Table of Contents

Am I biting into the world’s most expensive hash brown? It’s the question that always haunts me as I enjoy one of the all-you-can-eat breakfasts at the Premier Inn.

Several months ago, realizing that we were spending considerably more of our income than I would like on the “purple palace of dreams,” I opted for a tactical investment that I hoped would put jam on our toast today, instead of simply buttering our bread when we are 60 years old.

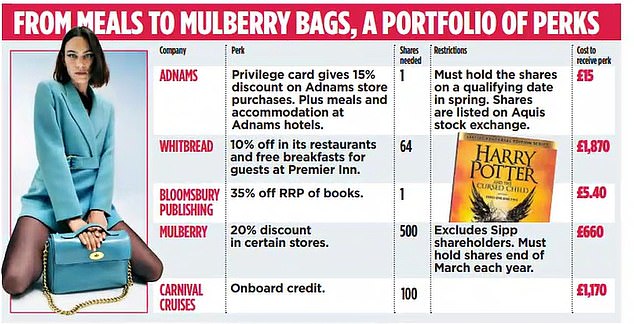

Whitbread, the former brewery turned hotel and restaurant group, is one of many companies offering “perks” to its shareholders. First, it offers you a 10 percent discount at its restaurant chains, but more importantly, the company also promises a free breakfast for shareholders and up to four guests for each night they stay at one of its hotels. .

Whitbread offers shareholders a 10 per cent discount at its restaurant chains and free breakfast at its hotels

Given that the current price of these breakfasts is £11 per adult, I did some quick math to see how much the profit could be worth and finally took the plunge. I must explain that we spend a lot more time in budget hotels than most.

For that price I could have gone to the Ritz.

This year we have two Year 12 teenagers visiting seemingly every university in the country to decide where they could apply. And, somewhat unexpectedly, our 14-year-old daughter is currently boarding at a music school 100 miles from us, in Somerset.

The local Wells Premier Inn has become a true “home away from home” as we navigate drop-off and pick-up locations and attend our daughter’s numerous concerts.

While Premier Inn rooms can be very good value for money, an extra cost of £22 per couple for breakfast is steep. This year alone, I expect we will have 15 hotel stays, so I made a decision and bought almost £2,000 worth of Whitbread shares in March.

My free breakfasts make me feel good, but what’s the real cost? And is it really a strong enough reason to justify my investment?

Crunching the numbers

Whitbread requires you to buy 64 shares or more to be eligible for its Shareholder Benefits card, and as each share is now worth just under £30, you would need to invest at least £1,870 at current prices.

This is enough for almost 90 breakfasts for two; I hope more than we will ever have to eat. Plus, the idea of investing in a stock thanks to a trick makes me feel more dizzy than an overdose of black pudding.

Susannah Streeter, of investment platform Hargreaves Lansdown, certainly agrees. She says: “Deals and discounts should be seen as a minor and unreliable bonus for owning shares.”

My investment performance so far suggests I should have followed their advice. My Whitbread shares are down £200 since March, and my breakfast is a measly four, so each one has cost me over £50. For that price I could have gone to the Ritz.

However, I am hoping to get a better result over time. After all, investing is a long game.

Bloomsbury Publishing offers book discounts to investors

Additionally, I bought my 64 Whitbread shares into my Sipp (Self-Invested Personal Pension), so although I can sell the investment, I can’t access the money for at least another decade. As this is a pension, I have also benefited from tax breaks when I invested the money, receiving relief at my marginal rate. That’s 40 per cent tax relief on my free breakfasts – 20 per cent on the Sipp and 20 per cent claimed through my tax return.

Also, I think my Whitbread shares will perform well over time. From my frequent stays, the hotels seem to be busy and the company’s strategy of getting rid of underperforming restaurants to increase room space seems to be paying off.

Stockbroker Liberum has a price target of more than £45 on the shares. Analyst Anna Barnfather says the company is buying back shares, which will support the share price, while the selling strategy should pay off in the long term. If he’s right, my Whitbread shares could become the goose that lays the (fried) golden egg.

Risks and pitfalls

If you, too, are tempted by a free fry-up or other attractive perks, you should do your homework first. Besides the obvious fact that the value of your shares can fall, there are other dangers that arise from buying shares at a profit.

The first is that there’s no guarantee that the company won’t change its mind, especially if too many people decide to cash in on its freebies. What’s more, figuring out if you’re eligible for benefits can be a bit complicated. Each company has its own rules: You generally must own a certain number of shares, and you may have to have owned them by a qualifying date of the year.

If you hold your shares through a fund, you will not be eligible to receive the benefits. In some cases, even holding shares on a DIY investment platform such as those offered by AJ Bell, Hargreaves Lansdown or Interactive Investor will make you invalid.

Mulberry offers investors discounts at certain stores

Once you’ve cleared these hurdles, you’ll need to check whether your individual savings account or Sipp provider transfers the benefit and, if so, how. I had to apply at Hargreaves Lansdown, where I have my Sipp, for a Whitbread shareholder benefits card.

Another major problem is that even employees of the company in which you own shares may not be familiar with the system.

In Wells, reception staff at the Premier Inn had never seen a shareholder benefits card before. After a long time, they finally managed to find a code in the system to place the offer.

Other benefits

Of course, if Premier Inn breakfasts aren’t your thing, there are a host of other benefits available, from credit to spend on your Carnival cruise to a third off Bloomsbury books.

If you already own shares, it may be worth checking if there are any benefits available.

It will be years before I can determine whether my bet on Whitbread will actually bring home bread, but for now it certainly sweetens the need to save money for my old age.

They say there is no such thing as a free lunch; I’ll wait and see if that applies to breakfast too.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.