I am 59 years old and happily married to a wonderful husband who is ten years older than me. He receives a full state pension. I run our small business, paying myself around £1,200 and putting £440 into a pension a month. All our income goes into a single fund that I manage day to day, since my husband is not really interested in the financial management of our household. He’s happy to have some cash in his wallet and rarely uses their joint debit card.

We have no mortgages and have savings of around £400,000. Despite this convenience, I find it difficult to spend money on myself. I’m always looking for the best value on everything: food, travel cosmetics, etc.

I buy clothes infrequently and have closets full of old things that I can’t part with. When she was younger she was a single mother. There was never any extra money and we barely managed to survive. Although my daughter’s school fees were always paid, she often needed to use credit cards to have enough food to eat. When I met my husband, he supported me in taking care of most of the daily expenses. Why can’t I now just relax and enjoy life without worrying so much about whether we have enough saved for our retirement?

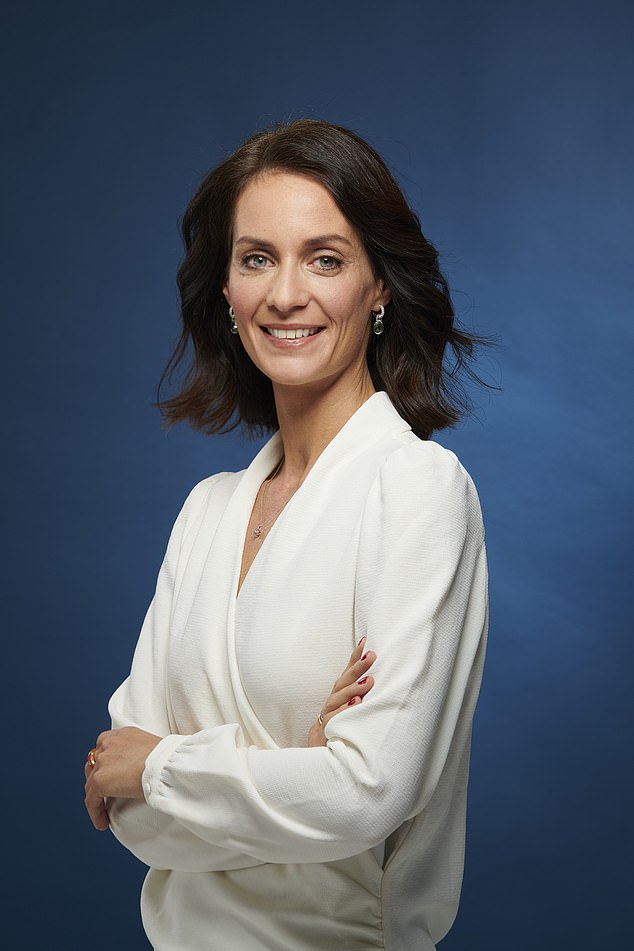

You seem to hang on to things (like old things in your closet) and money is one of those things; You cling to him and it is difficult for you to separate yourself from him, responds Vicky Reynal

Money psychotherapist Vicky Reynal responds: I’m sorry to hear that you are finding it difficult to enjoy the money you have. Part of you knows that you should just “relax and enjoy,” but another part of you finds it difficult to do so. You seem to cling anxiously to things (like old things in your wardrobe) and money is one of those things: you cling to it and fight to separate yourself from it.

Having struggled financially for years, you have been unable to readjust your spending habits to the new financial reality. This is because you may have an unconscious fear that one day things may become precarious again (however unrealistic that may be in light of your savings), so you defend yourself against your fear by holding on tightly to what you have. has.

But I wonder, since it’s not just money that’s hard to part with, if something deeper isn’t going on. I wonder if you get a sense of comfort and security from holding on to things, and if you would feel quite vulnerable letting them go. I have seen this in clients who have suffered emotional deprivation early in their life, who have felt that their parents or caregivers were not reliably available. That’s why they cling to things anxiously as a way of finding security and comfort in possessing something. They always worry that at some point they will be left “hungry.” You see, the fear could be due to an emotional hunger, but in the present we address it using other means: money represents the safety net, the ability to take care of ourselves and never feel homesick again.

Vicky Reynal says the useful question to ask yourself is: How would I feel if I tried to enjoy the money I have?

For many people, difficulty spending money could also be due to the values they grew up with. If you grew up in a family that prided itself on modesty and self-sacrifice, then as an adult you might find it quite difficult to go against that model and be more lenient with your money and lifestyle.

Let’s hope one of these resonates. The useful question to ask yourself is: How would I feel if I tried to enjoy the money I have? Would it evoke guilt and regret? Or fear, which makes you feel insecure? Or fear of judgment? And, if so, from whom? Try to explain what is preventing you from accessing enjoyment and how you feel. This will give you clues to discover where the difficulty lies. And once you’ve found it, see if there’s a different way to approach it. If it’s your parents’ lessons on modesty and frugality, do you still subscribe to them? Or have you assumed them too rigidly? Maybe you can have a new, more relaxed definition.

You can also try allocating a small budget each month to spend on “pleasure” items. That money, kept in a pot that you have calculated, is an amount that you can afford, it is yours to spend and it will not put other financial goals at risk.

Do you have any questions for Vicky Reynal? Email vicky.reynal@dailymail.co.uk.

Vicky’s book Money On Your Mind: The Psychology Behind Your Financial Habits, by Bonnier books, £16.99 is available now.