John Wayne Bobbitt, who rose to notoriety in 1993 after his then-wife cut off his penis while he slept, has now lost 10 more appendages: his toes.

Bobbitt was diagnosed with toxic peripheral polyneuropathy after being exposed to contaminated water at the Camp Lejeune military base in North Carolina in the late 1980s.

The disease causes nerve damage to the extremities, which has led to toe amputation for several years. The last digits were removed in 2023.

Bobbitt, now 57 and a former Marine, said he now only has two stumps for feet and needs special prosthetic shoes.

The condition has left him experiencing chronic infections and painful skin problems.

John Wayne Bobbitt, now 57, who rose to fame after his wife cut off his penis in 1993, has now lost his toes to contaminated water at Camp Lejeune.

The exposure caused nerve damage, resulting in the amputation of all of his toes.

Bobbitt’s toes were amputated over a period of several years and the last toes were removed in 2023.

Bobbitt’s condition has left him experiencing chronic infections and painful skin problems.

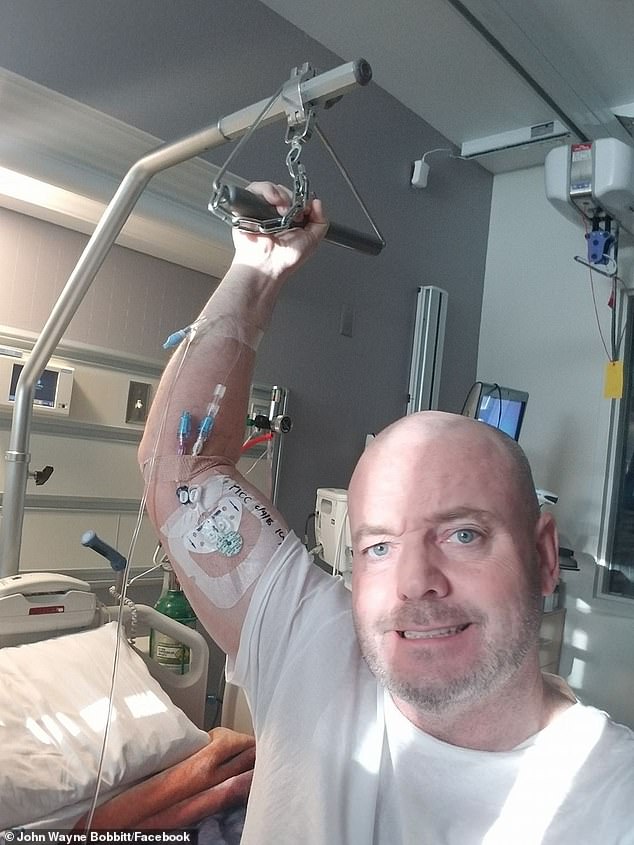

Bobbitt has updated his followers with his health issues and continues to post photos online.

Bobbitt also says his experiences at Camp Lejeune affected both his physical health and his cognitive functioning and mental well-being, which he believes may have affected his relationship with his ex-wife Lorena.

“I wasn’t behaving as I should. Maybe I would have made better decisions if my cognitive functioning wasn’t distorted by chemicals,” she said. Sun.

The Camp Lejeune pollution has been described as “one of the worst cases of water pollution in American history” and saw oil, industrial wastewater and toxic chemicals deliberately dumped into the military base’s local storm drains between 1952 and 1987, contaminating local water. supply for 35 years.

‘They knew. “They were testing the water and it was like 3,500 times above normal safety standards,” Bobbitt said.

In 1993, Lorena Bobbitt accused him of raping and beating her before the shocking incident in which she cut off his penis with a kitchen knife at her Virginia home.

She then got into her car and drove to her boss’s house, throwing her husband’s penis out of the window into the countryside, before calling the police and confessing what she had just done.

Bobbitt, now 57 and a former Marine, said he now only has two stumps for feet and needs special prosthetic shoes.

Bobbitt, a former Marine, was diagnosed with toxic peripheral polyneuropathy after being exposed to contaminated water at the Camp Lejeune military training facility in the late 1980s.

Bobbitt has had his toes removed for several years. This photo was taken in 2018.

The disgusting water contamination has caused Bobbitt and many of his fellow soldiers to suffer serious physical and mental problems.

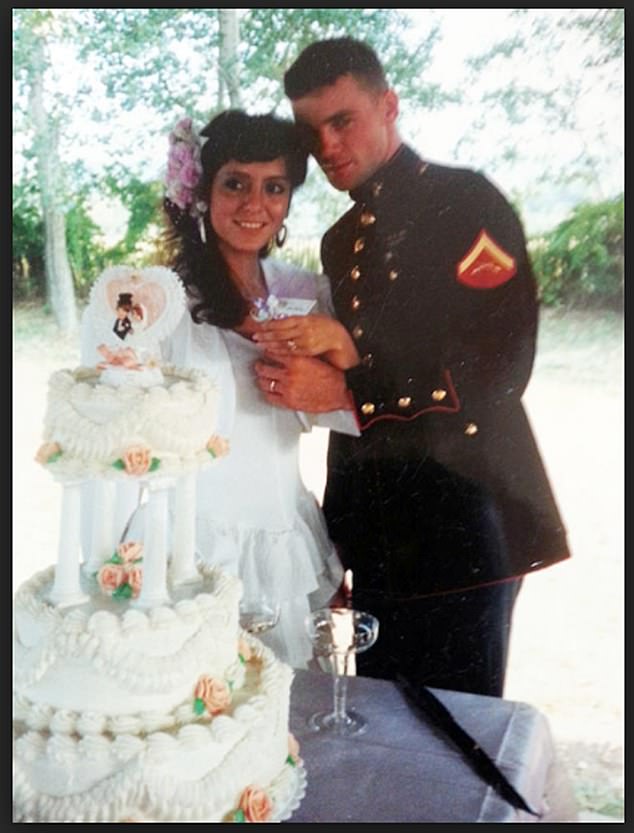

John Wayne Bobbitt on his wedding day to Lorena in June 1989

Lorena Bobbitt attracted enormous global attention after she cut off her husband John Wayne Bobbitt’s penis in 1993 after saying he had raped her.

John Wayne Bobbitt is seen during his 1993 trial.

Lorena used this kitchen knife to cut her husband’s organ after she claimed he raped her

John Wayne Bobbitt maintains that he did not abuse or rape her that night when she cut off his penis 30 years ago.

Incredibly, authorities were able to locate him after Lorena described the exact location.

Doctors were able to rescue it and reattach it over the course of a nine-hour surgery.

Bobbitt says he has returned to his “normal” role and was even able to begin a career as a porn star in 2013 in which he claims to have slept with over 70 women.

Lorena was accused of malicious wounding. At the trial she took the stand and was later acquitted due to temporary insanity.

She was sent to a psychiatric hospital where she was discharged after a month.

John Wayne Bobbitt was charged with spousal sexual assault. In a trial held in 1994 he was acquitted and continues to maintain his innocence.