According to Zoopla, house prices will remain static through 2024 as buyers take advantage of the flat market to get deep discounts.

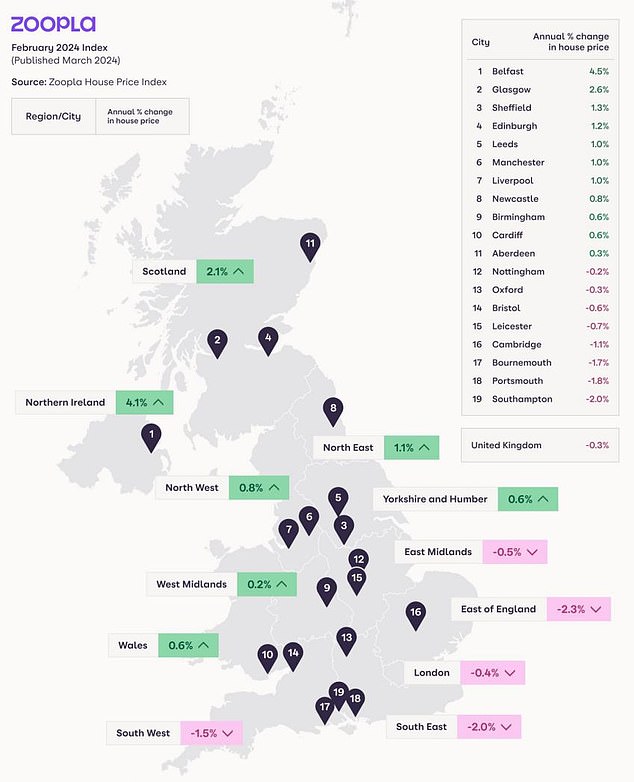

The property portal showed that house prices fell in the 12 months to March, albeit only by 0.3 percent.

Although Zoopla says house prices have recovered somewhat from six months ago, the company expects prices to level off in the second half of 2024 due to higher mortgage rates and reduced purchasing power.

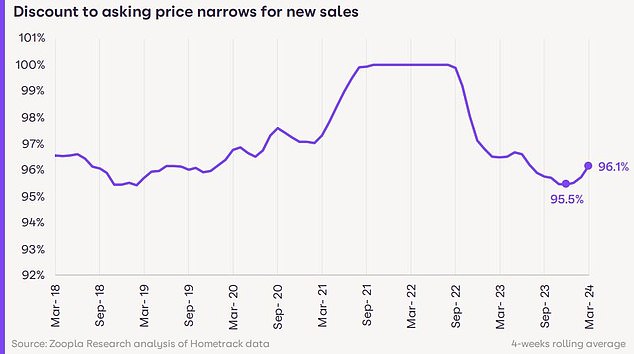

On average, sellers accept offers 4% below asking price, which according to Zoopla equates to an average discount of £10,000

Many buyers continue to haggle hard over price, as it remains largely a buyer’s market, according to Zoopla.

Two-fifths of sales agreed in March were made at a price 5 percent or more below asking price, the report said.

Half of sales fell below asking price in the last three months of 2023, but the figure remains high by historical standards.

On average, sellers accept offers that are 4 per cent below asking price, according to Zoopla, saving £10,000 or more.

However, some buyers manage to get even better deals. Zoopla added that 16 percent of all buyers received a 10 percent or more discount on the asking price, a discount of an average of £20,000 or more.

The discounts achieved have become smaller in recent months.

The average discount agreed has fallen from 4.5 percent in November last year to 3.9 percent in March 2024 – the lowest level since July last year.

Analysts at Zoopla say this reflects a combination of greater realism from sellers about their asking price and growing buyer confidence.

Discounts remain greater in London and the South East, where the average discount on asking price is 4.3 percent or £19,500.

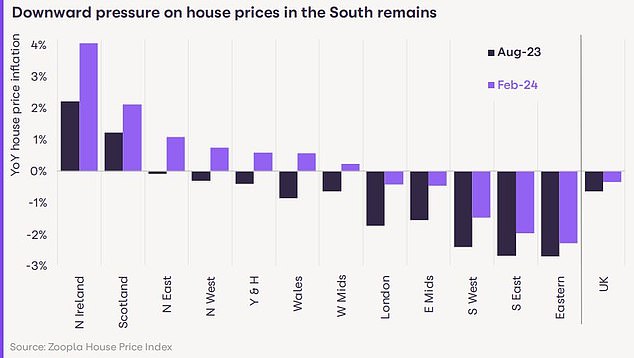

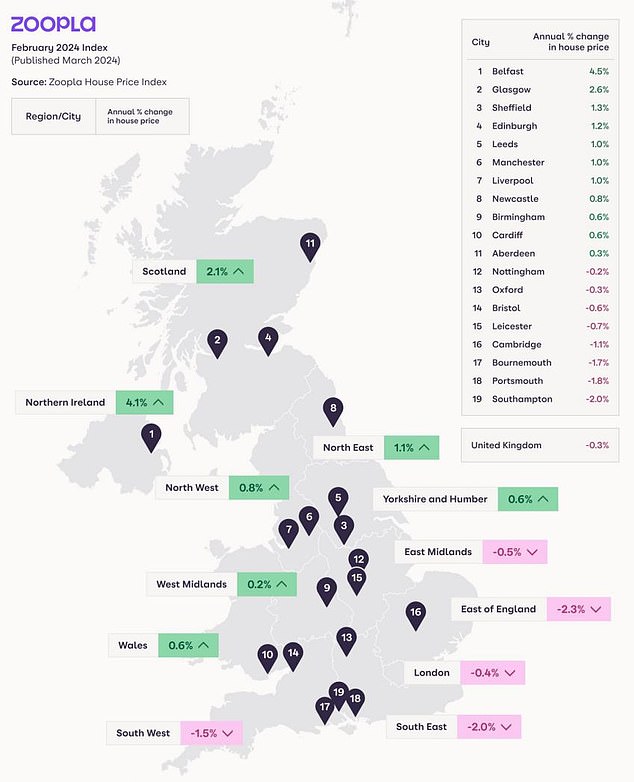

The southern parts of Britain continue to record annual price falls, led by the eastern and south-eastern regions of England: down 2.3 percent and 2 percent respectively.

However, the overall UK average is supported by Scotland and Northern Ireland, where average prices are rising by 2.1 percent and 4.1 percent year-on-year.

Agreements are being made about more home sales

Although Zoopla predicts that average house prices will remain largely flat this year, the company expects an increase in sales.

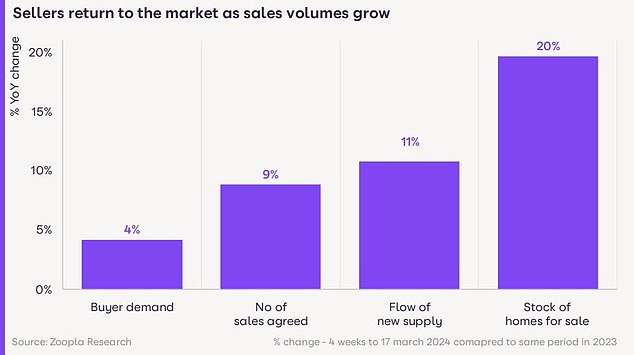

The number of new sales agreed in the first three months of this year was 7 percent higher than in the same period in 2023, the report said.

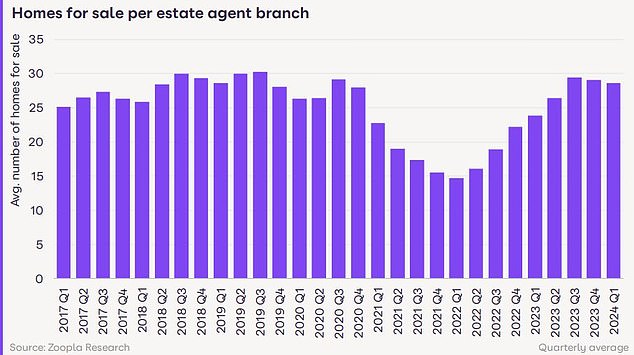

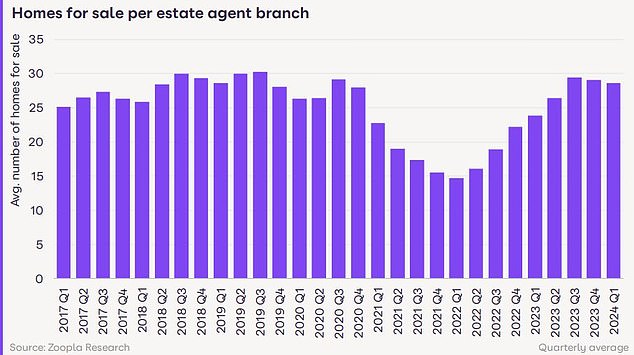

The average real estate agent has also had 11 percent more homes on the market in the past four weeks than this time last year.

In total, there are a fifth more homes for sale than at the beginning of 2023. This increased supply will keep price increases in check, according to Zoopla.

There is more going on: the number of homes for sale and the number of sales agreed have increased year after year

Richard Donnell, executive director of Zoopla, said: ‘Rising wages and falling mortgage rates have boosted consumer confidence, driving an improvement in housing market activity in the first quarter of 2024.

‘House prices are falling at a slower pace, but it remains a buyers’ market where there is a much greater choice of homes for sale.

‘We do not believe that house prices will rise faster, but there is more interest from buyers.

‘Sellers must remain realistic about where they set the asking price if they want to take advantage of improving market conditions to secure a sale and move in 2024.’

On the market: More homes are offered by real estate agents than now in 2023

What now with interest rates and the housing market?

What comes next for interest rates will largely depend on how quickly the Bank of England decides to cut the base rate. That will depend on inflation and other economic factors that play a role.

Markets are currently pricing in three rate cuts in 2024, with the first coming in June.

Economists at Capital Economics have put the first interest rate cut on the agenda for June, but have done so suggested that the Bank of England will cut the base rate to around 3 percent by the end of 2025.

This is lower than market forecasts that priced in a drop in the base interest rate to a low of 3.75 percent.

The expectations of lower interest rates are already priced into fixed-rate mortgages.

This is because banks change their fixed mortgage interest rates preventively, based on predictions about where the base interest rate will ultimately be in the future.

That is why the cheapest mortgage rates are now approximately 1 percentage point below the base rate.

Market interest rate expectations are reflected in the swap rate. These swap rates are influenced by long-term market projections for the Bank of England base rate, as well as the wider economy, internal bank targets and competitor prices.

Sonia swaps are used by lenders to price mortgages, and these have risen in recent weeks. This is one of the reasons why some lenders have increased their mortgage rates slightly.

The two-year swap rate is currently 4.36 percent and the five-year swap rate is 3.81 percent.

That offers a much more positive view of the future of interest rates than in the summer of 2023, when five-year swaps were above 5 percent and two-year swaps were yielding around 6 percent.

> View the latest mortgage rates you can apply for

In theory, if mortgage rates fall, this should increase buyers’ purchasing power and market sentiment.

Zoopla analysts believe mortgage rates around 4 per cent would support sales volumes, but incomes would need to continue to rise faster than house prices to help restore housing affordability, especially in southern England.

Rising household disposable incomes are expected to be the main driver of improved housing affordability this year.

Disposable incomes are expected to rise by 3.5 percent in 2024, while house prices will remain broadly flat this year.

Marc von Grundherr, director of Benham and Reeves estate agents, said: ‘While we are yet to see interest rates fall, there is no doubt that the certainty brought about by a sustained freeze has helped to significantly improve market sentiment.

‘Despite the disappointment with the spring budget, buyer confidence is growing and there remains a strong willingness to carry out transactions in 2024.

‘Of course, higher borrowing costs remain an obstacle, but one that buyers want to tackle now in the expectation that interest rates will fall sometime this year.

‘This has resulted in greater interest among sellers and we are also seeing a strong increase in the number of bids submitted.

‘Finding a buyer in a good position used to be a challenge in itself and so there is no doubt that market conditions have improved in this area.

‘Price remains the most important compromise for sellers when it comes to securing a buyer in today’s market, with higher mortgage rates continuing to limit buyers’ purchasing power.

‘However, the gap between this purchasing power price point and the seller’s asking price expectation has narrowed and we are finding that sellers are more than willing to make their move.’

Regional divide: There is a clear divide in Britain as the southern regions continue to record annual price falls, led by the eastern (-2.3%) and south-eastern (-2%) regions

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.