Yes, it’s that time of year when some women’s thoughts turn to white jeans and others. . . definitely don’t do it.

If you’re a female celebrity, pretty much any female celebrity, but chief among the white jeans fan club are Rosie Huntington-Whiteley, Katie Holmes, Sienna Miller, and, lest you suspect that white jeans are something you keep to yourself, fifty years old, Cindy Crawford. and Tilda Swinton, then you’ve already looked for your white jeans. You wore them on the first hot weekend in April (more kudos for going early) and have been making the most of white jeans and a camel/navy turtleneck.

Honestly, it’s harder to think of an A-list celebrity who, right now, doesn’t break out their white jeans, because white jeans are the classic, never-out-of-style, evergreen, and, worn correctly, summer garment. they have converted. a bland status symbol.

If you’re a normal woman with a dog, who travels on public transportation, gets stuck in the rain, and has a partner who eats chocolate in such a way that tiny, barely visible shavings land on the couch, then white jeans are the way to go. ideal. The last thing on your list. Even if they weren’t as practical as white rugs, you have to consider the potential of white jeans to exaggerate your hips and thighs.

It’s harder to think of an A-list celebrity, like Sienna Miller, above, who isn’t breaking out her white jeans right now.

Katie Holmes steps out in style on a rainy day in New York, wearing yellow heels with white denim and a gray sweater.

And here’s Katie again, rocking a white jeans look.

They get dirty in an instant, they add inches to your butt, they are not the friend of busy women with money problems, that’s how many of us feel about them. Good for Meghan Markle (thin, rich, Californian), not in real life.

And we are not entirely wrong. You can’t ignore the fact that white jeans get dirty 90 percent faster than regular jeans, but a washing machine with a fast cycle solves that problem.

As for adding centimeters below the waist, yes you can, but in exactly the same way as any jeans or pants; Their whiteness, strange as it may seem, does not make them any less flattering.

Pale pink, lilac, lemon yellow, all pastels tend to exaggerate the hips and butt, but the white ones don’t, as long as they are well cut and not bulky or tight.

If you’re a regular woman with a dog, then white jeans are last on your list, but megastars like Jennifer Lopez, above, can probably get away with it.

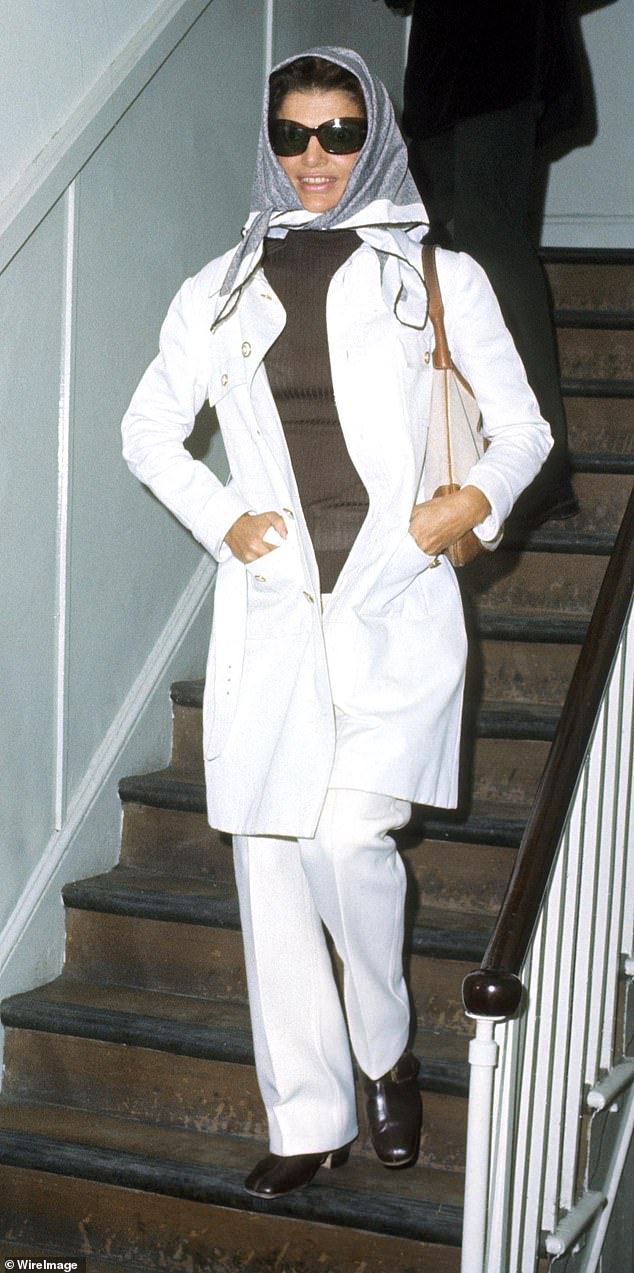

Since vintage stars like Jackie Onassis, pictured above in 1970, established them as a mainstay of the elegant and sophisticated women’s wardrobe, it hasn’t all been plain sailing for white jeans.

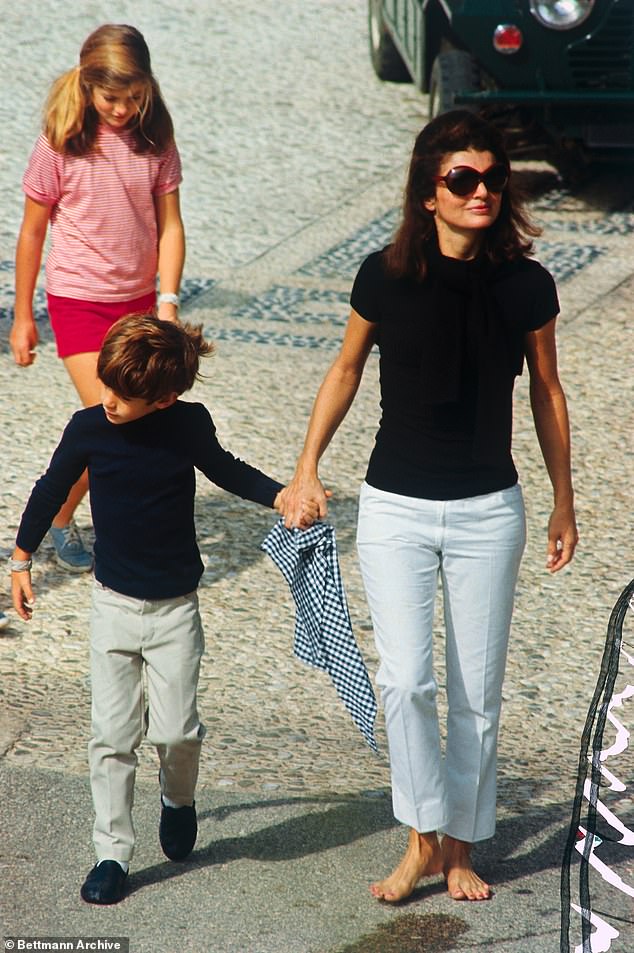

The future Jackie O, with a relaxed look the day before her wedding to Aristotle Onassis

Which quickly brings us to the question: But why bother? Because, in 2024, white jeans not only offer a fresh, easy alternative to blue jeans, they’re a shortcut to understated elegance: the rich, stealthy, stripped-down minimalism that’s everywhere this year.

What if the secret to looking stylish, put together and smart this summer was as easy as investing in the right white jeans? Or, to put it another way, can you look like a Montecito resident, or a Parisian fashion editor, for the price of a pair of baggy jeans from Marks & Spencer, or a pair of navy-cut straights from Zara, and if so? ? . . Could it not be fun?

It wasn’t always like this. The white jeans of the last decade, from the low-rise stretch skinnies with a whale-tale thong coming out of the back, to the ripped and ripped ones favored by model Gigi Hadid, haven’t always seemed like the ideal daytime piece. a day. Since Audrey Hepburn and Jackie O established them as one of the pillars of the elegant and sophisticated woman’s wardrobe, not everything has been easy for white jeans.

Lately they’ve taken on a certain sparkle: ‘Do I seem to care?’ reputation. Ask her husband what she thinks of when she thinks of white jeans and he’ll probably tell you that they’re the second wives of hedge fund managers, blocking the road with their ATVs.

Supermodel Cindy Crawford combines her white jeans with a classic navy blue knit and modern Birkenstocks.

…Top model Gisele Bundchen opts for an all-white look with toe sandals

White jeans are fine for Meghan Markle (a rich, slim Californian photographed with Harry during the Invictus Games in Dusseldorf, Germany, last year), but not in real life.

Ask your twenty-something daughter and she’ll narrow her eyes and beg you not to join the ranks of bleached blonde moms in Breton T-shirts and ankle-length white jeans.

But ask a fashion editor what she thinks of white jeans in 2024 and she’ll tell you that a simple, straight-leg or wide-leg pair (jeans or pants) is a key part of the minimalist luxury look for summer 2024. With ivory , with white, with more white or ecru, from head to toe (or with a dose of black) is currently the fastest way to look expensive and glamorous.

We have the white shirt, the white t-shirt, the white jacket and those mostly white Adidas Sambas. Wear some or all of them along with your white jeans and you’ll be making stealth wealth without even trying.

These are not the stiff, crisp, sturdy white jeans that definitely add weight below the waist (you need a model figure for those). They are also not the transparent second skin type that shows pockets and panties. They may not even be denim. They are the elegant alternative to black jeans/pants, and being white they are more glamorous than both.

Will I personally wear white jeans? No. But I will wear raw jeans and judging by the fact that mine are currently Marks & Spencer’s best sellers, I’m not the only one.