this is the largest number of migrants Australia has let into the country since it began registering them.

“These million migrants were allowed in at a time when Australia was already experiencing a housing crisis.”

Mr Giddings said when people come to Australia they are looking to rent and not buy, which is why so many people are on inspections for rental offers.

“Basic supply and demand,” he said.

The second reason the young property investor gave for Australia’s housing shortage was the low number of homes under construction.

“We’re just not building enough properties,” he said.

‘In Victoria, my home state, we currently have the lowest number of building approvals we have had in the last decade.

“This issue affects all of Australia.”

The 24-year-old cited an investigation by the Institute of Public Affairs that by 2028 the housing supply in Australia will be reduced by 252,800 homes.

Many Australians agreed with the young investor and also blamed the government.

“An absolute masterstroke by the government,” one of them wrote.

“Not to mention all of Victoria’s new investment tax laws, landlords are getting rid of them,” one said.

“If you can’t keep up with supply, reduce demand,” wrote another.

Giddings said the low number of houses being built in Australia is one of the main reasons rents are rising so much (pictured, people at an auction).

However, other Australians were quick to blame the investor.

‘You are the problem too. You can’t just blame construction and immigration. Do you know why people can’t afford to build? Because they can’t afford the price increase driven by decades of investors,” one wrote.

‘Investors and immigration: two problems [that] “We have to stop it,” said another.

Mr Giddings said yahoo He understands that it would be very difficult right now to be a tenant and that there is a lot of “pain” due to rising prices not only in rent, but also in everything else.

“I just think there are a couple of factors that are making the housing crisis worse that are not caused by tenants or landlords,” he said.

The investor, who became interested in the property after reading several books and listening to investment podcasts, made it clear to yahoo that he did not blame the people moving to Australia, but rather government policy.

Giddings dropped out of college midway through his business degree because he didn’t think it would offer him much.

Instead, the 24-year-old worked two jobs, seven days a week, saving more than $100,000 by age 22.

Giddings, who describes his family as middle class, bought his first property jointly with his father, according to yahoo.

The young investor believes the government has created high rents and a competitive market by allowing a million immigrants into the country amid a housing crisis.

‘My parents aren’t really the kind of people who know how to invest. Dad is a firefighter, mom is a hairdresser. “So he had borrowing power because he worked full time and I had the savings,” he said.

The worker, who has always been interested in investing, bought in his home state of Victoria and invested in Western Australia instead.

“There are 15,000 suburbs in Australia, it’s very unlikely that the area you live in is one of the best performing,” he said.

The first property cost the father and son $450,000 and then the 24-year-old used more savings to buy a second property.

Mr Giddings used the equity built up in the second property to purchase his third investment.

He achieved this impressive portfolio of properties when he was only 23 years old.

According to the Australian Taxation Office, the majority of homeowners are “mum and dad” investors, with a whopping 71 per cent of homeowners in Australia owning just one investment property.

Only 19 percent own two properties.

According to the Australian Bureau of Statistics, work began in 2023 on just 163,836 new homes, the lowest number since 2012.

Compounding the problem is the shortage of 90,000 workers, who are needed in the next three months so that the government’s housing plan can meet the deadline.