Sir Salman Rushdie says he has “no explanation” for how he survived a brutal stabbing, writing in his new book that it felt like “a miracle”.

The Booker Prize-winning author, who was stabbed in New York in 2022, gave his first television interview about the assault and described how his attacker came “hard and low – a squat missile”.

This led to him spending six weeks in hospital and losing his right eye. Doctors said he was lucky to escape with his life.

Sir Salman Rushdie says he has “no explanation” for how he survived a brutal stabbing, writing in his new book that it felt like “a miracle”.

Hadi Matar, the man accused of the attempted murder of British author Salman Rushdi, in 2022

But the Indian-born novelist, a fierce critic of religion, described how his brush with death left him struggling over how and why he had survived.

“This is a contradiction,” he admitted in the interview with the American program 60 Minutes.

‘How does someone who doesn’t believe in the supernatural explain the fact that something that seems like a miracle has happened? I have no explanation for it.’

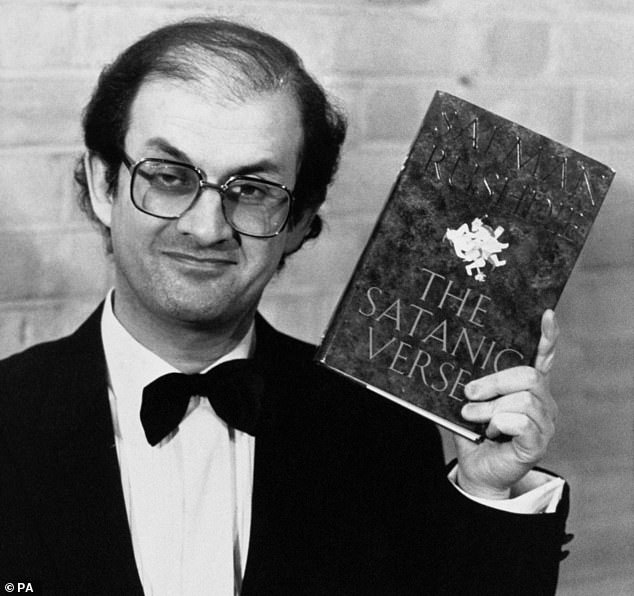

Sir Salman, 76, is the author of the 1988 novel The Satanic Verses, which led Iran’s supreme leader to call for his death and place a £2.5m reward on his head.

Sir Salman, 76, is the author of the 1988 novel The Satanic Verses, which led Iran’s supreme leader to call for his death and place a £2.5m reward on his head.

In the decades since, he said, “I had sometimes imagined my killer rising up in some public forum.”

He added that his first thought, upon seeing his attacker approaching him at New York’s Chautauqua Institution, was: “So it’s you.” Here you are.’

The novelist has written an account of the stabbing titled Knife: Meditations After An Attempted Murder, which will be published next week.