Table of Contents

A multi-millionaire mum has shared the four key steps she believes all parents should take to ensure their children become financially literate, revealing that two of her children were able to buy real estate before the age of 20 using their own money.

Julie Roy, 50, originally from Ontario, Canada, opened a private Montessori preschool in her mother’s basement at age 28 “with no experience or tutoring” thanks to a $25,000 loan from a “street shark.”

Thanks to her “sheer determination,” she repaid the loan within a year and quickly turned the small preschool into a thriving business that expanded to more than seven different locations across Canada.

Julie eventually sold the schools and moved to Omaha, Nebraska, with her husband Beau, now 52, and their four children: Xavier, now 20, Xander, now 18, Xane, now 14, and Xoë, now 13.

There he opened another series of preschools, but eventually sold them as well and made a considerable profit.

A multi-millionaire mum has shared the four key steps she believes all parents should take to ensure their children become financially literate from a young age.

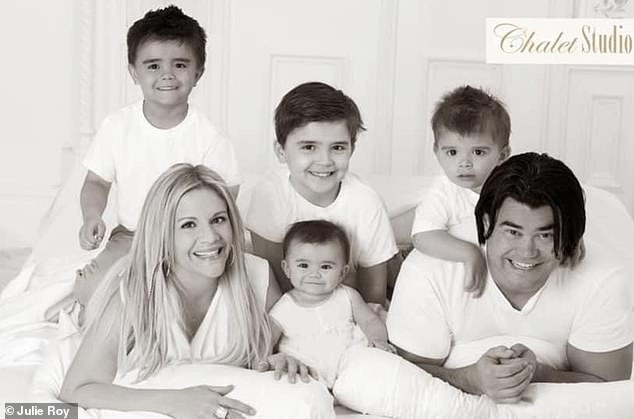

She believes all moms and dads, well-off or not, can help their children become “financial literate” using these four tips. She is seen with her children and her husband.

He has now amassed over $600 million in assets and dedicates his life to helping other aspiring entrepreneurs “multiply net worth, create passive income streams, and secure generational wealth.”

Julie, who is also a best-selling author and podcast host, recently spoke exclusively to DailyMail.com about how she achieved her immense success and, according to the self-made entrepreneur, the key to becoming rich is a “change in mindset “that I wanted. she did much earlier in life.

That is why he believes it is extremely important for parents to teach their children from a young age how to plan their future.

Julie’s two oldest children were able to buy their own homes at ages 18 and 19 with the money they had earned and saved over the years, and yours can too.

She believes all moms and dads, well-off or not, can help their children become “financial literate” using these four tips.

Implement the spend, save, give method: Julie let her children spend 50 percent of their allowance, but asked them to save 40 percent and donate the last 10 percent.

Julie used the “save, spend, give” method with her children from a young age, meaning her children had to save 40 percent of their allowance and donate 10 percent to charity.

Julie used something she called the “save, spend, give” method with her children from a young age.

That meant that any allowance or income they earned would be separated into three jars: one to spend, one to save, and one to give away.

He said he typically let them spend 40 percent of the money they received, had them save 50 percent and had them donate the last 10 percent to a “charity of their choice.”

“They have to know that they cannot have a dollar and spend 99 cents because this will not be (a successful way) to live,” he explained.

“When they’re little, the easiest way to teach them (about money) is to break it up, and that’s why we did that.”

Knowledge is power: Teach your kids about money as early as possible and use games like Monopoly to start the conversation.

According to Julie, the key to making sure your children grow up and are wealthy is to give them as much knowledge about money as possible.

According to Julie, the key to making sure your children grow up and are wealthy is to give them as much knowledge about money as possible.

She noted that playing simple games like Monopoly or Cashflow can be “amazing” ways to start a conversation with your kids about money. She is seen with her husband and her children.

‘We put (our children) in rooms with people who are doing amazing things. They’ve been in rooms with billionaires. We take them to every financial education conference we can,” he explained.

While others may not have the same opportunities as her, she noted that there is a lot of knowledge that can be gained from the Internet and even books.

“For me, as a child (coming) from a low- or middle-income neighborhood, (financial education) was inaccessible,” she continued.

‘Our parents didn’t know any better. We just knew what we knew. So (give your kids) access to everything you can. “There are a lot of videos on YouTube now about financial education.”

She noted that playing simple games like Monopoly or Cashflow can be “amazing” ways to start a conversation with your kids about money.

Get them to work from a young age: Julie highlighted the importance of making children earn their money through household chores or helping around the house

She shared: ‘Our children have been working as long as they could. I think having the ability to work for money is really important to teach children.

Julie highlighted the importance of having children earn money through household chores or helping around the house.

“It instills a good work ethic in them and teaches them how to manage money,” he explained.

‘Our children have been working as long as they could. “I think having the ability to work for money is really important to teach kids.”

He explained that getting rich was never an overnight process, so making your children work for their money from a young age would teach them that they had to work hard if they wanted to receive money.

“If you’re trying to start a business, you may have to put in an extra 20 to 30 hours a week outside of your (job),” Julie added.

‘We have worked weeks of 70 or 80 hours. She had three or four jobs (at first). You can’t think that you’re going to quit a job and create a business overnight. That’s not what happens.

‘The sustainability of running a business and creating a life of your own from the business is difficult. It takes many hours and a lot of willpower.’

It’s all about mindset: Teach your kids to spend on things that will make them more money in the end, rather than “liabilities” like cars and houses.

In the end, Julie explained that getting rich really came down to a “mindset change” that you could help your children achieve early on. She is seen with her husband.

In the end, Julie explained that getting rich really came down to a “mindset change” that you could help your children achieve early on.

He said it’s important to focus on using money to make more money – whether investing in the stock market or real estate – rather than spending on “liabilities” like cars or houses.

“I think it’s a difficult mindset shift for Americans because they’re constantly buying liabilities that don’t give them anything back,” Julie said.

‘We think of houses and cars as assets in American culture, when a house is not an asset: it’s a 30-year mortgage to a bank. And you are paying for maintenance and upkeep.

As an example, he suggested that you tell your children that instead of buying a one-room house they should use their money to buy a four-bedroom abode and rent out the other three rooms.

‘It’s an unconventional way of thinking. And I think parents need to first change that mentality and then apply it to children,’ he added.

‘It’s really important to teach children to start earning money and investing early. I wish we had started investing 20 years before we started.

‘Invest, even if it’s (a little) at a time. The mentality of working to invest, not to buy liabilities, is a huge change in mentality. “It’s understanding that investing is really the key to wealth in America.”

The mother of four added: “We think of houses and cars as assets, when a house is not an asset: it’s a 30-year mortgage to a bank.” And you are paying for maintenance and conservation’

He also encouraged his children to earn money outside of their jobs through “side jobs.”

“We taught (our children) early on to have outside sources of income outside of their (9-to-5 job) and why that’s necessary,” Julie explained.

‘If you depend on only one income, then there is a limit to that income. But you have the opportunity to change your top line.

“A lot of people focus on spending with their kids, like, ‘Don’t spend this,’ or ‘You can’t have that because you don’t have enough money.'”

‘We keep teaching (our kids): “You can buy whatever you want, but you have to keep increasing your top line (income).”

‘Your income is derived from your ability to think about how big you want to be. So if you want to buy a Porsche, then you can’t have a job that pays you $50,000 a year.

‘And if they pay you $50,000 a year, you have to figure out how to make another $50,000 doing other things.

‘Either you get side jobs, side hustles, or add cash flow income streams that come in while you sleep.

“Teaching (children) about the mindset of adding money, value and income to their income, even when they’re not working for it, (is key).”