- A 2017 England Under-15 squad has surprised fans with its range of talent

- The best players from the Premier League, LaLiga, Serie A and Bundesliga were in the squad

- The championship title contenders are falling at the final hurdle! Who takes advantage of the day to get from here to the Premier League? Listen to the podcast It’s All Beginning

Football fans were left speechless after seeing an impressive 2017 England Under 15 squad.

The squad for England’s 4-3 defeat to Belgium at St George’s Park on a winter’s day was packed with new talent.

In fact, an acceptable midfield for the men’s team could be constructed from the names that took to the field and bench that day.

The starting name is Jude Bellingham, but he had to settle for a place on the sidelines and his number was 25.

To be fair to Bellingham, he was only 13 at the time, so he was competing for minutes alongside youngsters a couple of years older than him.

Jude Bellingham leads the 2017 England Under-15 squad which has left fans in awe

Cole Palmer and Noni Madueke, who argued over taking a penalty on Monday night, were together in midfield against Belgium in 2017.

Cole Palmer lined up in attacking midfield while Noni Madueke lined up in midfield.

Palmer didn’t know that seven years later, he would score four goals for Chelsea in a 6-0 thrashing of Everton, or fight with Madueke to take a penalty in the match.

Also on the bench was a certain Jamal Musiala, who now plays for Bayern Munich and Germany.

Although he represented England at under-21 level, he was born in Germany and decided to play for them at senior level, which was a huge blow for the Three Lions.

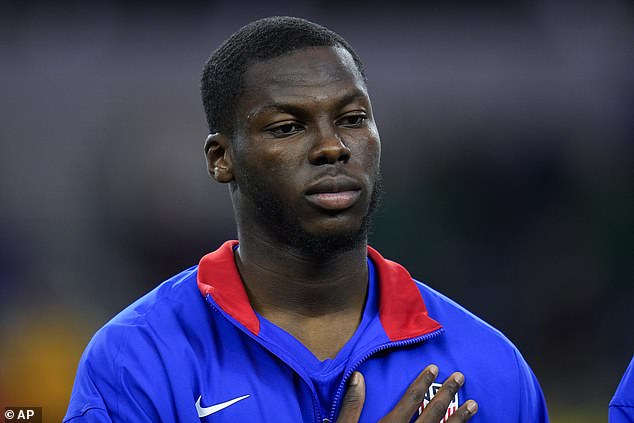

The captain in the engine room that day was Yunus Musah, who will be less familiar to fans in England. He left Arsenal’s youth team for Valencia in 2019 and is now a regular part of the AC Milan squad. He now plays for the United States internationally.

Morgan Rogers joined Aston Villa from Middlesbrough in January for £15million and has made a strong start.

Further down the football pyramid, Karamoko Dembélé plays for Blackpool, Lewis Fiorini plays for Charlton and there are several players in League Two and non-league.

Bayern Munich and Germany star Jamal Musiala was also on the bench that day

Yunus Musah also switched his international allegiance to the United States and plays for AC Milan.

Morgan Rogers has made the move to Aston Villa after impressing for Middlesbrough in the Championship

Others played in Scotland and Switzerland.

For Belgium that day, a certain Jeremy Doku was causing chaos from the number 10 position, but his teammates have not achieved the same reputation as the English.