Table of Contents

AatraZeneca has seen its value surpass £200bn in recent days following a spectacular rise in its shares. Few companies listed on the British stock exchange have ever achieved such a feat.

Under Sir Pascal Soriot’s leadership, the pharmaceutical giant is one of Britain’s biggest success stories. But not even its biggest fan could have foreseen that when he took the helm a dozen years ago.

AZ is one of the few UK-listed companies that are truly world-class in their field, a fact that seems to be going unnoticed by Rachel Reeves. The chancellor is seeking to reduce the scope of a deal to provide government support for a planned £450m vaccine manufacturing site in Merseyside, which may result in AZ taking the facility elsewhere.

Reeves may be reluctant to offer state backing to a multi-billion dollar enterprise that, by all indications, is thriving.

But as her predecessor Jeremy Hunt said: “If growth is the Chancellor’s aim, then breaking this deal is a fun way of demonstrating it.”

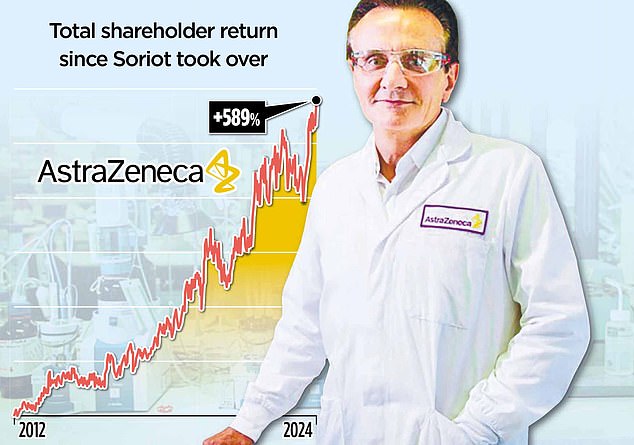

Magic formula: AstraZeneca shares rose from £29 when Soriot took over in 2012 to £130, giving a 589 per cent return with dividends reinvested

AZ’s status as a major British company has been a remarkable transformation since it came under siege a decade ago from Pfizer, the powerful US pharmaceutical group behind Viagra.

The US company launched a £69bn takeover bid and hardly anyone expected Soriot to triumph over the predator.

That was an underestimation of the wily and resilient Franco-Australian, who rose to the top from a difficult situation in the Parisian suburbs, where he was often forced to fight.

After defeating Pfizer, he faced the difficult task of proving to investors that he was right to have resisted.

Soriot has vindicated himself beyond everyone’s wildest dreams, except possibly his own.

Even without a hostile bidder, Soriot had taken over at a difficult time in the company’s long history. Its legacy dates back more than a century, to 1913, when a group of doctors and apothecaries founded Astra, originally a Swedish company.

Astra merged in 1999 with Zeneca, the pharmaceutical division of former British chemicals flagship ICI, which was dismantled following a hostile takeover bid by corporate raider Lord Hanson.

The pair listed on the London market with high hopes of creating another UK pharmaceutical powerhouse alongside rival GSK.

But in 2012, when Soriot emerged, the company was a laggard in its sector.

Some feared it could even follow ICI into the corporate graveyard.

Patents on valuable drugs were expiring, leaving it on the brink of collapse with very few projects in development.

Soriot, who had left European rival Roche over an apparently botched case, was accused of professional suicide.

On the contrary, his arrival heralded a spectacular rebirth.

In the midst of the bid for Pfizer in May 2014, it set a very ambitious goal: to reach revenues of more than $45 billion by 2023.

It achieved that goal ahead of time and has now set a new target of $80 billion in revenue by 2030.

Soriot’s secret is to invest heavily in growth through innovation.

While other big drug companies poured money into sales and marketing, he insisted on spending a fifth of his revenue on research and development, no matter what he did. The result is that the company has 13 blockbusters (drugs with annual sales of more than $1 billion) in its portfolio, including the cancer drugs Enhertu and Imfinzi.

It expects to launch 20 new drugs by the end of this decade, by which time it believes its tally of bestsellers will have reached more than 25.

Beyond 2030, AstraZeneca is pinning its hopes on ADCs, or antibody-drug conjugates.

In simple terms, it is a smart chemotherapy that delivers a very powerful attack on cancer cells while minimizing damage to healthy cells.

Other areas earmarked for growth include weight management, where it lags behind companies such as Novo Nordisk, maker of Wegovy.

The business is geographically diversified. China is the second largest market after the United States and further growth is expected in emerging economies.

Soriot’s crowning moment so far, however, has been its partnership with Oxford University to develop a Covid-19 vaccine, particularly as Astra is not particularly known for its vaccine expertise.

The injection was initially made on a non-profit basis, which may not have maximized shareholder returns in the short term, but it had invaluable publicity value.

Soriot’s generous remuneration has been the source of some controversy. Last year, his salary peaked at almost £17m, taking his total income at AstraZeneca to a staggering £135m – and rising.

A third of investors at this year’s annual meeting have protested against a pay policy that could boost their pay packet to almost £19m this year.

These are staggering sums, but at least they are rewards for success. Reeves may feel he has no reason to subsidise a business where the boss makes so much money and sales run into the tens of billions.

But the reality is that AstraZeneca can move its facilities, its jobs and its stock price elsewhere, thereby impoverishing Britain.

If you want growth, you need to support those who create it.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.