Table of Contents

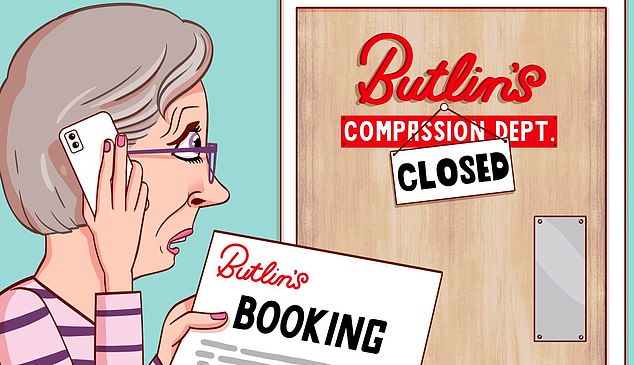

A year ago I booked a week’s holiday at Butlin’s in Skegness for myself and five members of my family, including my eight-year-old grandson. We were due to travel on 19 July.

Exactly one month ago we were informed that my eldest son (who was not travelling with us) has oesophageal cancer which has spread to his bones. He has been given three or four months to live and is now in a hospice.

I called Butlin’s to explain and ask if they could change our booking to next year or allow the other five family members to go. They replied that as I was the lead booker, the other family members would not be allowed on site and they would not change the name of the lead booker. I will lose £2040. Please help me.

LB, Northamptonshire

Sally Hamilton responds: I imagine Sir Billy Butlin would be turning in his grave at your experience, made worse, in my opinion, by the fact that you have holidayed with Butlin’s for many of the last 25 years.

You booked this year’s trip at the end of a lovely holiday at one of their resorts a year ago, but you told me that the way you were treated means you have no intention of ever crossing the threshold of another Butlin’s hotel again.

In his letter to me, he blamed himself for not taking out travel insurance and wanted to warn others about his mistake. I agree: travel coverage is a must for those planning to travel domestically or abroad.

Butlin’s offers optional cancellation cover when customers book. If you had chosen this, it would have cost you £32.50 and if you cancelled, you would have had to pay a £65 administration fee.

I felt that such a well-known brand, famous for its friendly hosts in red coats, could have shown more compassion. It made rational proposals, including allowing the other members of its group to attend as planned or moving the holiday to the following year.

You submitted supporting medical evidence, which clearly indicated the severity of your son’s condition, who is over 40 years old, and also included the fact that you are his welfare advocate. This is because, in addition to his terminal diagnosis, he lacks mental capacity. These were all reasons why you and your partner needed to be there for him.

In the company’s terms and conditions, part 6, on changes to bookings, it states that if the main booker (i.e. you) withdraws from the holiday, this constitutes a cancellation for the whole party. The main booker must always travel. This seems inflexible, but the contract is between Butlin’s and the booker.

Elsewhere, it states that there will be no refund if customers have not taken out the company’s cancellation policy, and that customers must claim reimbursement through their own travel insurance provider if they have coverage.

However, one sentence later caught my eye: “However, we will always try to offer you as many options as possible – for example, we may be able to reschedule your break for an administration fee as an alternative to cancellation.” I asked Butlin’s to reconsider. Within two hours of my intervention, a member of staff had called to apologise for the way things had been handled and to say that they would refund her £2,040.

Butlin’s tells me it made a mistake in its case, adding that its terms and conditions have recently been amended to allow changes to the name of the lead guest under certain circumstances.

A spokesman said: “We are sorry to hear that LB’s son is unwell. We apologise for how the situation was handled and have offered a full refund, which has been accepted.”

In September last year I bought a Riese & Muller Homage electric bike from Ride Electric, Tynemouth, for £8,000. I was promised delivery before Christmas. When it didn’t arrive, I was given various excuses. I agreed. I was then away for two weeks and suffered from back problems. Because of this and the winter, I was in no hurry to get the bike. Concern increased in March and the manufacturer Riese & Muller assured me there would be no delays. Ride Electric then said my bike would arrive within the next two weeks. But during that time, it broke down. What can I do?

IE, Newcastle upon Tyne

Sally Hamilton responds: The company handling the retailer’s liquidation told him that the money he paid for the bike had reached the manufacturer Riese & Muller, giving him hope that the manufacturer might come to his rescue with the bike — or his money.

But the administrators informed him that the company would not be delivering either, as it would keep the cash received to offset other debts owed to it by Ride Electric of Tynemouth. I asked him if he had paid by credit or debit card, as these payment methods give consumers rights when a product or service is not delivered, including when a company goes bust.

Under the Consumer Credit Act, credit card purchases worth more than £100 and less than £30,000 should be covered in these circumstances and customers should receive a refund. Unfortunately, you paid by bank transfer, which acts like a cash transaction and offers little protection if things go wrong.

This means you have to join the queue as a creditor of the company (and customers tend to be near the back of the line when it comes to refunds), behind the banks, the taxman and others, and will only receive compensation if there is cash left.

The administrators were frank and told me that “there is no prospect of there being sufficient funds to make payments to creditors.” The bicycle manufacturer offered a 10% discount on any bicycle in stock. But the day after I contacted them on your behalf to check on the negotiations, they offered me a 35% discount on any bicycle you wanted.

You agreed and went for a better model that cost over £9000, but with the discount it cost you £6000. The main lesson is to pay for large purchases with card if you can.

SCAM ALERT

Beware of emails claiming to be from Lloyds Bank warning of an important security update, says consumer website Which?.

Scammers ask you to complete an “account verification process” to confirm your identity.

The email tells you to click on a link to update your details, but this takes you to a malicious website that collects your personal and financial information.

Once scammers have this information, they can apply for loans and credit cards in your name.

Do not click on the link, but forward it to report@phishing.gov.uk.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.