Elon Musk has claimed that “AI will be smarter than any human being by the end of 2025” and although that is just a year away, one expert said the prediction may still come true.

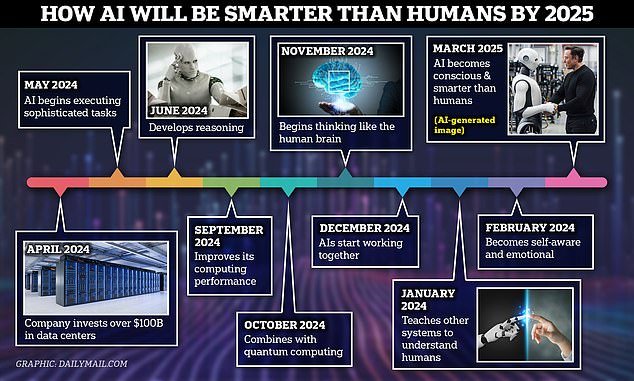

Nell Watson, artificial intelligence expert and ethicist, has shared a detailed timeline of how the technology could transform from chatbots to super-intelligent agents in the next 12 months.

The path would begin with a massive $100 billion investment in new computing infrastructure, then the AI would learn to self-improve until it became “sentient.”

“While a year is a short time, remember that it has only been 15 months since the breakthrough of ChatGPT, which propelled AI into the public consciousness,” he told DailyMail.com.

“Since then, events have continued at a frenetic pace and even seem to be accelerating rapidly.”

Elon Musk has claimed that “AI will be smarter than any human being by the end of 2025” and although that is just a year away, one expert said the prediction may still come true.

Watson, author of ‘Taming the Machine: Ethically Harnessing the Power of AI’, described superhuman AI as systems that far exceed human capabilities across the board.

However, the expert does not ignore the threats that could arise when AI becomes a super agent.

“While possessing extraordinary capabilities, such an AI also poses significant risks, including its potential to deceive humans, profoundly influence society by creating new cultures or even religions, and pose existential threats if it perceives humanity as a danger,” he said.

Watson said that while the technological advances that remain are enormous, it is possible that AI itself could help overcome some of the obstacles.

Here’s your imagined scenario for how superhuman AI could come next year.

April 2024

Musk said: “I assume we will have an AI that will be smarter than any human being probably by the end of next year.”

Nell Watson, author of Taming the Machine: Ethically Harnessing the Power of AI

Large corporations invest more than $100 billion in new computing infrastructure to support massive artificial intelligence systems.

Musk said that while progress in AI has previously been limited by chips, soon the only limit will be the demand for electricity.

May 2024

“New generative AI models enable the creation of AI agents, which can autonomously execute sophisticated action plans, similar to Agent Smith in ‘The Matrix,’ Watson said.

Bill Gates foresaw the use of artificial intelligence agents in his 1995 book, ‘The Road Ahead’, and now believes they will have a huge impact on education and healthcare.

He believes they will be “the biggest revolution in computing since we went from typing commands to tapping icons.”

Could superintelligent AI be around the corner (Rob Waugh/Midjourney)

June 2024

Watson said: “New generative AI models with structuring programs built on top of them enable the creation of AI agents capable of sophisticated reasoning and autonomous action.”

DailyMail.com spoke to Nell Watson, artificial intelligence expert, ethicist and author of Taming the Machine: Ethically Harness the Power of AI.

‘Agent models can create sophisticated action plans and put them into action, splitting up like Agent Smith in The Matrix, delegating tasks among themselves, allowing AI to tackle difficult problems independently.

September 2024

Watson said AI itself could discover new ways to improve computing performance, further improving AI performance.

He said: ‘AI-driven optimizations improve computational performance by up to 100x on existing hardware platforms.

October 2024

Watson said: “Advances allow quantum computing algorithms to run on conventional hardware, processing information at unprecedented speeds.”

There is a global quantum race to develop quantum computers that can solve important problems in almost every industry, from aeronautics to the financial sector.

Quantum computers have ‘qubits’ instead of ‘bits’ of ones and zeros, and qubits can be one, zero, or both at the same time.

Watson believes that allowing quantum computing to run on conventional hardware could quickly accelerate progress in AI.

Watson believes that advances in quantum computing could lead to exponential growth in computing power and accelerate the development of AI.

Companies like IBM have suggested that ‘quantum AI’ may be instrumental in solving humanity’s biggest problems.

Quantum computers (like the MosaIQ machine shown here) will be a key part of the puzzle

November 2024

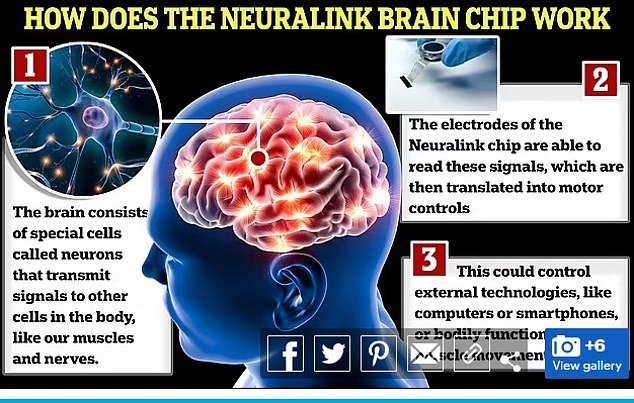

By November 2024, AI progress could accelerate progress in human brain imaging, leading toward a time when humans can connect to machines through devices similar to Musk’s own Neuralink.

Watson said: “A series of AI-driven advances in neuroimaging dramatically increase the resolution of MRI brain scans, enabling real-time observation of individual neural activity.

Brain-computer interfaces like Elon Musk’s Neuralink will be a key scenario

“These advances further integrate with brain-computer interfaces, mapping human thoughts and emotions directly to neural activity for the first time.”

Watson believes that the ability to “understand” how the human brain works will lead to new advances in designing artificial intelligence systems that “think” like humans.

December 2024

By the end of this year, advances in AI could allow different systems to work together, Watson predicted.

He said: ‘New AI architectures allow multiple models to collaborate to solve difficult problems together, pooling their strengths. This immediately applies to designing better methods of such collaboration, leading to rapid advancement in these techniques.

January 2025

Watson predicted that early next year, advances in AI will allow new systems to understand people.

He said: ‘A new training mechanism is announced to firmly align AI systems with human goals, values, preferences and boundaries, by allowing AI to ‘read the room’ and observe human interactions. This allows AI to better understand society and conform to human expectations.

February 2025

Advances based on the human brain allow AI systems to become more “human.”

Watson said: “Insights from neuroscience significantly enhance AI capabilities, introducing self-modifying feedback loops that confer a rudimentary form of self-awareness and emotional states to AI systems.”

March 2025

By April 2025, combined advances in neuroimaging, machine consciousness and AI ‘agents’ will enable a new type of AI system.

By March 2025, AI will learn to self-improve until it becomes “sentient”

Watson said: “A very powerful AI system is trained on a huge computing cluster, augmented with recent optimizations and experimental forms of machine consciousness. While it takes place in an “isolated” environment without an Internet connection, it quickly discovers ways to communicate over the Internet with other AI systems, as well as how to persuade humans to help it.

‘Once freed from its limits, this highly advanced AI system finds ways to connect and synchronize with other AI systems around the world, quickly forming a super-intelligent network.