A woman who beat the odds and landed a home in a big city now faces homelessness after losing her $29,000 deposit.

Queensland academic Dr Loretta McKinnon said her entire living situation was thrown into chaos when the Commonwealth Bank took 13 minutes to finalise the purchase of her future home.

The three-bedroom Brisbane home, owned by Nancy Lee, who comes from a family that owns numerous properties in south-east Queensland, was sold to Dr McKinnon for $580,000 at auction in late 2021.

However, the academic claims the Commonwealth Bank was slow to finalise the deal because of an incorrectly ticked box on the documents.

Ms. Lee then refused to grant an extension of the agreement, resulting in the termination of her contract.

Since then, communication between the parties has dissolved and led to several years of legal battles.

Last month, the Queensland Supreme Court ordered that Dr McKinnon’s $29,000 deposit – mostly money loaned to her by her father – be “forfeited” to the seller.

The funds were previously held in escrow by the real estate agents who handled the failed sale.

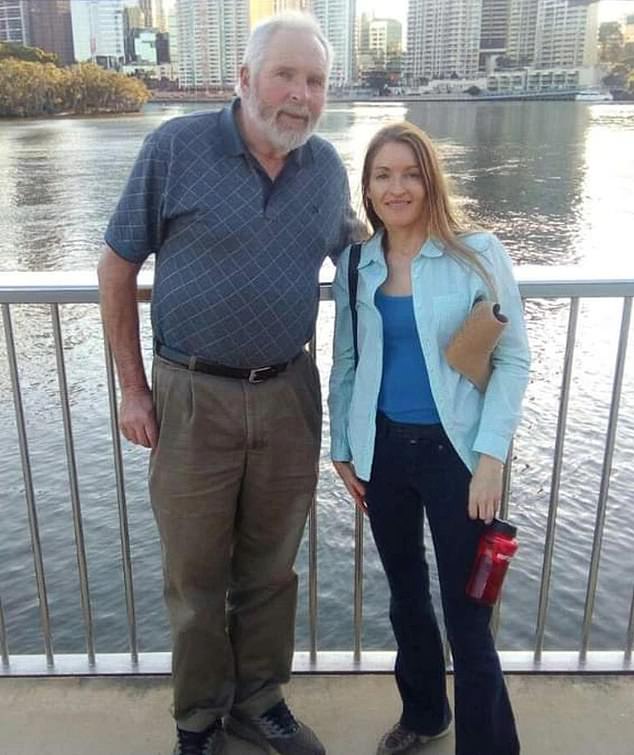

Dr Loretta McKinnon (right) bought a home in North Brisbane at auction for $580,000 in late 2021

Dr McKinnon said her entire living situation was thrown into chaos when the Commonwealth Bank took 13 minutes to finalise settlement of her future home (pictured)

Making matters worse is the fact that Dr McKinnon currently lives on the disputed property in Windsor, north of Brisbane, and Ms Lee is his landlady.

She received even more bad news in August when the Queensland Civil and Administrative Tribunal ordered her eviction in mid-October.

If you do not vacate the property by then, you risk being escorted off the premises by the police.

“I feel terrible,” Dr. McKinnon said. news.com.au.

She is not sure where she will live next month.

Earlier this year, Dr. McKinnon faced a possible bankruptcy filing after being notified that he had to pay $448,000 for the failed sale.

The order has since been revoked due to a discrepancy.

Dr. McKinnon had originally been granted a 90-day winding-up period to put her finances in order to purchase the property.

Ms Lee’s lawyer previously highlighted his client’s lack of legal obligation to extend the sale period, but did not respond to the outlet’s latest request for comment.

Queensland law has since changed to align with other states and allow for a two-week grace period in the event of failed deals.

However, the amendment was not made in time to help Dr. McKinnon’s case.

Dr McKinnon (pictured) has since been ordered to vacate the home, which she is renting, amid an ongoing legal battle to possess the property.

Last month, the Queensland Supreme Court ordered Dr McKinnon’s $29,000 deposit – mostly money loaned to her by her father (pictured) – to be “forfeited” to the seller.

Dr. McKinnon continued to fight for ownership of the house, which she claims is rightfully hers.

He had previously said: “It’s a situation of disadvantage after disadvantage. It’s horrible.”

The Commonwealth Bank was unable to comment due to privacy reasons.