Table of Contents

Whether it’s unaffordable home prices, higher mortgage rates, rising rents or higher levels of homelessness, the housing market appears to be caught in a never-ending crisis.

There remains an insatiable appetite to buy property. Many non-owners aspire to achieve this and dedicate their life savings to achieving it.

It’s a dream that remains increasingly out of reach for many as chronic property shortages drive up house prices and rents.

As for those who already have, they tend to want more. Whether that means buying a bigger and better house, buying a holiday home or investing in rental buying, the British obsession with property acquisition doesn’t stop at the former.

Owning property has become synonymous with both wealth creation and preservation, and as money continues to accumulate, prices continue to rise.

You can fix it? Every week we talk to a real estate expert about the real estate crisis.

Government interventions often seem to add fuel to the fire. Stamp duty holidays, Help to Buy, Right to Buy and other schemes were intended to help more people get up the ladder.

But while many of those initiatives were successful, they also had the effect of driving up home prices even further for those that came after.

Worst of all, the number of homeless people is increasing. According to research by the charity Shelter, there are more than 300,000 homeless people in England, many of whom are in temporary accommodation.

In the new series of This is Money, we speak to a property expert every week to ask what’s wrong with the British property market and how they would fix it.

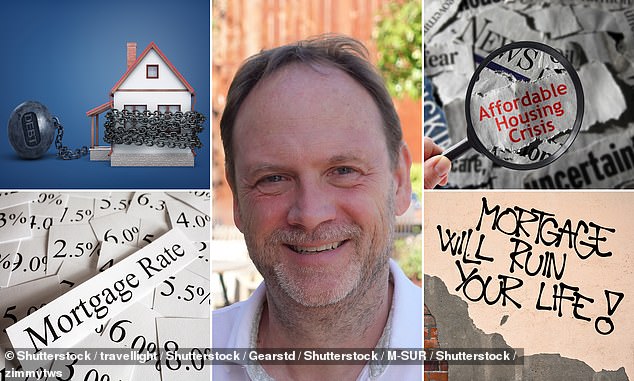

This week we spoke to Arjan Verbeek, founder and CEO of mortgage lender Perenna.

Arjan’s career in financial services has included creating multi-billion pound financing programs for various institutions and evaluating mortgage markets around the world, including Canada, the United States, Australia and Denmark.

He has held positions at BNP Paribas and Barclays Capital and was vice president at Moody’s analyzing mortgage risk.

Does Britain have a housing crisis?

Arjan Verbeek answers: Yes. We are in a real estate crisis that impacts all generations.

Young people are excluded from home ownership, mortgage prisoners are trapped in obscenely high standard variable rates (SVRs) and over-55s face discrimination, often being denied outright mortgages due to their age.

The UK mortgage market is uniquely flawed in that it is overly reliant on ‘cheap’ short-term products. This structure prevents people of all ages from buying the home they want.

In countries such as the Netherlands, Denmark and the United States, where long-term fixed rate mortgages are the norm, this is not the case.

In those countries, borrowers have a broader range of mortgage options, including long-term fixed-rate mortgages that offer full protection against interest rate shocks.

Arjan Verbeek, founder and CEO of mortgage lender Perenna, has analyzed mortgage markets around the world, including Canada, the United States, Australia and Denmark.

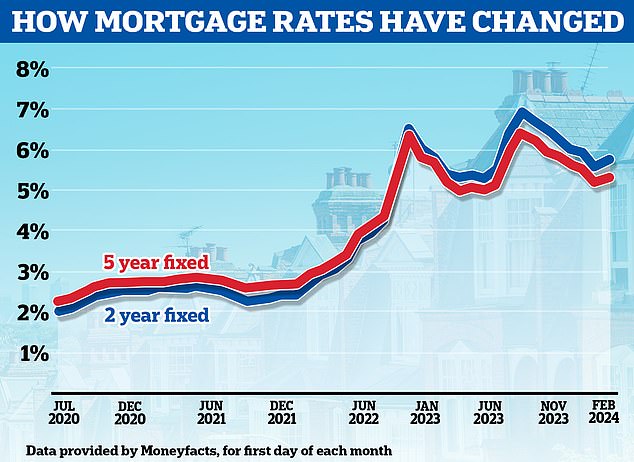

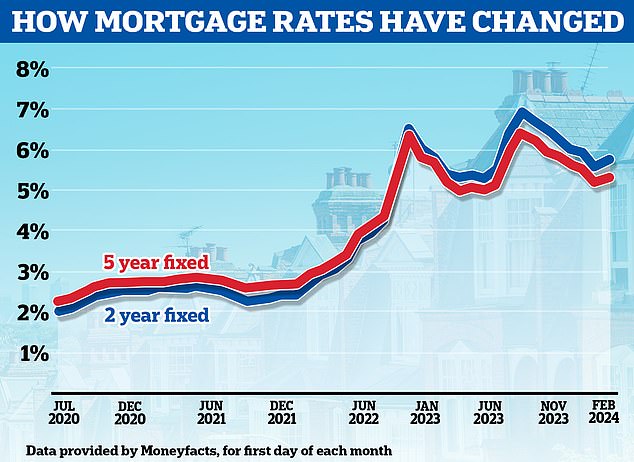

Increases in interest rates in recent years have exposed the risks associated with short-term fixed rate mortgage products in the UK.

By the end of 2024, more than 1.6 million homeowners will reach the end of their fixed-term agreements and experience significant increases in their monthly payments due to the faulty design of their mortgage product.

We are trapped in an endless cycle, which will continue if we do not fundamentally change our mortgage market.

It’s a tragedy that the average age of first-time buyers continues to rise. As a society, we cannot accept that.

How does this compare to the past?

Although recently exacerbated by high interest rates, these market problems have existed for a while.

The 2008 global financial crisis made me compare and contrast mortgage markets around the world and I realized that the structure of the mortgage market has a much greater impact on the health and stability of the economy than people realize.

Regulators recognized the risks and implemented protective measures.

However, these actions inadvertently blocked the market. It has not recovered properly since then and created the problems we are seeing now.

What in your opinion was the main cause of the real estate crisis?

A market that relies on “cheap” short-term fixed rate mortgages, meaning borrowers are not protected against rising interest rates.

At Perenna, we give borrowers the ability to lock in their mortgage interest rate for up to 30 years.

Short-term fixed-rate mortgages place a disproportionate burden on consumers, who should not be exposed to interest rate shocks.

Volatile rates: A market that relies on short-term fixed rates and “cheap” mortgages, meaning borrowers are not protected against rising interest rates, Arjan says.

Mortgages issued by traditional banks are designed to shift all interest rate risk to consumers.

We don’t think that’s right and unfortunately many people are experiencing the negative impact today.

I’m not quite sure how these traditional mortgage products meet consumer duty standards. We hope that the Financial Conduct Authority will carry out a thorough analysis of the “foreseeable harm” they cause. The evidence is current and difficult to dispute.

How would you solve the crisis?

A shift towards long-term fixed rate mortgage models This would provide much-needed consumer protection, greater affordability as borrowers are not stress tested for rate increases, and most importantly, get the country excited about homeownership again.

Update current loan-to-income (LTI) limit regulations Regulations such as loan-to-income limits prevent lenders from truly supporting first-time buyers.

Lenders can typically only make mortgages worth more than 4.5 times income to about 15 percent of their customers, and these tend to be borrowers who are already firmly on the ladder and wealthy.

While this regulation is very appropriate for short-term solutions, evidence suggests that in long-term solutions, people can responsibly borrow over 4.5 times.

Two-year preference: Britons tended to opt for two-year arrangements in 2023 in the hope that interest rates will be lower when they come to remortgage.

Reform the current mortgage guarantee system Extending the guarantee to cover the entire loan would significantly reduce the price of loans with higher loan-to-value ratios.

This would achieve greater acceptance and increase people’s ability to buy a home even in more difficult economic times.

The Government’s plans for a 99 per cent mortgage scheme have been scrapped, which was the right decision in relation to short-term solutions.

But a scheme like this for longer-term fixed rate mortgages is absolutely what is needed.

While there are certainly risks such as negative equity, this risk can be mitigated if the collateral is combined with a long-term fixed-rate mortgage.

In your opinion, will the real estate crisis ever be solved?

If we restructure our mortgage market, then yes, I firmly believe that we can solve the housing crisis and establish a housing market that is truly affordable and accessible.

Homeowners should not be forced to speculate on the biggest debt they have ever taken on.

One way to achieve this is to increase the availability and choice of long-term fixed-rate mortgages that can allow consumers to borrow up to 30 percent more than traditional lenders, feel confident and secure in their monthly payments, and have the flexibility to move house or remortgage if they need to.

I also see the FCA having a key role to play in ensuring that consumers are presented with a wider range of mortgage options, including one that eliminates interest rate risk entirely.

Homeowners should not be forced to speculate on the largest debt they have ever taken on due to the limited availability of mortgage products offered by major lenders.

We need a revolution in the mortgage market if we want to see a better future. We want people to get on with their lives without worrying about their mortgage product.

Perhaps by doing so we can also unlock a productivity revolution.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.