Table of Contents

More than 12 million Britons could improve their long-term financial situation by transferring cash or Isas into investments, a new report from Hargreaves Lansdown reveals.

Many of us are not on track to have enough for a comfortable retirement, with only one in seven households putting enough into their pension funds for a comfortable retirement, the report released exclusively to This is Money shows.

However, there are ways to change this by transferring money from existing cash savings or if Isa choose to invest some of your savings rather than keep the full amount in cash.

We look at savings and investment trends and how Brits could fill gaps in pensions and life insurance by moving savings around.

More than 12 million Britons could improve their financial situation by moving some cash into investments and pensions.

1. More people have emergency savings than five years ago

The percentage of Britons who have no extra money at the end of each month almost doubled between 2022 and 2023, rising from 11 per cent in 2022 to 21 per cent in 2023, data from Nationwide Building Society suggests.

But these new figures from Hargreaves paint a different picture. He shows that the number of households with enough emergency savings to cover them has increased from 46 percent in 2019 to 63 percent now.

The jump over the last five years can be attributed, in part, to lockdown savings, according to Sarah Coles, personal finance director at Hargreaves Lansdown.

Coles says: “The rise in savings is largely due to lockdown savings, which a large number of people are still holding on to, particularly those on above-average incomes.

‘The financial turbulence of recent years convinced people that they needed to hoard every spare penny and keep it on hand, in case things got even worse.

‘It means they haven’t spent their pandemic savings and, in many cases, have actually tapped into them. However, the siege mentality means they hold on to them for cash.’

Personal finance experts recommend keeping three to six months of household expenses in a cash savings account.

The emergency fund should cover your rent or mortgage payments, utility bills, food purchases and childcare and can be accessed at any time if your circumstances change.

2. Savers with large pots are not investing

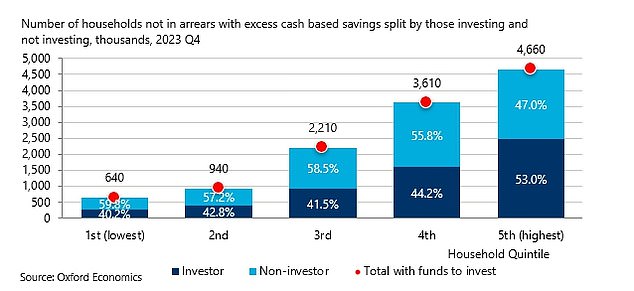

The research shows that 12.1 million households have sufficient savings and are in a position to increase their wealth for the future. But less than half of them are currently investing the extra money they have at the end of the month.

Households with incomes above £77,400 are the most likely to invest their cash, but still only around half of people in this group are currently investing.

There are 5.6 million households who have no arrears and more than enough savings, but do not invest in stocks and shares Isa.

This means that only 47 percent of the 12.1 million households without arrears and with enough savings to feel comfortable investing actually take the plunge.

For those people, this is a missed opportunity, since investing for the long term allows your money to work harder.

If you put £20,000 in a savings account paying 3 per cent over the next 20 years, it could end up being worth £36,415. If you put it on a stock exchange and the shares Isa returns 5 per cent a year, after 20 years it could be worth £54,253, or almost £15,000 more, simply for moving your money around.

Transferring extra savings that you know you won’t need for five to ten years into a Stocks and Shares Isas would improve long-term financial health, especially when it comes to later in life.

3. Those who have less to save continue investing

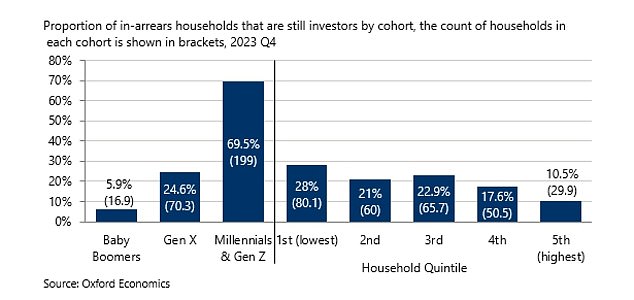

Younger and lower-income households still manage to invest even if they are behind on their payments and have less cash left.

Figures show that 15.8 per cent of defaulting households are currently investing.

Of those, nearly 70 percent of Millennial and Generation Z households who are in arrears are investing compared to just 5.9 percent of Baby Boomers who are in arrears.

But this does mean that younger households may not have enough of an emergency fund for a rainy day, suggests Hargreaves Lansdown.

One of the reasons Brits are not investing extra money is their familiarity with investments and financial literacy: households with better financial literacy are more likely to invest than those with low financial literacy.

Coles says: “A big part of why more people don’t invest is down to the fact that they have never been taught about investing, so unless they have become specifically interested, there has been no reason for them to invest.” would they ever choose above.

‘As a result, understanding of both investment and the impact of inflation is not widespread.

‘It means that some savers will simply focus on the interest they have been earning on their savings, and will not take into account how inflation has eroded their purchasing power.

‘It means that some of them have been losing money after inflation and yet they feel their money is growing because they see interest payments being added to it.

‘Others have never considered the investment and so do not understand the growth potential.

“We can see the impact that better understanding can have, because among those with better financial literacy, around half are investors, compared to less than a third of those with low financial literacy.”

A higher proportion of younger and lower-income households that are in arrears are still investing compared to their older counterparts.

4. We are not saving efficiently for retirement

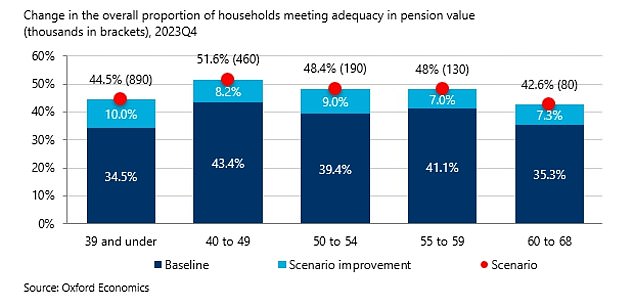

Only one in seven households, that is, more than 12.2 million people, has a pension sufficient for a comfortable retirement.

Within this group of people, 6.9 million could increase their pensions, as they have excess savings and hold investments that could be redirected to their pensions.

Helen Morrissey, head of retirement research at Hargreaves Lansdown, said: “Achieving a good retirement income can seem like a huge challenge, but for millions of households the key to helping themselves lies in their bank accounts and Isas.” .

By making small changes to the way you allocate your money, you can make a huge difference in your retirement prospects.

Paying a pension is tax relief and, because the money is invested rather than in cash, it has more opportunities to grow.

If you were investing £400 a month in cash savings, growing at 3 per cent, over 20 years, you would accumulate savings of £131,321.

If you put it into a pension and the tax relief takes it to £500 a month, growing by 5 per cent, after 20 years you could have £205,517, giving you a lump sum of £74,196 more, without having to pay. something extra inside.

If you are a higher or additional rate taxpayer, you can earn even more by benefiting from a tax relief of 40 per cent and 45 per cent respectively.

Morrissey said: “It is a relatively simple behavioral change that could see 1.8 million households over the threshold of a moderate retirement income and secure their financial future, while the prospects for the remaining households would improve significantly.”

Households with excess savings could put this money towards their pension, with only one in seven households on track to have enough for a comfortable retirement.

5. Deficiencies in life insurance could be corrected

There are 14 million households with children in Britain, but more than half of them do not have enough life insurance cover to protect their families if something were to happen to them.

Those who own their home and/or have children require greater life insurance coverage. Households that have liabilities that exceed the value of their life insurance coverage have a life insurance gap.

The difference is £89,800 for those with children, but reduces to £3,400 for the average tenant without children. It’s a staggering £194,200 for those who own their home and have children.

The report found that there are 2.4 million households that are not in arrears and can begin to cover the gap in their life insurance using the extra money they have at the end of the month. But this is mainly because they earn more.

Sarah Coles says: ‘The good news is that 2.4 million households have a solution within their reach, because they can afford to close the gap in their life insurance with the extra money they have at the end of the month, without falling short.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.