Table of Contents

HSBC’s new boss has unveiled a major overhaul that will include a geographical division between East and West.

Georges Elhedery said the plan to “simplify” the £123bn banking giant and cut costs would split it into four.

Two divisions will be independent operations in the United Kingdom and Hong Kong. Another will consist of corporate and institutional banking. A quarter will cover international wealth and top-tier banking.

Cost cutting: HSBC’s new boss Georges Elhedery (pictured) said plan to ‘simplify’ the £123bn banking giant and cut costs would split it into four

Companies within those divisions will be located in eastern markets, including the Asia-Pacific region and the Middle East, or in western markets, including the United Kingdom, Europe and the Americas.

Elhedery said: “The new structure will result in a simpler, more dynamic and agile organization as we focus on the execution of our strategic priorities, which remain unchanged.”

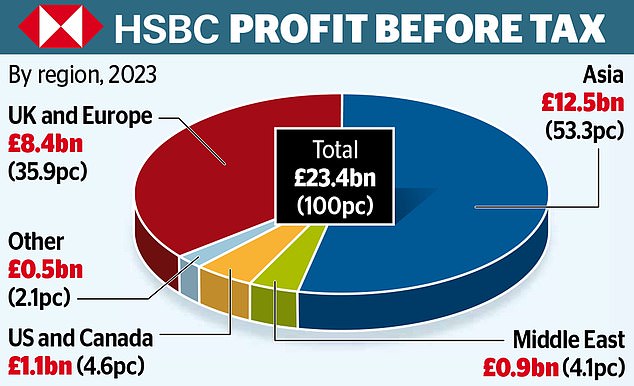

The bank was founded in Hong Kong and still makes most of its profits in Asia, but after taking over Britain’s Midland Bank in 1992, it moved its headquarters to London. It is listed in both London and Hong Kong.

Lebanon-born Elhedery, 50, took over last month after Noel Quinn, a veteran of the former Midland Bank, retired.

Chinese insurance giant Ping An, one of the bank’s largest shareholders, has been pressuring HSBC to spin off its Asian business. Shareholders rejected the move last year.

Susannah Streeter, head of money and markets at investment platform Hargreaves Lansdown, said cost cutting is the “big driver” of the changes announced yesterday.

Russ Mould, investment director at brokerage AJ Bell, said: “The creation of a new international wealth and premium banking division signals HSBC’s intention to be the bank of choice for the wealthy.”

HSBC yesterday also named its first chief financial officer in its 159-year history, promoting Pam Kaur, 60, who has been at the bank for more than a decade. The shares rose 0.9 per cent, or 6.1p, to 681.5p.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.