Table of Contents

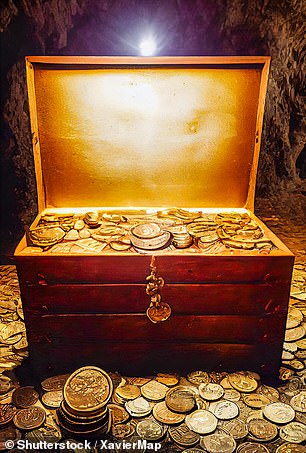

Unclaimed pensions: There’s a hidden treasure waiting for some people, so find out how to locate your old pots below

Now everyone is automatically enrolled in a new pension, every time they change jobs we are all accumulating more and more funds and many of us lose contact with them as time goes by.

Job hopping, automatic enrollment with every move and the tendency of people to lose pension information and not update schemes with contact details are behind the rise in orphan funds.

The cost of living crisis has highlighted the importance of tracking down missing pensions to boost your eventual retirement income, according to an industry campaign to help people find them.

“If ‘lost’ funds are not claimed, people will find it harder to achieve their desired retirement income and will become more reliant on the state pension and means-tested benefits,” says pensions consultant Punter Southall Aspire, who leads the initiative.

“People risk losing value by losing funds as they will not have had the opportunity to choose better pension products, more appropriate investments or consolidate funds to take advantage of lower fees.”

The value of the lost funds has increased significantly and the problem will continue to grow without intervention, according to the Pensions Policy Institute, the research charity which compiled the industry-wide figures cited above.

Why look for old pensions? And where do you start?

For the pensions industry, there is an incentive to help unite people with missing funds. There are administrative costs involved in maintaining data on them and trying to keep people up to date using outdated contact details, when some may be very small.

And from the point of view of individual savers, who might have many of these funds, it is well worth tracking and monitoring them from now until retirement age.

If you are looking for your old funds, you can use the Government tool. Free pension locator service as a starting point.

Be careful if you search on the Internet for this official service, as there could also be links to companies that charge, try to offer you other services, or may be fraudulent.

If you find some old pensions and register your current details with them, be sure to keep them updated with your new address whenever you move in the future.

So how can you locate lost pensions? Punter consultant Southall Aspire offers the following five-step guide.

1. Previous employers

List all the places you have worked. CVs, payslips, old P45 or P60 can help you.

If you can’t find an old company, perhaps because it changed ownership or closed, try to locate former colleagues who may have already discovered which operator took over your pension plan.

2. Old paperwork

Review your paperwork and see if you have pension statements from all your former employers.

You should also check that your contact details are up to date on all your pension statements.

3. Online Search

Check if there are any gaps where you don’t have a pension statement from an employer. Use the government Pension monitoring service to find the contact details for your pension plan.

If you can’t find them, it may be because your former employer was absorbed. You can find out if they were looking for it in Business House or the Government Charity Registration.

You may also need to contact your former employer or colleagues to find out the name of the provider if your employer used a ‘group personal pension’.

If you think you closed and had a traditional final salary pension, you can try the Pension Protection Fund.

4. Get in touch

Once you have the contact details for your former employer’s pension scheme, get in touch and see if you have a pension with them.

You will need your Social Security number to prove that you are the one contacting them (they may also ask for your pension plan number, if you have managed to find it, and your date of birth). You must also check that you have not transferred to another pension.

If you can’t find it in the system and are sure you worked there, our pensions columnist Steve Webb has another tip.

‘Ask if it’s also possible to search for a match based on just some of your details, to see if there is another member whose details match yours in all other respects.

‘If your name is often misspelled, you can also check for common typos.

“It may take polite persistence to get a plan to do this on your behalf, but a letter requesting this search and including other key details they can verify, such as date of birth and period of employment, could do the trick.” “.

STEVE WEBB ANSWERS YOUR QUESTIONS ABOUT PENSIONS

5. Pension valuation

Ask how much your pension is worth and get an up-to-date statement.

You should also give the provider your contact details so they can keep in touch and ask if you can register online with them to easily access your pension information.

Should you merge your old pensions?

A housekeeping exercise can reduce fees and paperwork and provide new retirement investment options.

But merging pensions is not always advisable because you risk losing valuable benefits – here we look at the pitfalls to avoid and what you need to know about combining pension funds.

Don’t be tempted to touch old pots before the age of 55.

Beware of the risk of scammers stealing your money, plus a huge tax charge that HMRC will charge even if your money has already gone missing in a scam.

There are very limited exceptions to the 55-year rule, and we don’t know of any legitimate companies that help you get your pension early outside of them, through a loan or anything else: only scammers.

The most popular question about pensions asked on the Internet is: “Can you collect the pension at any age?”, according to an analysis by marijuana consolidator PensionBee.

“There are only a few cases in which savers can release their pension before age 55, such as in the event of a serious illness or terminal illness,” the company warns.

‘No reputable pension provider will approve an early withdrawal unless these conditions are met.

‘There are numerous pension frauds that aim to help savers access their pension before the age of 55 by exploiting loopholes in the system.

“Unless a saver meets some of the above criteria or has been explicitly informed by a provider that they qualify for early release of their pension, savers should never rely on a third party to withdraw their pension on their behalf.”

Money’s pensions columnist Steve Webb receives a constant stream of questions from financially challenged people who want to access their pensions before the age of 55.

We respond to warn every person we contact about the dangers. Steve has answered reader questions about how to access a pension before age 55 here and the alternative options available to you, especially if you are in debt, here.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.