Table of Contents

- Overall, house prices fell by 0.6% year-on-year, the equivalent of £2,000.

- But new construction prices rose 8.8% month-on-month and 16.6% annually.

<!–

<!–

<!– <!–

<!–

<!–

<!–

House prices rose by 0.5 per cent in January, according to the latest figures from the Office for National Statistics.

The average house value was worth 0.6 per cent less than a year earlier, but this was much lower than the 2.2 per cent drop recorded in the 12 months to December 2023.

The typical house sells for £282,000 in January, £2,000 less than 12 months ago.

New homes appear to be leading the recovery, with prices increasing 8.8 percent during the month of January.

Boom: New home prices rose 8.8% month-on-month, while overall housing fell 0.5%

Ed Phillips, managing director of the Lomond group of estate agents, said: “This suggests that the momentum in the mortgage market which has been building since the latter stages of last year is now starting to translate into actual sales and that the market seems ready to take action. over the next few months.

“There is certainly no sign of the collapse in house prices predicted by many.”

The ONS says the data is a provisional estimate and could be subject to change.

Boom in prices for new construction

New builds have seen significant price growth, according to ONS figures, which could mask a fall in house prices across the rest of the market.

Year over year, new construction prices increased 16.6 percent. This compares to an annual decline of 2.4 percent for other properties.

Daniel Norman, managing director of property development platform Aprao, said: “This appetite for new homes should help give confidence to UK developers that now is the most opportune time to innovate and provide the market with a essential supply.

“Home buyers are willing to pay the premiums associated with new properties, although the cost of borrowing remains significantly higher than in previous years.”

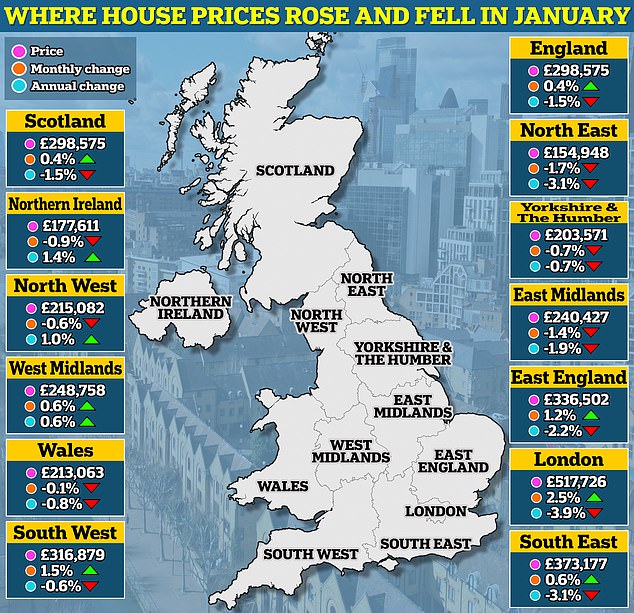

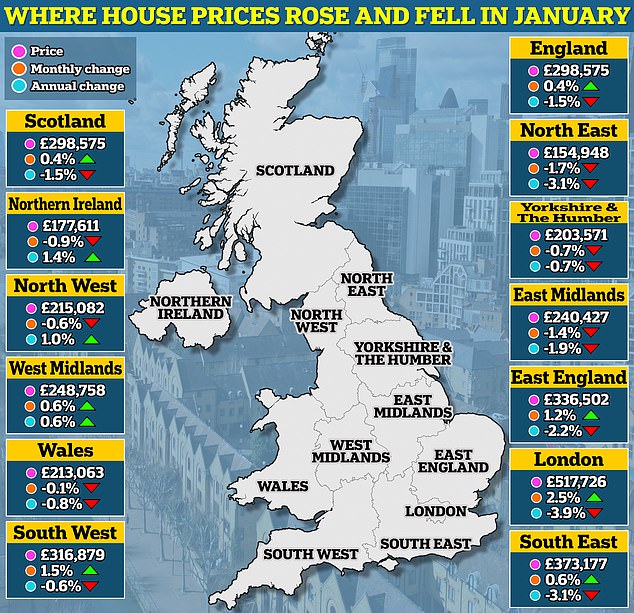

Prices in London start the year strong

London saw the biggest monthly price increase of any region, a jump of 2.5 per cent, according to ONS data.

However, prices remain down 3.9 percent year-on-year.

Marc von Grundherr, director of London-based agent Benham and Reeves, said: “Although it appears that the London market is struggling to recover at the same rate as the rest of the UK, the latest figures show that the capital enjoyed a substantial increase in property values earlier this year.

“While homes in the capital may be selling slightly below the historic highs seen in recent years, we continue to see very strong buyer appetite, with a robust level of transactions.

“This bodes very well for the year ahead and while we are already seeing signs of a recovery in London, we expect an even quicker return to form once mortgage rates finally start to fall ( Again).”

The South West of England also saw a monthly house price rise of 1.5 per cent in January, while house prices in Scotland rose by 1.3 per cent, as well as ‘an increase of 4.8 percent year-on-year.

Meanwhile, prices fell month-on-month in almost half of the UK’s regions, including the East Midlands where prices fell by 1.4 per cent and the North East where prices fell by 1.4 per cent. Prices fell 1.7 percent.

Nicholas Finn, managing director of Garrington Property Finders, said: “Average house prices were still under control at the start of the year, but today’s figures suggest they are starting to regain some ground lost in the 2023 reset.

“However, two elements are now keeping prices stable: a slight increase in the number of homes put on the market and a stabilization of mortgage rates. Further declines in borrowing costs could occur in a few months, which could dampen price inflation.

“As a result, well-informed buyers with strong finances continue to make very competitive deals.

“With many areas offering significantly better value than during the post-pandemic boom, buyer appetite is returning as many people who delayed their moving plans last year decide now is the time to act before prices pick up speed again.