Retirees could be heading for a golden period of income growth thanks to the rising value of state, workplace and private pensions, analysis suggests.

More than £12m is earmarked for an increase in state pension income by at least £1,660 over the next five years, according to The Mail on Sunday’s analysis of estimates contained in the Conservative manifesto.

Pensioners receiving the new state pension will enjoy at least £32 extra a week in their payments by 2029 – and may get even more.

Next year, state pensioner income is expected to increase by 3.7 percent, in line with projected income growth.

The increases are guaranteed whether a Labor or Conservative government is formed

next month.

The ‘triple lock’ promise ensures state pensions rise to the higher of inflation, income growth or 2.5 per cent by 2029.

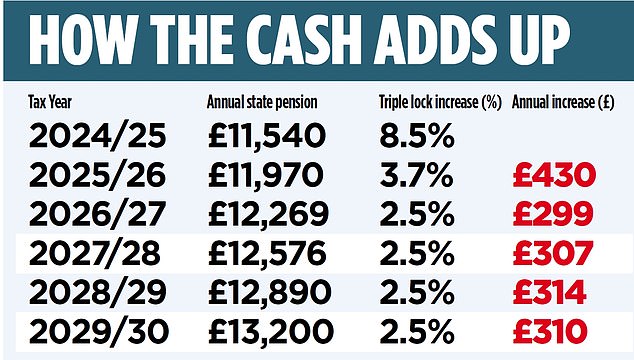

The two main parties have committed to respecting the triple blockade. Thanks to this, state pensions will rise more than inflation in each of the next five years, according to an analysis of pensions group Aegon’s manifesto predictions (see table below).

Next year, pensioners are expected to see their state income increase by 3.7 per cent, in line with projected income growth. This would raise the full annual state pension from the current £11,540 a year to £11,970, an increase of £430.

In each of the next four years, the state pension will rise by a minimum of 2.5 per cent, according to an analysis of Conservative Party predictions. This means that both inflation and earnings growth are forecast to be at or below the 2.5 percent threshold.

At first glance, the planned increases appear less generous than those recorded in the last five years. According to our calculations, the state pension will increase 40 percent less in the next five years than in the last five.

Pensioners receiving the new full state pension have seen an increase of £2,772.80 in their annual income since the 2019-20 tax year. That’s almost double the increase they will receive over the next half decade, according to the prime minister’s manifesto.

However, in recent years the state pension has increased based on inflation or workers’ salaries, while over the next five years it is expected to increase above those amounts.

Therefore, the purchasing power of pensioners will strengthen, as their incomes rise faster than workers’ wages and as prices rise in general.

Steven Cameron, pensions director at Aegon, says: “The triple lock will be very valuable in the coming years if inflation stabilizes because pensioners will do better than the working-age population.”

This is despite the projected increases being well below the extraordinary increases of 10.1 percent and 8.7 percent in April 2023 and 2024 respectively, when inflation and earnings growth were soaring due to Exceptional circumstances.

As the value of state pensions is expected to rise, private and workplace pensions are also expected to grow strongly. Pension funds have generally performed poorly – or worse, collapsed – in recent years due to high market turbulence. People close to retirement have been hit hardest, as they are more likely to invest more of their funds in bonds, which have fallen sharply in value as interest rates have skyrocketed. In the worst cases, The Mail on Sunday has spoken to readers whose pensions have fallen by 30 per cent.

But today the future looks much brighter for pension funds, says Mike Ambery, director of retirement savings at Standard Life, part of pension giant Phoenix Group. Savers will have already seen their pots start to grow faster over the last 12 months.

Those with workplace pensions who are far from retiring have made a 13 per cent return on their fund last year, against an average loss of 9 per cent in 2022. This is based on the average returns of 25 of Britain’s biggest workplace defaults. defined contribution pensions, known as Average Corporate Advisors Pensions. Today, most workers are automatically enrolled in money purchase pensions and are allocated a one-size-fits-all default pension fund.

Those just five years away from retirement, who invest in less risky assets, will have seen their pension fund grow by 8.53 per cent last year, compared to a loss of 9.71 per cent the year before.

Ambery says: “Don’t panic when it comes to investment returns because we expect there to be further growth in the coming years.”

Although the future seems better for pensioners’ income, it is not known what awaits them. And while the triple lock secures the value of the state pension, the outlook for private and workplace pension income is in the hands of the financial markets.

However, that doesn’t mean it’s out of your control. Current and future retirees can verify that their savings are invested in funds that will give them the best chance of income growth. Ambery suggests that one of the most important steps people in their 50s and 60s can take to improve their chances of getting a good pension is to decide when they want to retire and tell their pension plan.

This is because they could automatically be placed in a lower risk fund, resulting in lower returns and therefore could miss out on further growth, Ambery adds. She says: “Being in the wrong fund could make a difference of more than £10,000 a year for someone on a £200,000 private pension because of where the money is invested.” Ian Cook, chartered financial planner at wealth manager Quilter, echoes this and warns that there is a risk in taking too little risk.

He says: “Many of those in very low-risk pension funds have had to change their retirement plans because they have lost a lot of money in recent years when bond prices fell.”

But it’s important not to make knee-jerk reactions and those who kept those funds could soon see their loyalty pay off.

‘There has been a lot of uncertainty around investment markets because the trajectory of interest rates was uncertain, but that is changing, so we should see more normal market conditions.

“The Bank of England is expected to cut interest rates later this year and when it does, bond prices will rise again,” he says.

When interest rates fall, bond prices tend to rise, as new bonds issued are likely to have lower yields and investors who sell existing bonds with higher yields may do so at a higher price than debt. just issued.

This means that old or outstanding bonds held by pension funds may be attractive.

What are your tips for a richer retirement? Email jessica.beard@mailonsunday.co.uk

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.