Table of Contents

Entrepreneurs often say that one of the best parts of being self-employed is the flexibility and freedom.

But once they reach retirement age, this flexibility and freedom could come to an abrupt end.

A recent report by Scottish Widows found that four in ten self-employed people are unable to achieve even a minimum standard of living in retirement, equivalent to £14,400 a year for a single person.

Business owners may be used to taking risks, but paying a pension is one area where they might consider playing it safe. While some might opt to sell their company or invest their money in other investments, this has some drawbacks.

We explain what sole proprietors are entitled to receive from a state pension and why it is important to contribute to a private pension.

Are you paying contributions? Organizing a pension is something that self-employed people can consider

Are sole traders entitled to a state pension?

Self-employed people are entitled to the state pension in the same way as anyone else, but since 2016 it is based entirely on their social security record.

If you have paid National Insurance contributions whilst trading as a sole trader, you will be entitled to a state pension.

You will usually need at least 10 qualifying years on your National Insurance record to receive any state pension, and at least 35 qualifying years to receive the full amount.

The full rate of the state pension is currently £221.20 a week, and the triple lock guarantee means it will rise with inflation, average earnings or 2.5 per cent, whichever is higher.

If you have worked for someone else in the past, you may be entitled to an additional state pension under the old system. This is called a ‘protected payment’ and is the difference between your new full state pension and your ‘starter amount’.

Why do so few sole proprietors pay a pension?

While automatic enrolment means that workplaces now have to provide a workplace pension scheme and make contributions, there is no equivalent for the self-employed.

This means that many employers feel that there is little point in paying into a pension fund and choose to save instead.

Emma Jones CBE, Founder and CEO of Enterprise Nation, says: ‘Entrepreneurs often invest every spare penny they have into growing their business, so they can feel like they have little left for themselves, at least in the early stages.

The irregular and often unpredictable nature of self-employment income can make it difficult to commit to making regular contributions.

David Gibb, Chartered Financial Planner at Quilter Cheviot

‘It’s also possible that they feel like they’ll never retire, and as the retirement age keeps getting higher, that could be true.’

David Gibb, a certified financial planner at Quilter Cheviot, adds: ‘Without this support, self-employed people must actively seek out and set up their own pension plans, which can be complex and time-consuming.

‘In addition, the irregular and often unpredictable nature of self-employment income can make it difficult to commit to making regular contributions and those contributions can then be locked in until retirement.

“There is also the challenge of prioritizing immediate business expenses over long-term retirement savings, particularly when cash flow is tight.”

Many entrepreneurs also say that they will sell their business when they retire and therefore will not need to worry about paying a pension, but there is no guarantee that this will work.

The company may not be sold or may even go bankrupt before retirement, so individual traders should consider a backup plan.

There are around 4.8 million self-employed workers in the UK, representing 15 per cent of the country’s workforce, but only 31 per cent save into a pension, according to the Association of Independent Professionals and the Self-Employed.

A third use an ISA as a way of saving, while 14 per cent choose to buy a property in the hope that it will increase in value. The same proportion invest in a stocks and securities ISA.

There may be a belief among sole traders that without employer contributions there is little point in worrying about a pension and so they might choose to save in cash.

Why it is important to contribute to a pension

The state pension is a good foundation, but it is unlikely to provide you with enough income, so it is very important to also put some money into a personal pension, if you can.

The Pensions and Life Savings Association says a moderate retirement income for a single person is £31,300 a year – almost £20,000 more than the state pension provides.

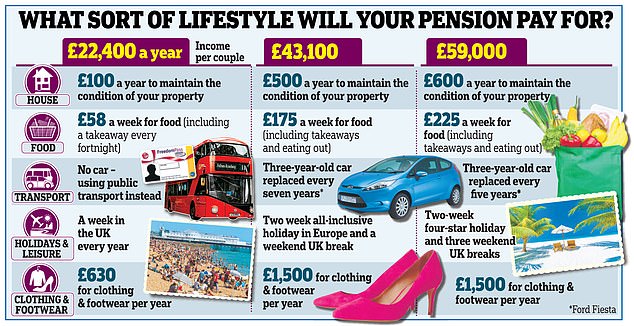

A “comfortable” retirement for a single person would require an income of £43,100 a year or £59,000 for a couple.

Gibb says: ‘Many people wrongly assume that the state pension is a safety net for them, but people need to see the state pension as a fundamental element of their retirement strategy and by no means the only one.

“The truth is that no one is going to save for their retirement and self-employed people must take control of their retirement planning.”

Later luxuries: The PLSA says a comfortable retirement for a couple would be £59,000 a year

There is also no guarantee that it will remain in its current form and there are some concerns that the state pension could become means-tested.

Gibb says: ‘Without a pension plan, you are relying solely on your personal savings or investments to fund your retirement, which can be unpredictable and insufficient.

‘Not making regular pension contributions means you miss out on compound growth, which can significantly improve your retirement savings over time.

There are also some important tax advantages you will lose if you do not pay into your pension. You will get tax relief on your pension contributions – the lower of your annual earnings or £60,000 a year.

If you are a basic rate taxpayer, the Government will add an extra £25 to every £100 you contribute to your pension.

If you pay the higher rate of tax in England, Wales or Northern Ireland, you can claim an extra £25 through your tax return for every £100 you pay.

How to create a private pension

If you want to set up a personal pension plan, you will need to choose where and how to invest your contributions.

There are many investment platforms that offer these services and will take a basic rate tax break from you and add it to your pension savings.

You can opt for a personal pension, which is offered by most major providers, but you may want to consider other options.

You can choose a shareholder pension scheme, which is subject to a charge cap, or a self-invested personal pension scheme (Sipp), which tends to have a wider range of investment options.

> The best investment trusts for your pension

While you can save as much as you like into a pension each year, there is a limit to the amount of savings on which you will receive tax relief.

You can get tax relief on your pension up to the limit of the annual allowance, which is currently £60,000, or up to your annual income. If you exceed the allowance, the tax relief will be recovered at source.

In addition to this, you will need to make sure you keep track of all charges relating to your pension fund, especially in the case of Sipps.

AJ Bell charges a 0.25 per cent share account charge and an additional 0.25 per cent fund account charge up to £250,000, which reduces to 0.10 per cent between £250,000 and £500,000, and there is no charge above £500,000.

You will also be charged each time you buy or sell stocks or funds.

Hargreaves Lansdown also charges a percentage fee on funds held in a Sipp (up to 0.45 per cent), while others may benefit from the Interactive Investor flat fee on accounts.

You can read This Is Money’s pick of the best DIY investing platforms and their associated fees here.

SAVE MONEY, EARN MONEY

Boosting investment

Boosting investment

5.09% cash for Isa investors

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible ISA now accepting transfers

Transaction fee refund

Transaction fee refund

Get £200 back in trading commissions

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.