Table of Contents

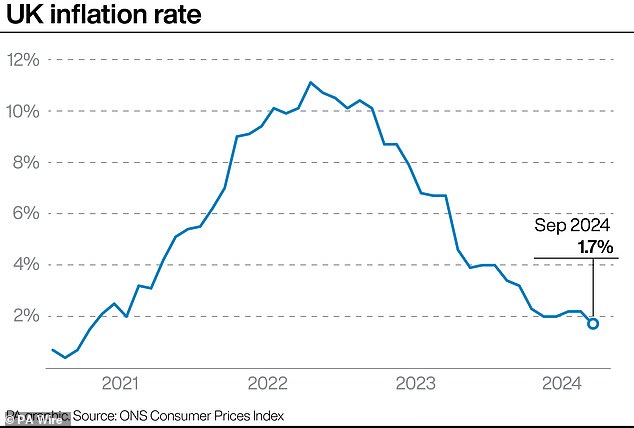

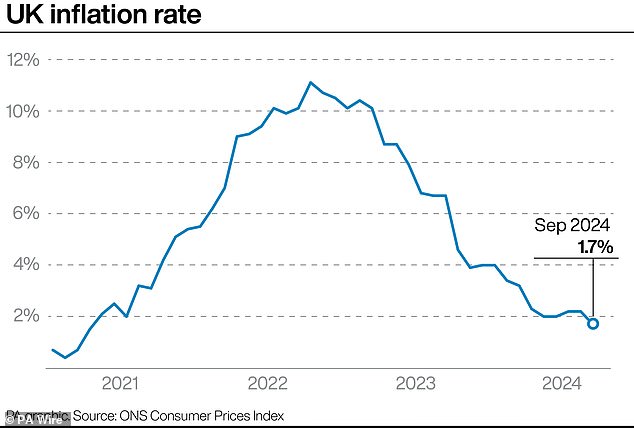

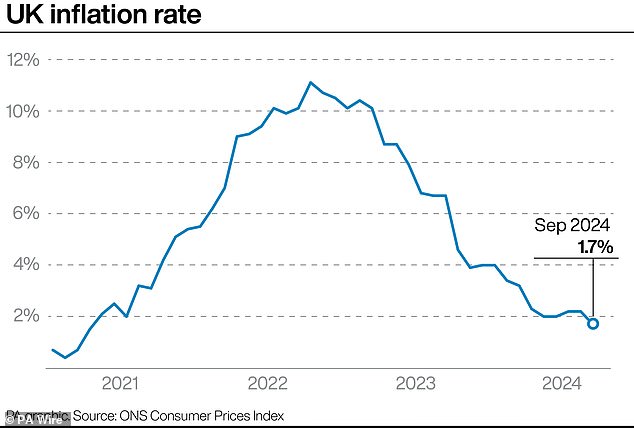

Inflation hit its lowest level in three years after a surprise drop in September, paving the way for more interest rate cuts.

For millions of people receiving benefits, the September reading paves the way for smaller payment increases.

The Government uses September’s inflation figure to calculate how much benefits, including universal credit, should increase by the following April.

However, the larger-than-expected drop in inflation is expected to be temporary and the CPI will rise again at the end of the year.

Falling inflation: CPI fell below 2% target in September, meaning benefit claimants will receive a smaller increase in payments

While it is good news for the Treasury, which will pay out less in benefit payments, claimants are likely to see much smaller increases than expected next year.

We look at which benefits and bills are linked to inflation and what it will mean for claimants.

Why are profits affected by inflation?

Historically, the Government has used September’s inflation reading as the base month for increasing benefit payments the following April.

Since 2011, the default inflation measure used is the Consumer Price Index (CPI) to ensure benefits remain in line with the cost of living.

The weaker-than-expected September reading, driven by a drop in transport prices, means headline inflation has fallen below the Bank of England’s 2 per cent target.

While this is good news for overall costs, millions of benefit recipients will lose out as inflation is expected to pick up in October.

Because benefits are increased using a lagged measure of inflation, it means that the real value decreases when inflation rises again.

By April, the inflation rate could, in theory, be much higher than the Bank of England’s target, while profits rise by just 1.7 percent.

Lalitha Try, economist at the Resolution Foundation, said: “This temporary drop comes at a bad time for millions of low- and middle-income families as it will result in a smaller increase in their benefits next year.”

The foundation’s calculations found that a typical low-income family with two children receiving universal credit will see their annual benefits rise by £253 next April, or just over £20 a month.

If benefits for working-age people were increased in line with the October reading, which is expected to be around 0.5 percentage points higher, a family would see their universal credit increase by a higher annual sum of £ 327.

How much will the state pension increase?

Pensioners will not be as affected by a temporary drop in inflation because the Government has committed to the triple lockdown.

This ensures that the state pension will increase by inflation, average earnings or 2.5 per cent, whichever is higher.

This year, the biggest increase was the increase in average wage growth of 4.1 percent. This means the new full, flat state pension is expected to rise to £230.30 a week, taking the total to £11,975 a year. It marks an annual increase of £473.

The old full basic state pension is expected to rise to £176.45 a week, taking it to £9,175 a year.

At the same time, the Chancellor is scrapping the Winter Fuel Payment, worth between £200 and £300, for all pensioners except those eligible for Pension Credit.

“Rachel Reeves may choose to shout about this push to beat inflation in her first budget in two weeks… but it remains to be seen how long they can deliver on these promises,” says Rachel Vahey, head of public policy at AJ Bell.

‘The state pension is now at a level dangerously close to the frozen personal benefit and should surpass it within two years.

‘At that moment something must surely give. But slowing the rise in state pension growth or unfreezing the personal benefit looks unlikely.

“It could be that this rapidly approaching critical moment means the Government is finally forced to address the question of how much the state pension should actually offer, at what age and how it can sustainably increase payments each year.”

What other benefits increase with inflation?

The benefit enhancement affects a wide range of benefits, including payments administered by both DWP and HMRC.

They include all disability benefits such as Personal Independence Payment (PIP), Attendance Allowance, Disability Living Allowance and Carer’s Allowance.

Universal credit, which is one of the most claimed benefits, will also increase by 1.7 percent next April. It marks a significant drop from the 6.7 percent paid earlier this year.

| Standard Universal Credit Allowance | Current monthly | Expected increase of 1.7% | April 2025 after expected increase per month (£) | April 2024 increase |

|---|---|---|---|---|

| Single under 25 years old | €311.68 | £5.30 | €316.98 | €19.57 |

| single over 25 | €393.45 | €6.69 | €316.98 | €24.71 |

| Set under 25 years | €489.23 | €8.32 | €497.55 | €30.72 |

| Set over 25 | €617.60 | £10.50 | €628.10 | €38.78 |

| Source: Department for Work and Pensions, AJ Bell. Based on an expected 1.7% increase in standard Universal Credit allocations from April 2025, rounded to the nearest cent. | ||||

Last year, the standard universal credit allowance for a couple aged 25 and over increased by almost £40 a month. Next April, it will rise by just over £10, according to calculations by AJ Bell.

A small improvement to universal credit could also reignite debate over the two-child benefit cap and whether it should be removed to help low-income families.

The policy, introduced by the Conservatives in 2017, limits the amount of universal credit given to families with more than two children born after April 2017.

Low-income families typically receive an extra £3,455 a year in universal credit or tax credits for each child they have.

But the two-child limit means applicants will not receive more for a third or subsequent children born after April 6, 2017.

Critics say it pushes more families into poverty and negatively affects single-parent families.

What about other train bills and fares?

Inflation has been used to calculate other bills, including phone and broadband bills, but they tend to use data from the end of the year.

In the past, providers have used December inflation data to calculate how much to charge customers, usually with an additional fee.

However, the new rules mean that from next year companies will no longer be able to hit customers with inflation-related price increases in the middle of a contract.

Instead, telephone and broadband companies have to prominently display medium-term price increases in pounds and pence.

However, regulator Ofcom did not place any limits on the amount these companies could charge, meaning customers could face even higher bills.

Rail companies have also used inflation to calculate how much they can increase their fares.

Typically, train fares increase in March based on the retail price index (CPI) inflation level from July of the previous year, plus or minus up to 1 percent.

In July, the ONS said July CPI inflation was 2.2 per cent, meaning travel firms could increase fares by up to 3.2 per cent next March.

SAVE MONEY, MAKE MONEY

3.75% APR Var.

3.75% APR Var.

Chase checking account required*

5.05% solution after one year

5.05% solution after one year

Prosperous momentum for Al Rayan

free share offer

free share offer

No account fee and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible Isa now accepting transfers

Trading Fee Refund

Trading Fee Refund

Get £200 back in trading fees

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence. *Chase: 3.69% gross. T&Cs apply. 18+, UK residents

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.