A top think tank economist has revealed how much Americans really need to save in their retirement accounts, and it’s far less than $1 million.

According to Andrew Biggs, a fellow at the American Enterprise Institute think tank, a typical senior who reported having a successful retirement had between $50,000 and $100,000 in savings.

In the past, financial gurus have claimed that the average American should have $1.46 million or more than 10 times their salary in savings to be financially secure in old age.

But the latest report from the Federal Reserve Board study entitled ‘Survey on Home Economics and Decision Making’ states otherwise.

According to Andrew Biggs, a senior fellow at the American Enterprise Institute think tank, a typical senior who reported having a successful retirement had between $50,000 and $100,000 in savings.

The survey asked retirement-age Americans: “In general, which of the following best describes your financial management?”

Of respondents ages 65 to 74, 3 percent said they “found it difficult to get by,” 12 percent “just got by,” 37 percent were “fine,” and 49 percent were “living comfortably”.

Federal Reserve Board researchers also asked, “Approximately how much do you currently have saved for retirement?” with options ranging from ‘less than $10,000’ to ‘over $1 million’.

Of those surveyed, only 19 percent said they had less than $10,000, while 86 percent said they were doing well or living comfortably with between $50,000 and $99,999 in their bank accounts.

Biggs also noted that these amounts would be sufficient for a retiree, since other sources of income, such as social security, are much more beneficial than people realize and many could simply live off their security checks before even dipping into them. their own savings accounts.

‘Social Security benefits are more generous than people think. While nothing extravagant, a typical couple can expect an income more than twice the senior poverty line before touching a penny of their own savings.

“It is impossible to find any evidence that seniors need even a fraction of $1.46 million in savings to be financially secure,” Biggs wrote in his Wall Street Journal column.

The Federal Reserve Board concluded at the end of the study that the average American only needed between $50,000 and $99,999 to be “well off” and between $100,000 and $249,000 to “live comfortably.”

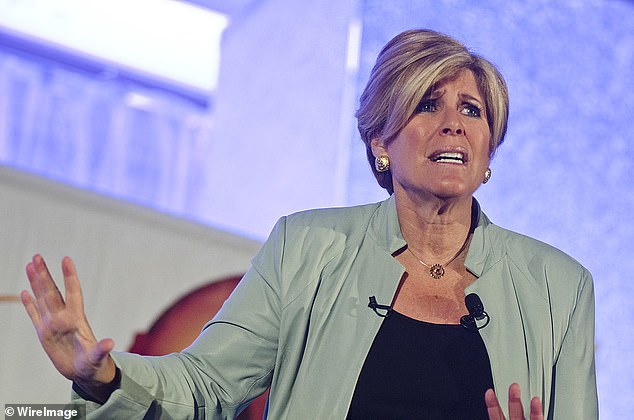

Early last month, personal finance expert Suze Orman advised those looking to retire to put as much money as they can into a Roth IRA.

A Roth IRA is a type of individual retirement account where you contribute after-tax dollars from your paycheck and, as money genius Orman points out, all future withdrawals are tax-free.

This means much more financial freedom than other retirement plans, including a 401(k), offer.

Those types of accounts are funded with pre-tax money, he adds, so your entire dollar will have a chance to compound.

In a time where every penny counts, advice is more than welcome and can give your money a much-needed boost.

“If you’re not saving for retirement in a Roth, I think there’s a good chance you’re making a mistake,” former CNBC host Suze Orman told Benzinga, promoting the specific type of retirement account.

In terms of inheritance, heirs can inherit Roth accounts without the burden of income taxes, he said; This is not the case with cash or inheritances, of which Uncle Sam will always receive a portion.

This can be a significant advantage for those in a higher tax bracket, Orman said, as he explains to Americans how to protect the wealth they worked so hard to accumulate.

For the less fortunate, there are no tax benefits for the current year, so your contributions, no matter how small, can grow tax-free.

This can be done once the account has been open for five years, or after the account owner turns 59½, Orman denied, while repeatedly touting the flexibility of Roth’s penalty-free withdrawals.

A Roth 401(k), which is only available through certain employers, is even better, he said.

The main difference between a Roth and a traditional 401(k) is when taxes are applied, he added, detailing how in a traditional 401(k), contributions are made before taxes, while in a Roth 401(k), contributions are taxed. in the front.