<!–

<!–

<!– <!–

<!–

<!–

<!–

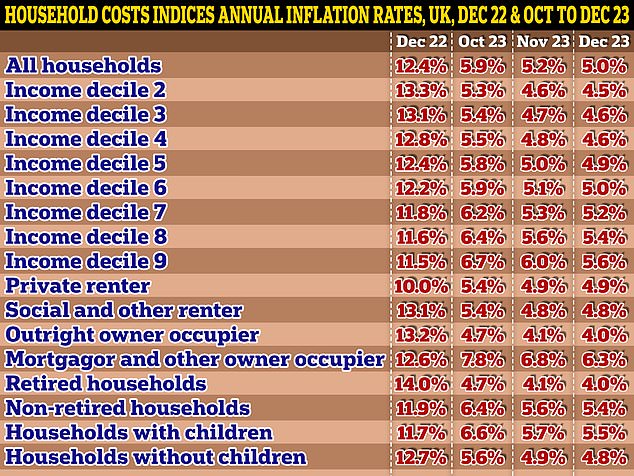

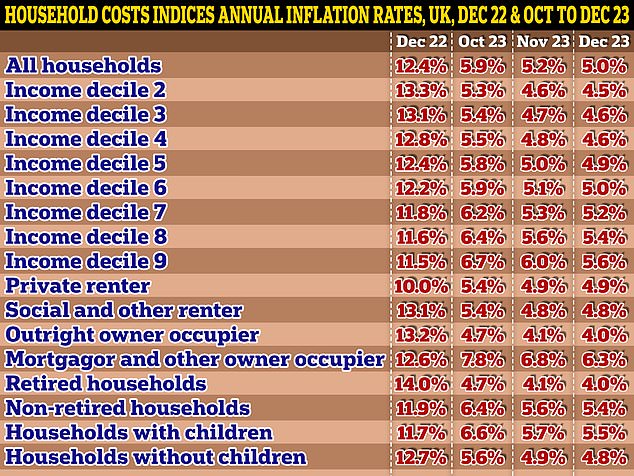

Households with a mortgage faced the biggest rise in costs in the year to December 2023, according to new data.

Mortgage-owning occupier households had the highest annual inflation rate of 6.3 per cent, reflecting rising mortgage loan interest payments, the Office for National Statistics said.

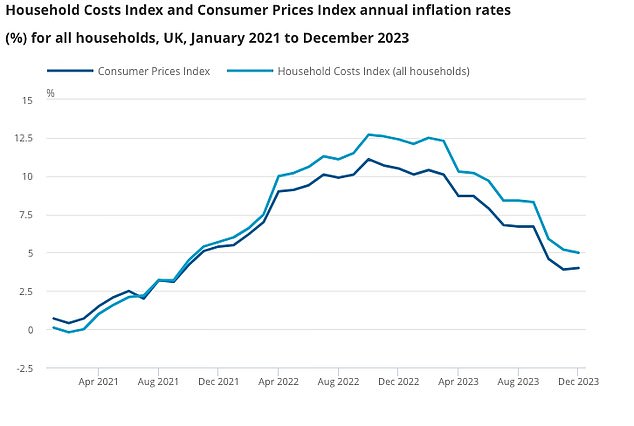

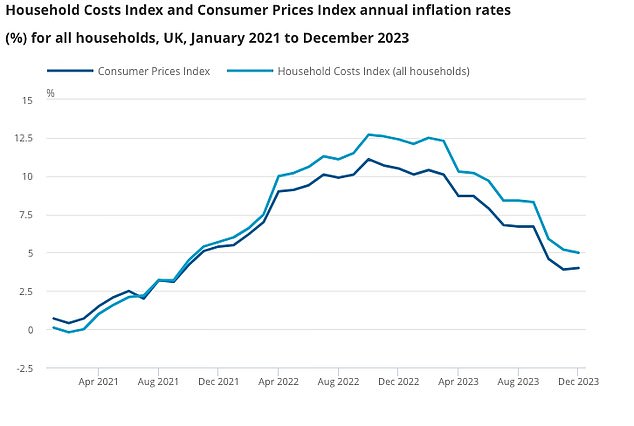

UK household costs, measured by the Household Cost Index (HCI), rose by 5 per cent on average, up from 8.3 per cent in September 2023, with housing being the biggest contributor.

Accumulation: Households with mortgages faced the largest cost increase in the year due to rising rates

In comparison, the Consumer Price Index (CPI) rose 4 percent in the year to December 2023.

Like the CPI, the HCI tracks the price of goods and services consumed by all households in the UK, but also includes changes in mortgage interest rates, stamp duty and other costs related to purchasing a home. house or apartment.

Private and social renters experienced similar inflation rates from October 2023, falling to 4.9 and 4.8 percent respectively in December 2023.

The annual rate for households occupied by freeholders fell below that of private renters in October 2023 and remained the lowest of the tenure types in December, at 4 per cent.

The ONS said private renters had the lowest cumulative rate in the four years to December 2023, at 21.2 per cent, compared to between 24.8 per cent and 26.4 per cent for other types of renters. tenure.

The ONS said groups that spent a higher proportion of their basket on mortgage interest payments, or a lower proportion on electricity, gas and other fuels where prices were falling, experienced higher annual inflation rates.

Those with lower inflation rates were hit hardest by food and drink, and recreation and culture, but this was offset by falling energy prices.

The annual inflation rate for high-income households (decile 9) increased by 5.6 percent compared to a 4.5 percent increase for low-income households.

However, this does not take into account the cumulative effect of sustained high prices.

While high-income households experienced the highest annual rate of inflation over the past three months, their four-year costs were 24.5 percent, while low-income households had a cumulative rate of 25 percent.

Non-retired households also continued to have higher costs (up 5.4 percent), while retired households saw a sharp drop from 14 percent in December 2022 to 4 percent in the year to December 2023.

Households with children also faced a 5.5 percent higher rate, while those without saw a 4.8 percent increase.