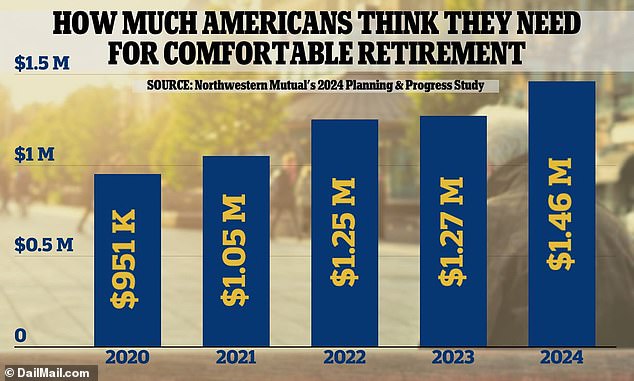

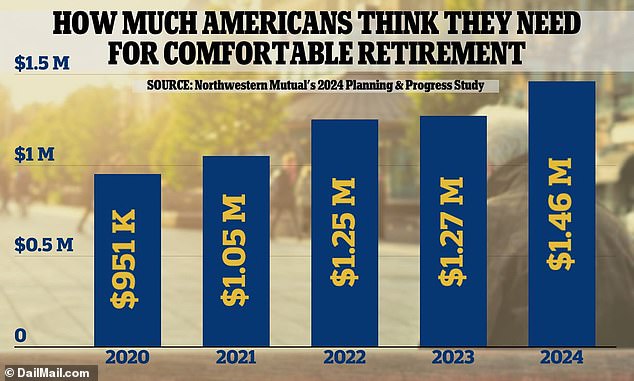

The “magic number” Americans believe they need to retire comfortably has reached an all-time high, while the amount they have saved is declining, a new report reveals.

American Adults Believe They Need $1.46 Million for a Comfortable Retirement, Study Finds survey by Northwest Mutual.

This is a 15 percent increase from the $1.27 million reported last year, far outpacing the rate of inflation.

Over the course of five years, this ‘magic number’ has risen a whopping 53 percent from the $951,000 target Americans reported in 2020.

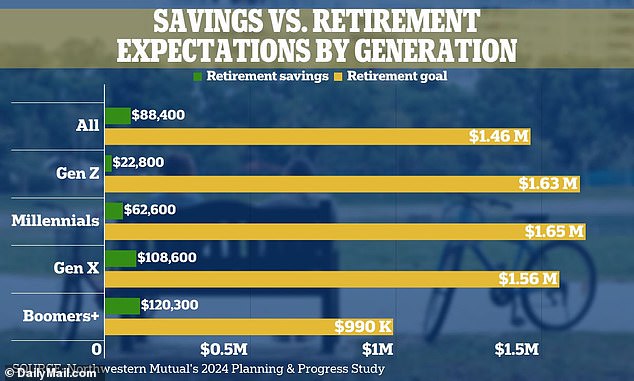

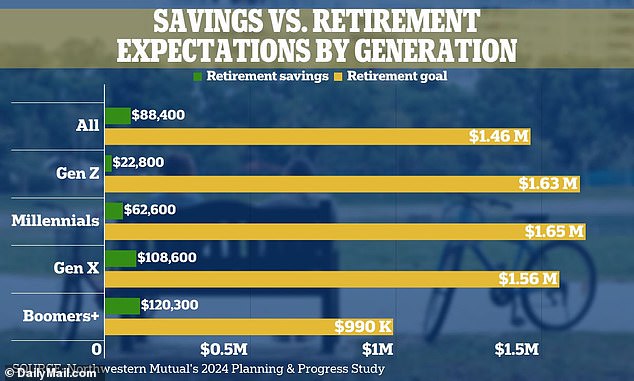

But as the amount Americans suspect they will need in their later years has risen, the amount they have actually saved in their savings has not kept up.

Average savings in the US have declined from $89,300 in 2023 and are more than $10,000 away from a five-year high of $98,800 during the Covid-19 pandemic in 2021.

American adults believe they need $1.46 million for a comfortable retirement, Northwestern Mutual survey finds

The average American has just $88,400 in their retirement fund today, the study found, a monumental $1.37 million short of the target.

Average savings have fallen from $89,300 in 2023, and are more than $10,000 away from a five-year peak of $98,800 during the Covid-19 pandemic in 2021.

‘In 2023, the rising cost of eggs in the supermarket symbolized inflation in the United States. In 2024, it will be savings,” said Aditi Javeri Gokhale, chief strategy officer, president of retail investments and head of institutional investments at Northwestern Mutual.

“People’s ‘magic number’ for comfortable retirement has soared to an all-time high, and the gap between their goals and their progress has never been wider.”

To reach the ultimate retirement savings goal, the study revealed, a 50-year-old American would need to start saving $4,586 a month.

Meanwhile, a 40-year-old would need to save $1,792 a month, a 30-year-old would need to save $805, and a 20-year-old would need to save $382 a month.

The study found that there is a large gap between what people think they will need to retire and what they have saved to date across generations.

In 2024, more than four million Americans will turn 65, the largest increase in Americans reaching traditional retirement age in history.

But among the generations closest to retirement, there is still a gap between retirement goals and reality, exposing a growing retirement crisis in America.

The study found that there is a large gap between what people think they will need to retire and what they have saved to date across generations.

Boomers, on average, have $120,300 saved for retirement, $870,000 short of their goal of $990,000.

Generation

Millennials are also $1.59 million away from their retirement goal, while Generation Z, the youngest generation in the survey, is $1.61 million away from their goal.

However, the study found that the hope among Generation Z is that by starting to save earlier, they will be able to retire sooner.

They typically expect to retire at age 60 and say they started saving for their later years at age 22, nearly a decade earlier than the average American, who said they started saving at age 31.

It comes after billionaire CEO Larry Fink said one option to avoid a “retirement crisis” in the United States could be for Americans to work after age 65.

‘No one should have to work longer than they want to. But I think it’s a little crazy that our fundamental idea about the proper retirement age (65) comes from the time of the Ottoman Empire,” the Blackrock CEO wrote in his 2024 letter to shareholders.

Larry Fink, head of Blackrock, the world’s largest money manager, believes Americans may need to work from age 65 to avoid the collapse of the Social Security system.

However, Teresa Ghilarducci, an economist at the New School for Social Research, said The Wall Street Journal that this growing ‘magic number’ reveals more about retirement anxiety than it does about retirement planning.

He said that while $1.46 million may make sense as a retirement target for higher-income households, many people would need much less and could be overestimating the size of their savings.

“Retirement anxiety is through the roof,” he said.

Kurt Rupprecht, partner and private wealth advisor at K Street Financial, told the outlet that the size of the savings you need depends on a variety of factors.

This includes your income, marital status, whether you plan to pass money on to any heirs, where you plan to live in retirement, and how long you are likely to live.

But there are some guidelines and rules of thumb to gauge your retirement readiness.

Fidelity Investments, for example, suggests saving 10 times your annual salary by age 67.

For example, a household with an approximate median income of $75,000 would need to have $750,000 saved by age 67.