Table of Contents

Three in four Brits have never changed their current account, but there are huge cash rewards to be had by switching banks.

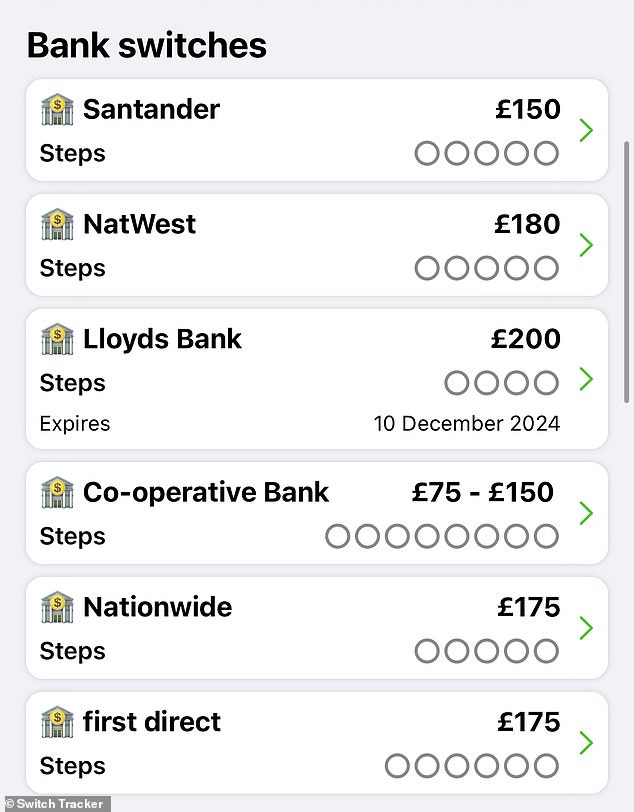

You could add an extra £1,030 to your savings pot by taking out each of the bank switching bonuses currently available at five banks.

First Direct, Nationwide, Lloyds, NatWest and Santander are each offering between £150 and £200 in a bank-switching rush before Christmas.

But for some this is nothing new. There is a whole community of savvy savers who picked up on this game some time ago and are maxing out bank switching bonuses as a way to get free money.

Felix Johnson, 23, from London, is one of them. He told This is Money that between October 2023 and April this year, he earned more than £1,100 in just six months by switching bank accounts six times.

Each of the banks also offered cash ranging between £150 and £200 at the time.

Felix (left) used an app called Switch Tracker (above right) to collect £1,100 in bonuses.

Felix said: ‘I started my first exchange in October 2023 and then went from there to collect all the bonuses that were available at that time.

“I didn’t set out to do this with any particular savings goal, but I was planning to move house, so I used the cash from the move to furnish my new home and put money towards the deposit.”

Felix said he did this with the help of an app called Switch Tracker.

He said: “I wasn’t aware how lucrative switching banks could be until I used this app – it’s basically free money.”

‘I downloaded it and notifications appeared when a bank launched an exchange bonus and how much it offered.

“He also told me how much I could earn. I collected all the exchange bonuses available.”

The Switch Tracker App was founded by software engineer Tim Harrison in May 2023.

Since its launch, it has helped users raise almost £3 million in exchange bonuses and has been downloaded 25,000 times across the App Store and Google Play, Harrison tells This is Money.

The app works the same way as keeping a checklist in your phone’s Notes app (or an old notebook) of what steps need to be completed and how far along someone is in the change process.

Notifies users when a new exchange offer is activated and describes the obstacles they must overcome to obtain it.

Most banks require new customers to have two or more active direct debits to transfer as part of the switch.

If they don’t already have them, Switch Tracker allows users to set up a £1 direct debit which can be canceled after making the switch. Since the app is free to use, this is the only money it makes.

This part is completely optional and users can set up their preferred direct debit any way they want.

Users cannot complete a bank switch through the Switch Tracker app and must still use the Current Account Switching Service (Cass) and the mobile app or online site of the bank they wish to switch to.

Harrison said: ‘There is a community of highly motivated career changers who are active in online personal finance forums. I wanted to help make it easier for people to take advantage of trade-in bonuses.

‘Some changed banks making well over £1,000 in total, because changing banks has been going on for years. Many people have made all the offers, for each bank, for several years.’

Switch Tracker app alerts users when a switch offer is released and how to get it

In the last 12 months there have been 1.3 million bank changes, according to Cass.

Banks that offer cash for change have the advantage when it comes to getting customers to use them as their primary bank account, but this is also a condition of receiving cash for change.

Most banks require switching customers to deposit at least £1,000 into their newly opened bank account, use their debit card at least twice and log into mobile banking to get the cash.

Felix said banks that don’t offer cash bonuses for switching, for example Monzo and Starling, don’t appeal to him as much as his main bank.

A word of warning when it comes to eagerly collecting exchange bonuses: it could affect your credit score.

Felix said: “My credit score took a bit of a hit as I changed banks six times in as many months, but I use a credit card which helps improve your credit score.”

Banks will conduct a credit search before allowing you to open an account. The impact of these can last up to six months on your record and affect your grade.

Some financial firms start to worry when they see a lot of credit searches, as it looks like you may be in need of money, causing your score to drop.

Therefore, it is not advisable to switch banks repeatedly if you are about to take out a mortgage or other loan.

SAVE MONEY, MAKE MONEY

1% refund

1% refund

About debit card expenses. Maximum £15 per month*

Energy bills

Energy bills

Find out if you could save with a fixed rate

free share offer

free share offer

No account fee and free stock trading

4.58% cash Isa

4.58% cash Isa

Flexible Isa now accepting transfers

Sip Rate Offer

Sip Rate Offer

Get six months free on a Sipp

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence. *Chase: Refund available during the first year. Exceptions apply. Over 18 years of age, resident in the United Kingdom.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.