Table of Contents

In Britain, we are more accustomed to measuring our houses by the number of bedrooms they have than by square footage; In fact, research suggests that three in five don’t know the size of their property in square footage.

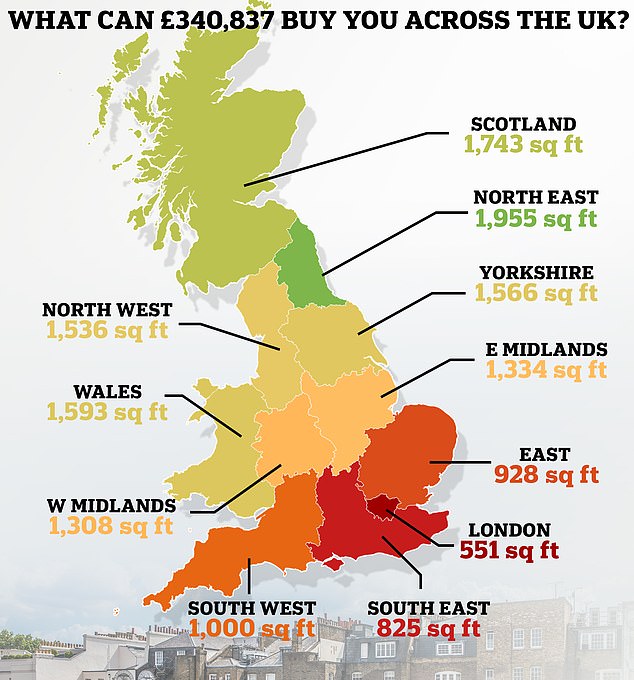

But an in-depth study by Savills shows, with an average property price of £340,837, the huge differences in size across the country.

In London, that sum would typically buy you a studio and 551 sq ft, says the estate agency giant.

However, it would secure him a five-bedroom house in the north-east, covering 1,955 square metres, almost four times the size of London.

Best value: Heading to the North East of England is where buyers will get the most for their money.

Meanwhile, in Scotland, the median house price would buy a large four-bedroom, 1,743 square foot home.

In Wales, Yorkshire and the Humber and the North West, this figure would be enough for a four-bedroom house of just over 1,500 sq ft, while it could be enough to afford a 1,300 sq ft house in the East and West Midlands.

At the other end of the spectrum, £340,837 would buy just 1,000 square feet in the south-west and 928 square feet in the east.

While homebuyers would have by far the least purchasing power in London, the second most expensive area is the South East, where the average would secure 825 square feet, or a medium-sized two-bedroom home.

Lucian Cook, head of residential research at Savills, said: “Exactly what an average of just £341,000 can buy you varies dramatically across Britain, from a small studio in central London to a large four or five-bedroom house. in parts of the north east of England.

‘This has important implications for who can buy where and, in turn, pressures on different housing types and tenures in different locations.

“It also determines the extent to which households have to stretch financially to meet their housing aspirations in the place they would like to call home.”

| Region | Square feet | type of house |

|---|---|---|

| Northeast | 1955 | Medium 5 bedroom house |

| Scotland | 1,743 | Large 4 bedroom house |

| Welsh | 1,593 | Medium 4 bedroom house |

| Yorkshire and the Humber | 1,566 | Medium 4 bedroom house |

| northwest | 1,536 | Medium 4 bedroom house |

| East Midlands | 1,334 | Small 4 bedroom house |

| West Midlands | 1,308 | Small 4 bedroom house |

| South west | 1,000 | Small 3 bedroom house |

| East of England | 928 | Small 3 bedroom apartment |

| Southeast | 825 | Medium 2 bedroom house |

| London | 551 | Medium 1 bedroom apartment |

Square meters aren’t the only thing when it comes to buying a home, with a mixed housing stock, from extremely old properties to new builds.

Since three in five Brits don’t know the size of their homes in square feet, the number of bedrooms is a more traditional size indicator.

For example, a house you are looking to buy may have a huge kitchen, but if you don’t particularly like cooking, then there could be an alternative property that is set up in a way that better suits your needs.

However, if you’re looking to get the most square footage for your money, choosing Easington, County Durham would allow you to afford a 2,858 square foot, five-bedroom home.

The village is located 12 miles south of Sunderland.

Meanwhile, the £340,837 would normally secure 2,625 sq ft in Rhondda, Wales or 2,551 sq ft in Na h-Eileanan an Iar, in the Western Isles of Scotland.

On the other hand, in St Albans, Hertfordshire, you could get just 547 square feet, which is equivalent to a one-bedroom apartment.

The average would also see you buy less than 600 sq ft in Esher & Walton, Epping Forest and South West Hertfordshire.

Meanwhile, in central London, their purchasing power would be significantly reduced.

| Constituency | Square feet | type of house | Constituency | Square feet | type of house |

|---|---|---|---|---|---|

| Saint Alban | 547 | 1 bedroom flat | easington | 2,858 | Large 5 bedroom house |

| Esher and Walton | 553 | 1 bedroom flat | rhonda | 2,625 | Large 5 bedroom house |

| Epping Forest | 553 | 1 bedroom flat | Na h-Eileanan an Iar | 2,551 | Large 5 bedroom house |

| South West Hertfordshire | 583 | 1 bedroom flat | Middlesborough | 2,508 | Large 5 bedroom house |

| Mole Valley | 601 | 1 bedroom flat | Liverpool, Walton | 2,445 | Large 5 bedroom house |

In Kensington, for example, you might only allow 220 square feet or 236 square feet in Westminster.

In Dagenham, on the other hand, your money would stretch to 770 square feet.

We’ve chosen three houses currently on the market with Rightmove, which you could pick up for around the average price of a UK home.

Family House – This property has a family bathroom and ensuite bathroom.

1. Cardiff: three-bedroom house, £350,000

This three-bedroom semi-detached house in north-west Cardiff is currently for sale for £350,000.

The new construction features a double driveway, a spacious kitchen and two bathrooms.

South of the River: This townhouse is located near three different train stations.

2. Lewisham: one-bedroom house, £345,000

This one-bedroom property in Lewisham, south London, is on the market for £345,000.

The semi-detached house is spread over two floors and has a private patio.

The property is located close to bus stops and amenities, as well as Catford train station.

Edinburgh Fringe – This three-bedroom property is located on the outskirts of the city, close to the town of Musselburgh.

3. Edinburgh: three-bedroom house, £350,000

This three-bedroom detached house in Edinburgh could be yours for £350,000.

The house, which has a two-car driveway, has a large eat-in kitchen and is within walking distance of Newcriaghall train station.