Table of Contents

The UK’s five biggest banks are still failing to offer competitive savings rates despite the Financial Conduct Authority’s consumer rights rules introduced last summer, new figures reveal.

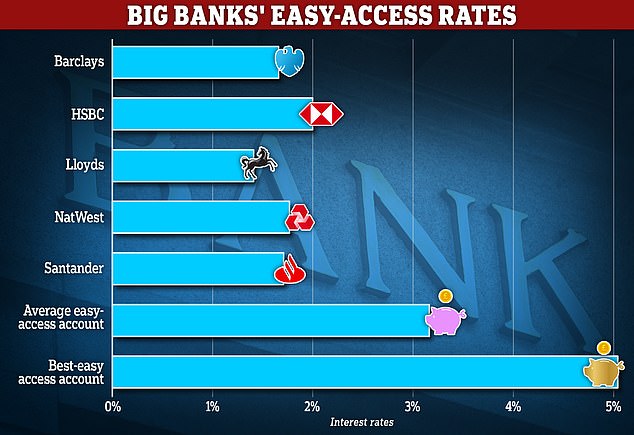

Barclays, HSBC, Lloyds, Santander and NatWest continue to offer easy access savings rates well below the market average, new figures from rates tracker Moneyfacts Compare reveal.

There is still a surprising gap between market-leading accounts, often offered by smaller banks and building societies, and the easy-access rates of the big banks.

All five banks continue to offer savers easy-access accounts that pay less than 2 percent.

Underperforming: The big five banks lag behind the market average when it comes to the interest they pay savers on easy-access accounts.

On £10,000 of savings, Moneyfacts figures show that easy-access flexible accounts at five of the UK’s largest banks pay an average interest rate of just 1.69 per cent, below the market average for an easily accessible account at 1.43 percentage points.

Lloyds Bank is the worst performer, adding just 1.4 per cent to the money saved on its easy access offer, or £1.40 for every £100 saved.

HSBC’s flexible saver pays 1.98 per cent, while NatWest’s pays 1.74 per cent. Santander’s easy access deal pays 1.7 per cent, while Barclays pays 1.65 per cent.

This is despite the average easy access rate being 3.12 per cent according to Moneyfacts. The best easy access account pays 5.1 percent.

It comes as the FCA is implementing its new consumer rights rules, which require banks and building societies to provide “fair value” to savers.

James Hyde, spokesman for Moneyfacts Compare, said: “Consumer rights regulations relating to existing products have been in force since 31 July 2023, meaning businesses have had almost a year to review any products they before it was not competitive and make it comply with the established rules. by the Financial Conduct Authority.

‘Unfortunately, the big five banks still pay significantly lower variable savings rates. All of its most affordable walk-in accounts offer less than 2 percent annual interest, putting them all in the bottom fifth of the market.

‘Currently, a saver investing £10,000 in an easy access Isa offered by a big bank would lose £169 in interest each year (compared to the average rate paid in the market), or £344 (on a leading account). market). .’

Banks are making more money with their OWN cash

More than 80 per cent of accounts on the market currently pay 2 per cent or more on a balance of £10,000, according to Moneyfacts Compare.

This is Money analyzed the easy access rates of these banks in November and found that they paid savers an average easy access rate of 1.85 per cent, so the average rate paid between them is now lower than in November of 2023.

Lloyds’ easy savings rate of 1.4 per cent has not changed since November 2023. NatWest’s easy savings rate remains unchanged, as does Barclay’s and HSBC’s, while Santander’s was 2.4 per cent. 5 percent in November and is now 1.7 percent.

Last month, Treasury Committee figures revealed that NatWest, Barclays, Lloyds and Santander received more than £9 billion in interest on Bank of England reserves in 2023, a 135 per cent increase on the previous year.

Under quantitative easing, the Bank of England created £895 billion of new money in the form of central bank reserves held by commercial banks, of which around £700 billion remains in circulation.

The Bank pays interest on those reserves at the bank rate, currently 5.25 percent. This has generated considerable income for banks as a result of the sharp increase in interest rates since 2021.

What do the bank bosses say?

Last month, the Treasury Committee asked four big bank bosses to outline the steps they had taken to offer better savings rates to customers.

Vim Maru, chief executive of Barclays UK, said: ‘Our transfer rate is regularly assessed as part of pricing governance and has increased as the bank rate has increased.

“Our product range offers different interest rates for different savings goals, including our Rainy Day Saver (5.12 per cent up to £5,000), which encourages customers to develop a saving habit while maintaining instant access to their money”.

Charlie Nunn, chief executive of Lloyds Banking Group, said: “We already offer savings products with competitive rates of up to 4.25 per cent for instant access, up to 5.10 per cent on fixed rate accounts and up to 6. 25 percent for monthly savings accounts.

“We also continually evaluate all of our accounts to ensure they offer fair value and, in doing so, consider the wide range of features and benefits customers are looking for before choosing a particular account type.”

Paul Thwait, NatWest group chief executive, said: “When you look at our products, we offer competitive rates on savings products – over 6 per cent on our Digital Regular Saver, our term accounts currently pay up to 4.60 per cent. “. cent for one year or 4.20 per cent for 2 years (fixed rate Isa rates), and we’re paying up to 3.3 per cent on our instant access savings products.

Mike Reigner, CEO of Santander UK, said: ‘Since the Bank’s rate started to rise, we have significantly increased the amount we have paid out to our savers across our range. In 2022 we paid £195 million in interest to customers on our range of savings products, but in 2023 we paid £1,399 million.

“We have done this in a way that we believe is fair, respects the consumer’s duty and allows us to compete for new business through flexible pricing in our sales rates.”

What to do if you get 2% or less savings

Many savers remain loyal to the big banks despite the low, easily accessible interest rates on offer.

The best easy-access accounts pay 5 percent or more, so if your savings earn a much lower rate than this, you should think about moving your money elsewhere.

> See easy-to-access and best-buy savings rates using This is Money charts

Savers can find a 5.1 percent easy access account at Chase Bank, while Oxbury Bank offers 5.02 percent on easy access savings.

James Hyde said: ‘Customers should proactively monitor savings rates, particularly if they have a variable rate which providers can adjust very reactively.

“Be prepared to change if you feel your loyalty is not being adequately rewarded.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.