I am a full-time working mother earning £65,000 a year, while my husband, who works in a care home, earns around £27,000.

We have two children, 6 and 4 years old. When my first daughter was born I was earning less than £50,000 and therefore initially collected child benefit.

When my salary went up I stopped taking it and haven’t claimed it for the last four years, although looking back I think I should have tried to claim something while I was on maternity leave as it would have helped me a lot.

A friend told me that the child benefit rules changed in the Budget and that I should now be able to get it and it would be worth taking it again.

How I do this? Will it be worth having to pay something? Will I have to file a tax return, for example?

I earn £65,000 and have two young children. Should I start claiming child benefit again?

Angharad Carrick from This is Money says: Child benefit for high earners has been a contentious issue since George Osborne introduced it in 2013.

Previously, the Government clawed back child benefit for households where the highest earner had an income of more than £50,000, and withdrew it entirely when they earned more than £60,000.

This meant that a household with two parents earning £49,000 each would receive the full child benefit, while a household with one parent earning £50,000 would see some or all of the benefit withdrawn.

Unlike other taxes, it was based on total individual income rather than household income, so whoever earned the most bore the brunt of the charge.

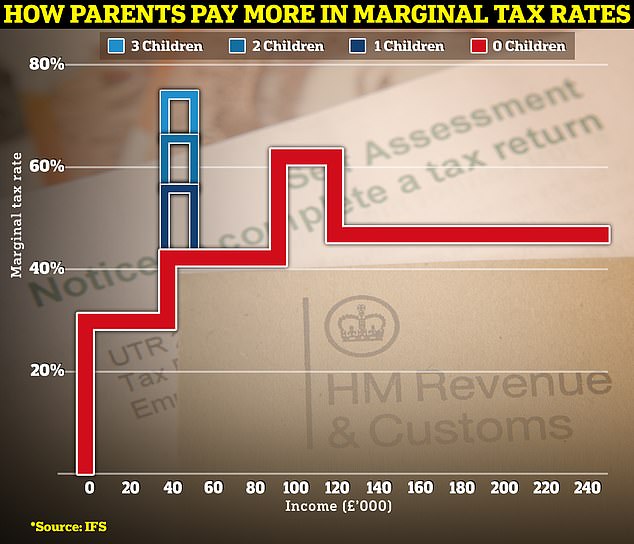

While income tax and national insurance for someone earning £50,300 is 42 per cent, the removal of child benefit means the marginal tax rate for a parent with one child is 54 per cent, while for a father with two children is 63 percent. This figure increases to 71 percent for parents with three children.

All of this meant that many parents, like you, did not bother to register for self-assessment and file a tax return to claim child benefit.

However, last month the child benefit rules changed, raising the threshold at which some child benefit is removed to £60,000, and the threshold at which it is withdrawn to £80,000.

Tax traps: The graph above shows marginal tax rates for income tax and national insurance on the red line, rising to 62% between £100,000 and £125,000 due to the removal of the personal allowance. The blue lines show the effect of removing child benefit between £50,000 and £60,000.

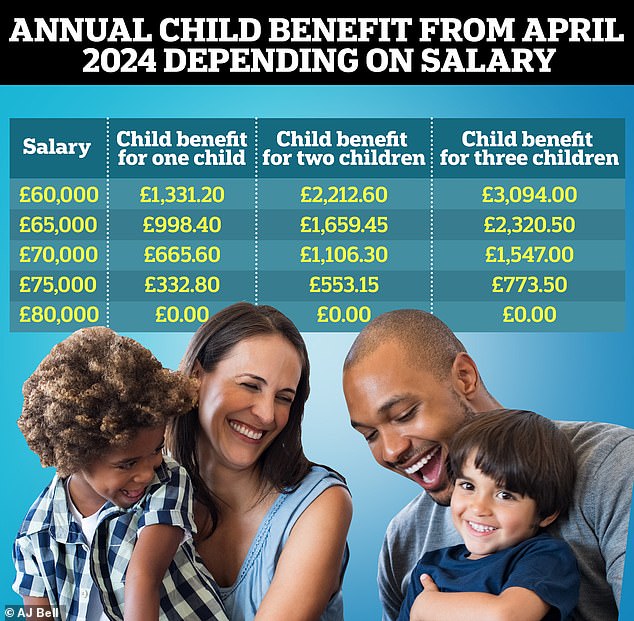

Under these new rules, you would have to pay back some of your child benefit because you earn more than £60,000. Current rules state that you will be charged 1 per cent of your child benefit for every £200 of income over £60,000.

So is it worth re-applying for child benefit? We asked the experts.

Shaun Moore, tax and financial planning expert at Quilter, says: As your income is £65,000, you will have to pay back some of the profit. This is equivalent to approximately 25 percent of the family allowance you receive.

Therefore, for two children, the child benefit rate is approximately £2,212 per year, but you will have to pay around £553 of this amount due to the charge, leaving you with £1,659.

As you have not claimed your child benefit for four years, you will need to reapply via the HMRC child benefit page or download the HMRC app and claim it through it.

Child benefit can go back up to three months, so if you apply now you will be able to receive payments from February 2024.

Robert Salter, partner at Blick Rothenberg, says: In general, I would recommend that anyone who is entitled to child benefits (even if some of it is recovered) proactively applies for it.

There are several reasons to do this. First of all, why should you give up money to which you are legally entitled?

And secondly, what happens if your income suddenly falls during the course of the year and your income, for example, falls below the relevant thresholds?

This is an obvious risk for those who are self-employed, but it can also occur when one of the following situations occurs:

- You receive a significant portion of your income based on commissions, bonuses, etc. and these can vary from year to year.

- You are sick for a significant part of the year; either

- You are fired or your work hours are reduced;

Child benefit application rules normally allow a child benefit application to be backdated up to 3 months after the application date.

Therefore, if you suddenly became ill and were not paid (for example because you are self-employed) or lost your job, you would not necessarily be able to retrospectively claim child benefit for the entire tax year.

Claiming the benefit initially and then having to pay it back (in part), if necessary, is – in simple terms – a type of insurance policy.

File a tax return

Angharad Carrick says: Since you will have to pay back 25 per cent of the child benefit – around £550 of your current salary – you will need to file a tax return for 2024/25.

This means that you will have to register for the self-assessment, which is quite simple.

You will need to go to the government website and reactivate your account. Make sure you have your Government Portal information and Unique Taxpayer Reference Number on hand.

Robert Salter says: While you would be required to complete a 2024/25 UK tax return in due time, I would highlight the following:

You won’t need to submit your tax return to HMRC until 31 January 2026, so you will have ‘access’ to the child benefit money for a considerable period of time automatically before any repayment is required; and

If the only items that need to be reported on your tax return are your salary and child benefit claims, you should be able to submit your tax return to HMRC yourself. There should be no need to pay an accountant to prepare a tax return, for example.

If you’re worried about being able to “pay back” the 25 percent child benefit that, in this case, would have to be paid back in January 2026, when your tax return is due, for example, because you’re worried you’ve spent the money, you can ask HMRC to make an adjustment to your PAYE tax code to recognize the money that will need to be repaid.

This should help ensure that, at the end of the tax year, you have generally paid the correct amount of tax, including any adjustments necessary due to the clawback of child benefit.

Reduce your adjusted net income

Angharad Carrick says: Before you start considering whether to claim the money and file a tax return or opt out, it’s worth looking at what counts toward the higher income threshold and some ways to lower it.

The child benefit charge applies to your adjusted net income, which excludes the value of any charitable pension contributions or donations you make, for example.

Charlene Young, pensions and savings expert at AJ Bell says: If you make your own payments into a personal or workplace pension scheme, make sure you deduct them from your income, as this could give you the opportunity to recover the full amount of child benefit.

For example, someone earning a salary of £65,000 before tax could make a contribution of £4,000 towards a pension, which would automatically increase to £5,000 thanks to the automatic £1,000 tax relief.

This means not only an extra £5,000 in your pension fund, but also £5,000 deducted from your adjusted net income figure.

Their adjusted income would be reduced to £60,000 and they would be refunded the full value of child benefit. As a higher rate taxpayer (40 per cent), they could also claim an extra £1,000 in tax relief by contacting HMRC.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.