Table of Contents

The death of Mike Lynch in the Bayesian superyacht disaster was the tragic event of the summer.

The ship sank off the coast of Sicily on August 19, killing Lynch, his daughter and five others.

But for his widow, Ángela Bacares, the nightmare has barely begun.

Tech giant Hewlett-Packard (HP) is chasing her for £3bn which it says is owed to her late husband.

Tragedy: Tech giant Hewlett-Packard (HP) is pursuing Mike Lynch’s widow (pictured) for £3bn it says her late husband owes her.

Lynch, 59, had been locked in legal battles with HP for more than a decade. Problems arose after the sale of his company Autonomy to HP, then run by Leo Apotheker, in 2011 for £8.6bn.

The tycoon was extradited to the United States in 2023 to face charges of defrauding the American giant in connection with the deal. In June, a California court acquitted Lynch.

However, in a separate case before the Superior Court in 2022, HP won a multimillion-dollar lawsuit accusing Lynch of fraud in its purchase. And the US company, despite facing criticism, decided to pursue the grieving family for the £3bn.

The decision, described by Lynch family friend Patrick Jacob as “completely lacking in humanity,” is another questionable judgment from a company that critics say is guilty of a litany of failures over decades.

Even before the disastrous Autonomy deal and its failed attempt to jail Lynch, one of Britain’s most respected tech entrepreneurs, HP’s record was marked by boardroom dysfunction, bad deals and alarming CEO turnover. .

Strictly speaking, it is Hewlett Packard Enterprise (HPE), created in 2015 when the Hewlett-Packard empire split up, that is pursuing Bacares.

Just two weeks after the tragedy, it said: ‘HPE’s intention is to follow the process to its conclusion.

“Basically, we believe that what happened was not in the interest of shareholders and we have to take action.”

HPE may well feel the need to appease its investors. It has a legendary past, but its recent history highlights how this former Silicon Valley pioneer is a fallen giant completely overshadowed by Google, Meta and Apple.

Today, Hewlett-Packard’s two successors, HP Inc and HPE, are worth a combined $60 billion. In contrast, Google’s parent company Alphabet is worth $2 trillion, Meta’s market value is $1.4 trillion, and Apple’s is $3.4 trillion.

One technology analyst told the Mail: ‘HP is a tragic story. It once dominated the tech scene, but has fallen behind. There is a lesson for others: technological mastery does not last forever.

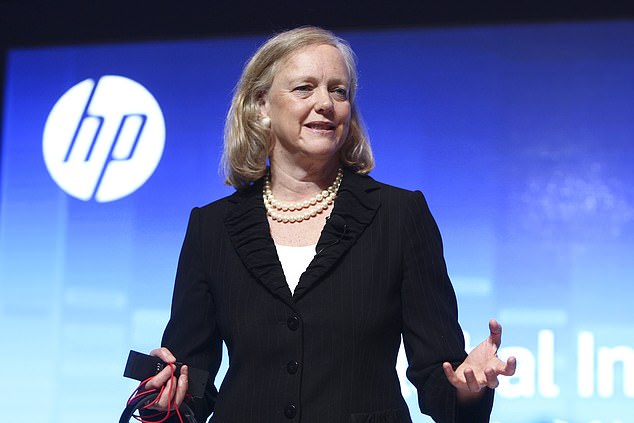

Boss: Under Meg Whitman (pictured), who was next in line as CEO, HP slashed Autonomy’s value by 80 percent in November 2012.

“The reality is that the company probably cannot afford to give up Lynch and his family.”

The process will place a heavy financial burden on the family, close sources say, and Bacares, 57, is understood to be nervous about fighting HP without her husband.

The measure shows that even in death, Lynch and his family cannot free themselves from the American company that persecuted him.

When Lynch sold Autonomy, it was the most expensive acquisition of a British technology company ever made. Some saw it as confirmation that British technology could compete on the world stage.

Others were more skeptical. At the time, HP was struggling financially and had a history of large acquisitions that went wrong. Many felt that Lynch had sold his company to the wrong bidder and that he was making a deal with a “wounded animal.”

Less than a year later, the deal soured when HP announced an $8.8 billion writedown and said it had uncovered “accounting misrepresentations.”

The debacle would no doubt have horrified founders Bill Hewlett and Dave Packard, who founded the company in 1939 in a garage in Palo Alto, California. HP went on to dominate the American tech scene for decades.

In the 1990s, HP was a global company, known primarily for its personal computers and printers. It employed more than 80,000 people, generated $48 billion in net income, and had a market value of more than $17 billion.

The company was also well known in the UK, operating from a London office and a huge campus in Bracknell, Berkshire.

When Lynch was introduced to HP executives in 2011, she was a shadow of her former self.

A decision totally lacking in humanity

The problems began in 2002, when it embarked on a $25 billion merger with Compaq – the largest deal ever in the technology sector at the time – creating the world’s largest PC seller.

The merger was led by CEO Carly Fiorina, who ran unsuccessfully in 2016 as a Republican presidential candidate. The Compaq deal was a disaster from the start. Analysts condemned it as “the worst merger ever” and it became a textbook case in business schools on how not to do it.

Fiorina resigned in 2005 with a golden sendoff reportedly worth $21 million.

HP then went through four CEOs in six years, and its reputation and stock took a hit. From 2000 to 2011, the stock fell 85 percent and more scandals followed.

Shortly after Fiorina, 70, left, evidence emerged that the company had hired private investigators to spy on board members and journalists.

In 2010, CEO Mark Hurd resigned after a woman who worked in marketing for HP sent him a letter accusing him of sexual harassment.

An investigation found that Hurd, who died in 2019 at age 62, had falsified expense reports and other financial documents to conceal the relationship.

Next was German businessman Apotheker, 71, who led HP from November 2010 until his dismissal in September 2011.

During his tenure, he completed the Autonomy deal while trying to turn HP into a thriving enterprise software business.

He relied on Autonomy’s 2010 annual report to assess its financial situation and was drawn to what he saw, as it had posted revenue of $870 million.

In April this year he told a London court: “They were solid figures. We were just coming out of the end of the great financial crisis. Many software companies were struggling.

Mastery clearly doesn’t last forever

“This was an example of a software company that was still growing at double digits.” But the deal quickly became a failure.

Under Meg Whitman, who was next in line as CEO, HP wrote down Autonomy’s value by 80 percent in November 2012, blaming $5 billion of the decline on “serious accounting irregularities” and “outright misrepresentations” by HP. by Autonomy.

Whitman and Lynch had a troubled relationship from the beginning. She thought he was not suitable for an executive position at a large company, and on one occasion Lynch allegedly did not tell her that Autonomy would not meet its revenue goals until the day before the company announced its results.

Whitman, 68, later said it was “completely unacceptable conduct for any leader.”

It is understood that Lynch made repeated complaints to Whitman suggesting that Autonomy was not being properly integrated into HP. These included Autonomy staff being physically barred from HP offices, according to court documents.

Under Whitman, HP also undertook its most dramatic transformation yet. The former eBay boss oversaw rounds of cost cutting and then decided to split the company in 2015.

Whitman opted for HPE, which took over HP’s enterprise software operations, including Autonomy. The other half, HP Inc, houses the printer and PC business.

The tragedy for the Lynch family is that not even dead people can escape HP’s clutches.

In fact, Lynch had been celebrating being licensed on the Bayesian in Sicily when he sank.

How his family must rue the day they met Silicon Valley’s original pioneer.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.