Table of Contents

Respite was finally on the horizon for beleaguered homeowners when mortgage rates began to fall this year. However, property investment is now harder to afford as stamp duty hits them with a double whammy.

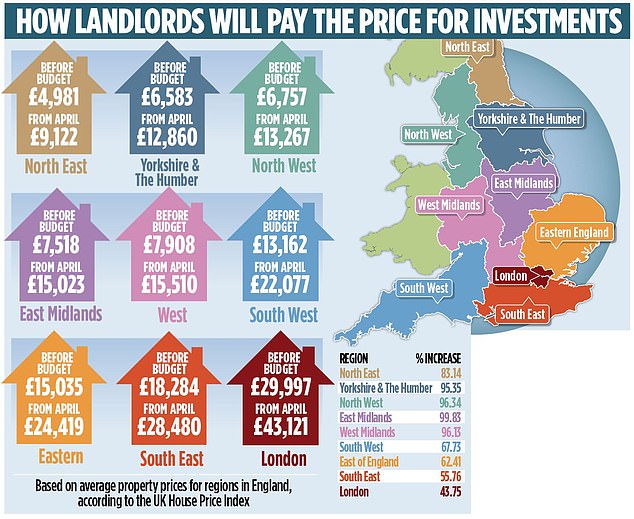

Homeowners’ stamp duty bills in April may be almost double what they were before Chancellor Rachel Reeves’ Budget, Wealth and Personal Finance can reveal.

Buyers of additional properties in England, including rental homes and second homes, will have to pay an average of £20,957 from April, according to calculations by Coventry Building Society.

This is up from £12,566 just a few weeks ago as landlords now have to pay a higher surcharge and thresholds will be lowered from April. It has the potential to completely change the landscape for real estate investors.

These are the stamp duty hotspots where homeowners will be hit hardest by upfront costs.

Chancellor Rachel Reeves failed to extend the stamp duty holiday in her October budget

What has changed since the Budget?

Buyers of second homes must now pay a 5 per cent surcharge on existing stamp duty rates, up from 3 per cent.

Additionally, the Chancellor failed to extend the stamp duty exemption in the Budget, dealing a second blow to homeowners who enjoy higher thresholds from 2022.

Stamp duty is payable on residential properties costing more than £250,000. First-time buyers pay no stamp duty on properties valued at less than £425,000.

Rates start at 5 percent and increase to 12 percent depending on the value of the property. Additional property buyers will now have to pay an additional 5 per cent.

For example, a homeowner buying a property worth £309,572 (the average house price in England, according to the UK House Price Index) would have paid £12,266 in stamp duty before the Budget. At that time a 3 per cent surcharge was imposed on existing stamp duty rates.

On October 31, after Ms Reeves increased the surcharge to 5 per cent, £18,457 would have been owed. That same homeowner will have to pay £20,957 from April 1, when the stamp duty holiday ends and thresholds fall again. On top of that, new rules mean homeowners must obtain an energy performance certificate (EPC) in band C by 2030, which could also prove costly.

Southern Homeowners Face Biggest Bills

Brokers have warned that multitudes of owners could cut back on their investments or even leave the sector altogether following increases in the much-hated tax.

Those spooked by the Chancellor’s announcement have already walked away from deals after they were suddenly forced to find thousands of pounds more to complete sales in a matter of days.

John Hawkesford, of Hawkesford James estate agency in Sittingbourne, Kent, says landlords in his area are already anticipating a reduction. He knows of seven who issued a notice for their properties to sell earlier this month.

It has also lost two sales since the Budget, as owners pulled back on investments amid higher start-up costs. “The owners are so afraid that Labor will come back later with more positions, so they think it’s time to get out of the sector,” he says.

In spring, buy-to-let investors in the capital will face an average stamp duty bill of £43,121, Coventry BS calculations show.

The calculations consider the 5 percent surcharge and the setback of the thresholds. It is based on official average housing prices by region. London has the highest average bill. Before Ms Reeves’ inaugural Budget, just £29,997 was owed for investment purchases in the capital. Homeowners in the South East will have the second highest stamp duty charge after London, at £28,480 from April, up from £18,284 just a month ago.

Additionally, property investors in the East of England will be hit with a tax bill of £24,419 from spring, up from £15,035 before the Budget.

Portfolio and casual owners will disappear from the property scene due to the rise, says Ben Perks, director of Orchard Financial Advisers.

He says: ‘I have owners in my portfolio who until a year ago bought a property at least every three months. Now they have to pay additional taxes, so they have been deferred. Casual owners simply won’t bother as they will have to pay additional taxes to obtain ownership and then pay taxes on their income.’ The changes could lead to an exodus of homeowners to the North, where yields are more attractive.

North and Midlands will see further increases

While southern homeowners will have to pay the highest amount from April, other regions will see the biggest percentage increase in their stamp duty bills.

Second home buyers in the East Midlands will pay 99.83 per cent more than before the budget.

The county that will see the biggest increase is Greater Manchester. Here, homeowners’ stamp duty bills will rise by 99.14 per cent in April. Payments will rise to £14,558 in April, up from £7,311 last month.

Second home buyers in Nottinghamshire will have to pay an average of £14,191 from April, a 98.38 per cent increase in stamp duty bills from before the budget.

The West Midlands county is close behind with an increase of 98.24 per cent.

However, the impact of the stamp duty changes will not only be felt in regions with the highest bills or percentage increases, as all counties with available house price data will see their stamp duty liability increase. by more than a third in April.

Are you a homeowner worried about rising stamp duty? Email L.evans@dailymail.co.uk

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.