Joe Biden’s proposed increase in capital gains tax would “crush” the US economy, a leading expert has warned.

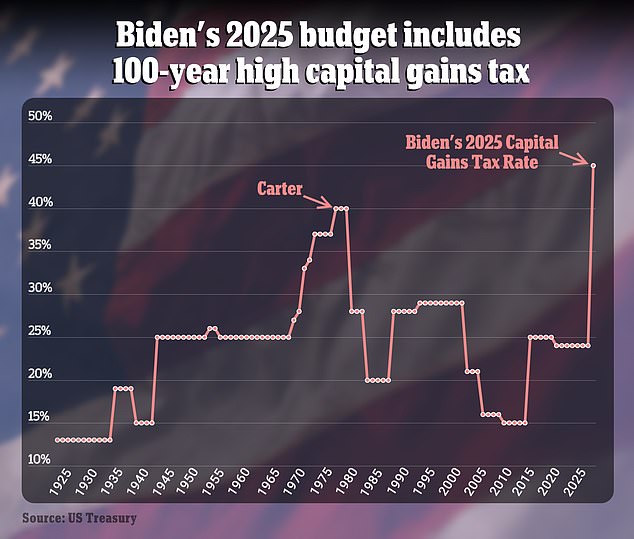

The president has outlined plans to increase the maximum marginal rate on long-term capital gains and qualified dividends from 23.8 percent to 44.6 percent.

Capital gains tax is paid on investments that have increased in value in the time between their purchase and sale, for example shares, property or cryptocurrencies.

Under Biden’s proposal, eleven states would end up paying more than 50 percent in capital gains taxes when combined with state taxes. High-tax states, such as New York, California and Hawaii, will be hardest hit.

Ted Jenkin, CEO of oXYGen Financial, warned that the planned increases will take effect at the same time that critical tax cuts introduced by Trump also expire. Jenkin warned that those two factors would “crush” the economy as Americans rush to sell their assets ahead of the surge.

President Joe Biden is proposing a major overhaul of both income taxes and capital gains taxes as part of his 2025 budget.

Biden’s 2025 budget proposal includes the highest capital gains tax rate in US history: 44.6 percent

‘If these new policies go into effect when the Tax Cuts and Jobs Act (TCJA) of 2017 expires at the end of 2025, in 2025 we will be looking at a barrel of millions of Americans selling their highly appreciated stock positions at today’s long price term. forward capital gains rates versus paying double in 2026,” Jenkin wrote in an op-ed for Fox Business.

This means that the presidential election in November could determine how much taxes Americans will have to pay when they sell assets.

Trump’s tax cuts reduced individual income tax rates, nearly doubled the standard deduction and increased the federal estate tax exemption.

Income tax brackets will return to their highest pre-2017 levels when current law expires on January 1, 2026, affecting most taxpayers. Biden has not yet indicated whether he will extend these pauses if he remains in power.

Stock sell-offs, like the one Jenkin predicts, have caused numerous market crashes in the past, including the crash of 1929 that preceded the Great Depression.

About 58 percent of U.S. households owned stocks in 2022, according to the Federal Reserve’s most recent survey of consumer finances. That’s up from 53 percent in 2019, the Wall Street Journal reported.

Stock ownership has increased in recent years in part thanks to a booming stock market.

The Dow Jones Industrial Average and S&P 500, two major US stock indices that track the broader market, have more than doubled in value since the initial stock market crash at the start of the COVID-19 pandemic.

Pictured: Ted Jenkin, CEO of oXYGen Financial, said Biden’s proposed tax increases could cause a stock market crash if enacted in 2025.

Still, stock ownership in the United States is almost entirely skewed toward those with higher incomes.

The richest 10 percent of taxpayers own 93 percent of the stock market’s wealth, according to Federal Reserve data, while the poorest 50 percent owned just 1 percent of stocks.

Not all investors will pay Biden’s sky-high 44.6 percent capital gains rate if they sell a stock.

Capital gains tax brackets are progressive, as are income tax brackets.

If a single person with income of $47,025 or less has long-term capital gains (for example, they sold a stock after holding it for a year), they will pay an effective rate of zero percent in tax year 2024, according to Bank fee.

The rate increases to 15 percent for those earning between $47,026 and $518,900. Above that, a single taxpayer can expect to pay a 20 percent rate.

Business owners would also be hit hard by Biden’s new rules, according to Jenkin, which could cause downstream effects such as people losing their jobs.

“What you could see as a result of the suggested long-term capital gains rate rules is business owners putting their companies up for sale much more aggressively in the market to pay less taxes,” Jenkin wrote. .

He continued: “This could also have a major trickle-down effect on people losing their jobs as smaller companies consolidate into larger ones and could also stall the germination of new companies as the upside potential for risk-taking financial, legal and personal may not exist. give entrepreneurs the excitement of launching businesses like they have done in the past.

Former President Donald Trump has not yet detailed what his capital gains tax policy would be if elected in 2024, but he has supported and signed tax cuts in the past.

Biden’s proposed budget also revises how inherited assets would be taxed.

Under current law, when someone transfers property after their death, it is generally not considered a taxable gain for income tax purposes. Forbes reported.

Biden’s proposal would reverse that, making death a realized gain for the person who inherits the assets.

In particular, this excludes those of $5 million or less.

For all of these changes to become a reality, two separate proposals would need to be approved in the final 2025 budget.

And Biden will have to win the 2024 election. The latest RealClearPolitics polling average puts Trump 1.1 percentage points ahead of Biden.

So far, Trump has not proposed any major changes to the capital gains tax system.