A human jaw found by a boy rock collector in Arizona has finally been identified more than seven decades later, but how it got there remains a mystery.

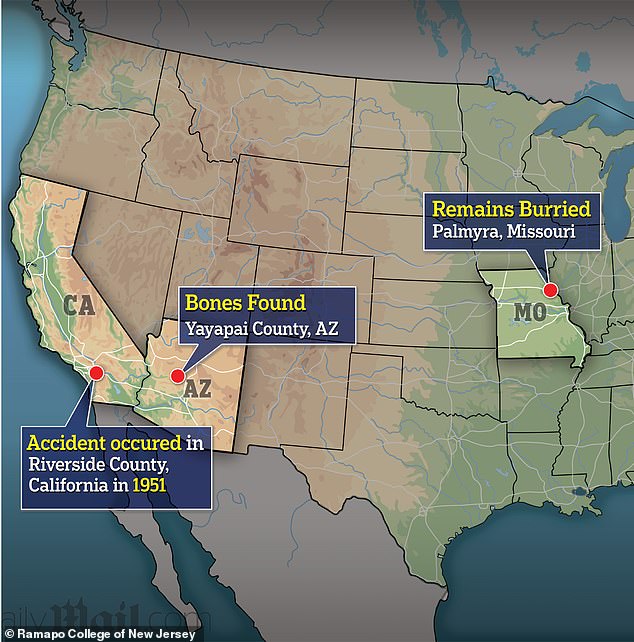

DNA testing revealed that the bone belonged to US Navy Captain Everett Leland Yager, who died in a plane crash during a military training exercise in Riverside County, California, in July 1951.

His remains were later recovered and buried in Palmyra, Missouri, or so it was believed until now.

“No one is sure how the jaw bone ended up in Arizona, since the accident took place in the air over California,” said experts at the Ramapo College of New Jersey Press release.

“One theory is that a scavenger, like a bird, picked it up and eventually deposited it during its travels over Arizona. Plans are being made to reunite the remains with family.

DNA testing revealed that the bone belonged to US Navy Captain Everett Leland Yager, who died in a plane crash during a military training exercise in Riverside County, California, in July 1951.

His remains were later recovered and buried in Palmyra, Missouri, or so it was believed until now.

The bone was believed to have been found by a boy rock collector in Arizona, but how it got there is a mystery.

The bone was believed to have been found by a boy rock collector in Arizona, but how it got there is a mystery.

‘Years later, a flash forward came to a boy who wanted to build a rock collection and increased said collection by one unit during a scavenging exploration, presumably in Arizona. But it wasn’t a rock; “It was a human jaw bone,” said Lisa A. Ambrose, a spokeswoman for Ramapo College in New Jersey.

When the ‘rock’ was handed over to the authorities, they named it ‘Rock Collection John Doe’.

The case was later turned over to the Yavapai County Sheriff’s Office and the Yavapai County Medical Examiner.

In January 2023, the office asked for help as it attempted to solve the mystery of its origins.

This case involved the youngest person who allegedly contributed to a genetic genealogy research case that was solved.

Through the collaborative efforts of the Ramapo College Genetic Genealogy Research Center and the North Texas Human Identification Center, DNA testing was performed.

The bone was eventually identified as belonging to US Marine Corps Captain Everett Leland Yager, which was confirmed by comparison with a DNA sample from his daughter.

“It wasn’t until March 2024 that Captain Yager’s daughter’s DNA sample confirmed a father-son relationship, solving the case and confirming that Rock Collection’s John Doe was in fact Captain Everett Leland Yager,” Ambrose said.

This case involved the youngest person who allegedly contributed to a genetic genealogy research case that was solved.

“This case was a lesson in expecting the unexpected and a testament to the power of an IGG education at Ramapo College of New Jersey,” Cairenn Binder, assistant director of the IGG Center at Ramapo College, said in the news release.

“The team that worked on this case at our IGG training camp included truly outstanding investigators, and we are very proud of them for helping to repatriate Captain Yager’s remains and return them to his family.”

Earlier this month, the remains of a black sailor who died during the Japanese attack on Pearl Harbor were finally identified more than 80 years later.

The remains of David Walker, a 19-year-old black sailor who died during Pearl Harbor, have finally been identified more than 80 years later.

David Walker was 19 when he left his African-American high school in Norfolk, Virginia, to work as a waiter in the segregated navy.

He was on the battleship USS California, which was moored at Ford Island, Pearl Harbor, when the ship was hit by two Japanese torpedoes and sank in the opening minutes of the infamous attack on December 7, 1941.

Walker was one of 103 victims who died on the USS California that day, more than 50 of whom were African-American waiters, cooks and stewards.

Last month, the Defense POW/MIA Accounting Agency (DPAA) announced that they had finally found and identified Walker’s remains.

Walker’s closest surviving relative, her cousin Cheryle Stone, who was born 30 years after the attack on Pearl Harbor, told DailyMail.com earlier this month that it was “heartbreaking” that her mother was not alive to witness this moment afterwards. to never give up the search for him. .

The remains of those aboard the USS California were recovered between December 1941 and April 1942 and buried in the Halawa and Nu’uanu cemeteries.

During the first round of identification after the attack, 42 victims were named.

In September 1947, the American Graves Registration Service unearthed the remains of the victims and transferred them to the central identification laboratory at Schofield Barracks.

But lab staff could only confirm the identifications of 39 men from the USS California at the time.

The unidentified remains were later buried at the National Memorial Cemetery of the Pacific (NMCP), known as Punchbowl, in Honolulu.

He was on the battleship USS California during the attack on Pearl Harbor. The ship was hit by two Japanese torpedoes and sank.

And in 1949, a military board determined that the remains of unresolved crew members, including Walker, were not recoverable.

But then in 2018, the DPAA exhumed the remains of 25 unidentified Punchbowl sailors.

Through anthropological, dental, and mitochondrial DNA analysis, forensic scientists from the DPAA and the Armed Forces Medical Examiner System were able to identify Walker’s remains in November 2023.

Walker’s name is among the many missing soldiers etched on the Walls of the Missing at the Punchbowl in Hawaii. Now that he has been accounted for, a rosette will be placed next to his name.

Walker will be buried on September 5, 2024 at Arlington National Cemetery.