Have you ever wondered how the property market has performed under different chancellors?

Well, exclusive research for This is Money and Mail Online Property reveals just how vibrant the property market has been during the tenure of various Chancellors over the past 30 years.

In particular, the data analyzed how many real estate transactions took place during his tenure.

Ahead of tomorrow’s Budget, research by estate agency Jackson-Stops looked at property sales under nine chancellors since 1997.

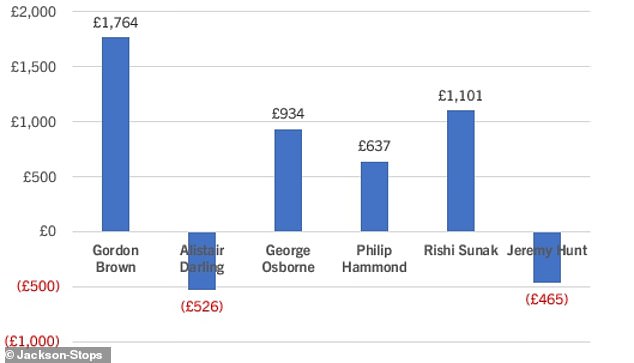

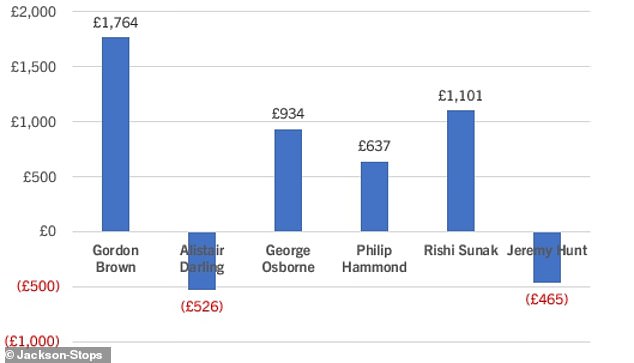

Property gains: Four of the six chancellors have seen home values rise while in office.

Seven of those nine chancellors have been from the Conservative Party and yet it is one of the two Labor chancellors included on the list who obtained the highest score.

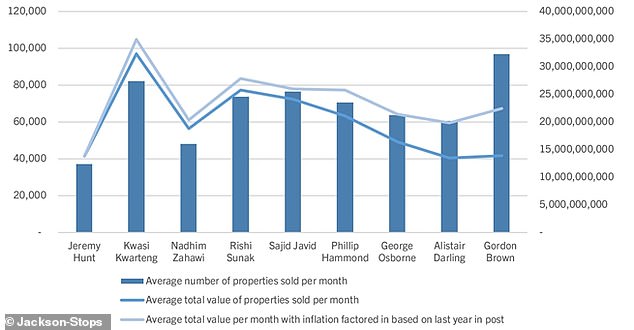

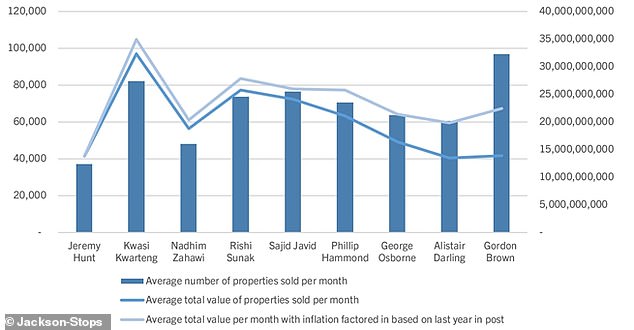

In first place is Gordon Brown, who oversaw an average of 96,999 property sales each month.

By contrast, it is almost triple the sales volume overseen by current chancellor Jeremy Hunt, whose average is 37,236.

Former chancellor Gordon Brown oversaw an average of 96,999 property sales each month

However, Gordon Brown worked during a period of extraordinary growth in the housing market – particularly the mortgage market – between May 2, 1997 and June 28, 2007.

His term ended just before the start of the financial crisis, the height of which was in 2008, when hundreds of people a week were being evicted from their homes.

Alistair Darling was Chancellor during that turbulent financial period and remained in office between 28 June 2007 and 11 May 2010.

The graph shows how house prices (adjusted for inflation) have fared under the six chancellors who have been in office for more than a year since 1997; The values are monthly figures.

The research looked at a variety of factors, including monthly transaction volumes and average house price growth under the nine chancellors.

Among the six chancellors who have served more than 12 months since 1997, Brown’s time in office saw the largest positive effect on house prices based on monthly average prices.

House prices in England rose by £1,764 a month on average during his tenure, ahead of Rishi Sunak on £1,101.

House prices in England rose by £1,101 a month on average during Rishi Sunak’s tenure as Chancellor

| Chancellor | Time in power in months(2) | Average monthly property sales | Average value of monthly sales, adjusted for inflation (3) | Change in average house price | Change in the total value of the real estate market | Change in total mortgage debt | Change in total property value | Monthly variation in real estate prices, adjusted for inflation (4) |

|---|---|---|---|---|---|---|---|---|

| 1. Gordon Brown | 121 | 96,999 | £22.4 billion | 223% | 2. 3. 4% | 166% | 279% | £1,764 |

| 2. Alistair dear | 3. 4 | 60,689 | £19.9 billion | -6% | -8% | 8% | -fifteen% | -£526 |

| 3. George Osborne | 74 | 63,661 | £21.4 billion | 28% | 27% | 9% | 38% | £934 |

| 4. Philip Hammond | 36 | 70,672 | £25.8 billion | 8% | 14% | 9% | sixteen% | £637 |

| 5. Sajid Javid | 7 | 65,763 | £26 billion | 8% | eleven% | 6% | 13% | £3,535 |

| 6. Rishi Sunak | 28 | 73,687 | £27.9 billion | eleven% | eleven% | 5% | 14% | £1,101 |

| 7. Nahim Zahawi | 3 | 48,042 | £20.4 billion | 3% | 3% | 1% | 4% | £5,519 |

| 8. Kwasi Kwarteng | 1 | 82,087 | £34.9 billion | -1% | -1% | 1% | -1% | -£2,526 |

| 9. Jeremy Hunt | sixteen | 37,236 | £13.8 billion | -2% | -2% | 0% | -3% | -£465 |

| Source: Jackson-Stops | ||||||||

Both Alistair Darling and Hunt have served more than a year as chancellors and have seen house prices fall during that time.

Darling saw an average monthly drop of £526 compared to an average monthly drop of £465 for Hunt. The data adjusted all figures for inflation.

It means Darling is the worst performing chancellor for homeowners in terms of value alone, according to the research.

He witnessed the biggest drop in the value of England’s property market, of 8 per cent, along with a 15 per cent drop in property values during his tenure during the 2008 financial crisis.

The only other Chancellor since 1995 to see average monthly house prices fall during his tenure while mortgage debt remained firm or increased is Kwasi Kwarteng.

Kwasi Kwarteng was responsible for the now infamous “mini-budget” under the shorter-serving British Prime Minister Liz Truss.

Chart shows average total value and volume of properties sold per month under each Chancellor

Meanwhile, the most successful Conservative candidate as measured by house price growth and equity is George Osbourne.

He saw residential values growing more than three times as fast (28 percent) as mortgage debt (9 percent).

This was boosted by the recovery from the financial crisis, as well as the introduction of the Help to Buy scheme, aimed at helping those struggling to get on the property ladder.

During his 74 months as Chancellor, Osbourne saw £1.2 billion worth of property sales completed.

While Brown reached a higher level at £1.7 billion, who served for almost twice as long as Osbourne at 121 months.

| name of the chancellor | Party | Date in position |

|---|---|---|

| jeremy hunt | Conservative | October 14, 2022 until now |

| Kwasi Kwarteng | Conservative | September 6 to October 14, 2022 |

| Nadhim Zahawi | Conservative | July 5, 2022 and September 6, 2022 |

| Rishi Sunak | Conservative | February 13, 2020 to July 5, 2022 |

| Sajid Javid | Conservative | July 24, 2019 Ð February 13, 2020 |

| Philip Hammond | Conservative | July 13, 2016 to July 24, 2019 |

| George Osborne | Conservative | May 11, 2010 to July 13, 2016 |

| Alistair Darling | Labour | June 28, 2007 to May 11, 2010 |

| Gordon Brown | Labour | May 2, 1997 to June 28, 2007 |

| Fountain: |

The current prime minister, Rishi Sunak, was chancellor for 28 months, from February 2020 to July 2022.

He is unusual as the only Chancellor – apart from George Osborne, who benefited from the post-2008 recovery – to do better than his predecessor in increasing average house prices by 11 per cent and total capital by 14 percent.

The recovery of the property market after the pandemic and the stamp duty holiday contributed to this.

Although Jeremy Hunt has presided over a period in which house prices have fallen… he gives first-time buyers a fighting chance

Mark Harris, of mortgage broker SPF Private Clients, said: “It is no surprise that Gordon Brown is considered homeowners’ favorite chancellor, considering how property prices appreciated during his years at the helm.

‘The property market was booming, with almost three times as many transactions a year as now.

‘It could be argued that Mr Brown benefited from booming economic conditions, which was quite the opposite for Alistair Darling, whose tenure at Number 11 coincided with the global financial crisis and the resulting fall in house prices.

‘Although Jeremy Hunt has presided over a period in which house prices have fallen by an average of £465 a month, a statistic that will not endear him to homeowners, it does give first-time buyers a fighting chance.

“However, the significant decline in transactions during his tenure is worrying, so all eyes are on this week’s Budget to see if the Chancellor can offer any meaningful help to boost the property sector.”

The current Chancellor has so far seen monthly house prices fall by £465 on average, but experts say this gives first-time buyers a “fighting chance”.

Nick Leeming, of Jackson-Stops, said: ‘Declining conditions have meant diminishing returns.

‘Analysis of the data points to a trend where the shorter the term of each Chancellor in power, the smaller the increase in value of both property values and house price appreciation.

‘Our analysis indicates that the nation’s chancellors have become progressively worse over the past three decades in their management of the English property market.

‘While Gordon Brown’s decade as Chancellor of the Exchequer set several records, it was Alistair Darling who witnessed the biggest fall in the value of England’s property market, presiding over the financial crisis.

‘It is after that period that we began to see Chancellors tactfully pull levers to help stimulate economic and property growth, but without withstanding their own round of criticism in doing so.

‘The legacy of both Help to Buy and the stamp duty holiday led to spikes in the market and a sharp rise in property prices. In June 2021, for example, we saw house price growth of 13.4 percent, the highest in 17 years.

He added: ‘According to our data, Jeremey Hunt’s time in office has produced the lowest number of average monthly property sales in the last 30 years, since records began.

‘The March budget will be an important time for anyone planning to buy or sell a home.

‘It will also lay the foundation for the Conservatives’ tactics to win the hearts and minds of consumers ahead of the autumn general election. “The industry will be watching with bated breath.”