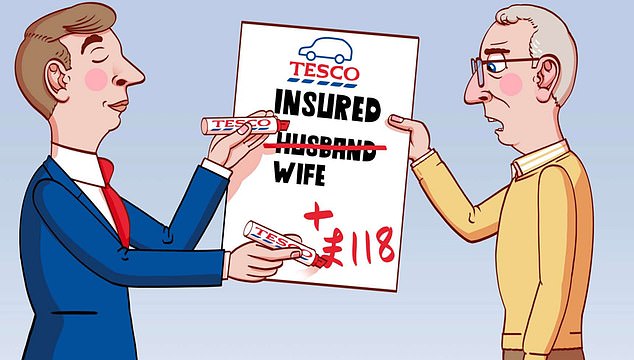

I am a designated driver on my 79 year old wife’s Tesco Bank comprehensive car insurance. The premium increased at renewal from £508 to £1,127, although my wife managed to negotiate it down to £908.

Meanwhile, I have been seeing an optometrist for several months for double vision and reported it when renewing my driver’s license. I am 85 years old and I was advised not to drive.

I called Tesco Bank to request my cover be removed. I was expecting a reduction in the premium but was surprised to be told that not only would there be no discount on the price, but I would have to pay them £118.

I refused to cancel because I thought this was absurd, and I told him so.

DJ, Kettering, Northants.

Sally Hamilton responds: Tesco Bank’s response to his vision problem seemed overbearing and I can appreciate how upset he felt. Not only did he face the lifestyle-changing disappointment of having to give up his license after 68 years, but also a nasty financial penalty for giving up insurance coverage he couldn’t use.

He did the right thing by telling the Driver and Vehicle Licensing Agency about his double vision, known as diplopia. It is one of six eye conditions that drivers should be honest with the agency about. Drivers can be fined up to £1,000 if they fail to mention any medical condition that affects their driving and may risk prosecution if they are involved in an accident as a result.

I asked Tesco Bank to re-examine her case and explain why they were charging her more for less cover than a whole person. He again said that this calculation was normal for his business in such circumstances. A spokesperson says: ‘Insurance premiums are assessed based on a number of risk factors, one of which is whether a couple is insured under the same policy. Where this is the case, we apply a discount to the premium.’

There is some method to this apparent madness. The insurer says its claims data suggests that a couple insured on the same auto policy is less likely to make a claim than a single driver and may therefore get a discount.

The lost discount on his premium, combined with a charge to adjust it taking into account the period before he was removed from cover, amounted to £118. Tesco Bank acknowledges that it could have been clearer in its exchanges with you about why it calculates your premiums in this way. The spokesperson says: ‘We recognize that we could have done more to explain the impact of removing your name from the joint policy when you contacted us. We have since spoken to DJ and agreed to remove him from the policy as requested and reinstated the premium discount as a gesture of goodwill. He has also agreed to waive the £40 cancellation fee (which applies if policies are canceled after the initial 14-day cooling-off period), should his wife decide to request a quote from another insurer.

When I met with you last week, you told me that you were recovering well from surgery on your right eye and that you were still having problems with your other eye. You said his wife decided to stick with the Tesco policy, but she added her 55-year-old son as a second driver. This also generated a discount, but only £16, meaning the total premium was £892.

I have been a Barclays customer for 31 years. Although I no longer live in the UK, my accounts are still active. At the end of November last year, I called the bank after my card kept getting declined and I couldn’t access my online accounts. They told me they had closed because I live in Australia.

The bank said it had written to me giving me the information, including a unique reference number (URN), to allow me to withdraw my money from the account.

I never received any letter. I completed a claim form that I downloaded from the bank’s website and wrote a cover letter (explaining that I had not received any notice of the closure or a URN) and sent it via certified mail on December 11.

I received a response in early February dated a month earlier, containing another form and requesting that I send it with the URN. I spent 45 minutes on the phone explaining the situation again but was continually asked for the reference number which I never received. What I can do?

CP, Perth, Australia.

Sally Hamilton responds: You explained to me that you have had two accounts at Barclays since you were 15 years old. The money comes from renting part of the flat his father and sister own in the UK, as well as from the usual birthday and Christmas cash gifts paid by the family for their children. The balance at the time the account was closed was just over £3,000.

Their situation arose because Barclays decided four years ago to stop offering accounts to people abroad without a UK address and has gradually closed existing accounts.

Other banks took similar steps with customers in certain European countries after the UK left the EU. Under Barclays rules, customers can only manage their accounts with a non-UK address if they work outside the UK for six months or less, or if they are employed by organizations such as the Armed Forces or diplomatic service. People who have powers over a client’s account could also be allowed to have an overseas address.

Barclays told me that it wrote to him about a year ago giving him several months’ notice that the account was going to be closed and explaining his options. The information sent included detailed instructions for further arrangements for your banking, such as withdrawing or transferring balances and downloading any statements or information you needed. Barclays says two further reminders containing the URN were issued. You never received any of these.

While his problems were probably compounded by the international postal service, Barclays did not make his life easy when he attempted to resolve matters over the phone. I wouldn’t email the URN or let you know it over the phone, for example.

Barclays confirmed that it received the downloaded claim forms you sent in January, but was unable to follow your instructions because they did not contain the URN. This despite someone telling him on the phone that this wouldn’t matter if he explained the problem in a cover note.

After my intervention, Barclays sent him another letter with new forms and URN, which happily arrived safely. He has already completed and returned them, and recently told me that the money was finally released. You thanked me for my help.

All is not lost when it comes to your UK banking. You and your husband have a joint account with Halifax that you rarely use, which until recently had a balance of just £15. She was worried that this would suffer the same fate as her Barclays accounts, but he was relieved when Halifax assured her that he would not close it. He has now redirected his rental income to that account.

A Barclays spokesperson says: ‘Our Barclays UK products are designed for UK customers. Barclays UK no longer offers personal current or savings accounts to retail customers who have a non-UK address registered with us, with limited exceptions. This customer received six months’ notice of this decision prior to account closure and information explaining the next steps to take.’

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.