Table of Contents

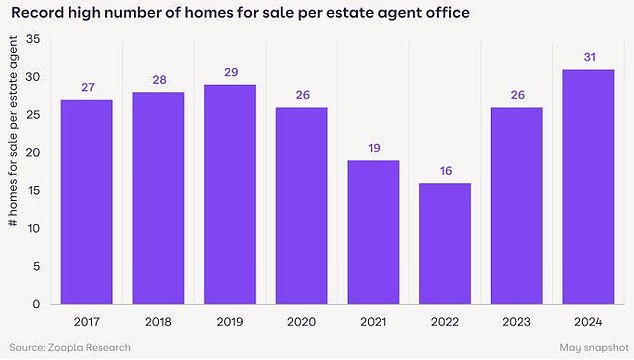

According to Zoopla, the number of homes on the market has reached the highest level in eight years, as sellers return to the market in increasing numbers.

It said the options available to homebuyers were helping to keep house prices in check, and had fallen 0.1 per cent in the 12 months to April.

The real estate portal says the average agent has 31 homes for sale, 20 percent more than this time last year.

This is due to a glut of three- and four-bedroom family homes coming up for sale, following a chronic shortage of such properties during the pandemic.

The average real estate agent has 31 homes for sale, the highest level in eight years, according to Zoopla

In terms of value, Zoopla says there is £230bn of homes for sale, up 25 per cent on a year ago.

Many homeowners are believed to have delayed their moving decisions last year amid erratic high mortgage rates and concerns about home prices.

But now that mortgage rates have fallen a bit and the market appears more stable, a growing number of homeowners who previously held off are now taking action.

Most homes for sale are new to the market. However, almost a third of the homes currently available for sale were also put up for sale in 2023, but failed to find a buyer.

Zoopla says 43 per cent of these homes that had been on the market in 2023 had their asking price reduced by more than 5 per cent to attract buyers.

What does this mean for the real estate market?

More homes on the market mean more potential buyers, as most sellers are moving to another property.

However, the number of homes for sale has generally grown faster than the agreed sales increase.

The number of homes agreed for sale is only 13 per cent higher than this time last year, although it depends on location.

For example, agreed sales increased by 22 per cent in the North East of England, but only 1 per cent in Wales.

Agreed sales are 13% higher than this time last year, but supply is growing faster

Zoopla says tax changes for holiday lets and the prospect of a double council tax on second homes are likely to encourage some homeowners to sell.

This exacerbates the expansion of homes for sale throughout the Southwest, which has the highest concentration of vacation homes.

The south west of England has seen a 33 per cent increase in homes for sale compared to last year, according to Zoopla.

This means shoppers have more to choose from, which can help them negotiate deeper discounts.

In fact, the growing number of available homes is likely to keep house prices lower, according to Richard Donnell, executive director of research at Zoopla.

It says: ‘The growth in available supply is good news, after several years in which a shortage of supply limited sales volumes and raised house prices.

“We expect this expansion in supply to keep house price inflation in check for the remainder of 2024.”

But Donnell doesn’t expect house prices to drop.

“Prices are really set by demand and affordability rather than supply,” Donnell says.

“Increased supply would keep prices static and if we saw an increase in forced sellers it would be more likely that prices would fall, but this is unlikely.”

One region that has seen much above-average growth in the number of homes for sale is the South West, where there are a third more homes for sale compared to this time last year.

House prices rise in the north of England

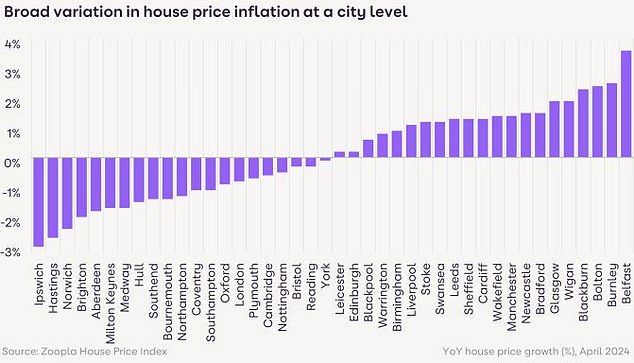

House prices are essentially stable year on year, falling just 0.1 percent in the 12 months to April, according to Zoopla.

However, there appears to be something of a divide between north and south, with prices continuing to fall across the south of England and rising in areas further north.

This is best demonstrated at city and town level, where annual house price changes range from a 3 per cent fall in Ipswich to a 3 per cent rise in Belfast.

Two other towns to record modest year-on-year house price growth are Burnley, up 2.5 per cent, and Bolton, up 2.4 per cent.

Meanwhile, house prices in Norwich are down 2.4 per cent and in Hastings by 2.7 per cent.

“This variation is due to the absolute level of house prices and levels of affordability versus higher mortgage rates,” says Donnell.

‘Coastal cities – and those that attracted an influx of demand during the pandemic in the ‘race for space’ – are seeing higher-than-average price declines as demand weakens and these one-off pandemic factors take hold. fade away.

“We expect the current variation in house price inflation to continue through 2024 as incomes and house prices realign with the biggest adjustment in London and the south of England.”

In fact, the north-south divide could continue for the next two years, according to Donnell.

“A lot depends on how fast incomes grow – the relationship between prices and incomes is most imbalanced in London and the south of England – we need incomes to grow faster than prices to restore this – it is not going to return to previous lows , but some further readjustment is necessary; much depends on the trajectory of base rates and the impact on mortgage rates.”

North/South Split: Zoopla’s Richard Donnell believes split in price growth could continue for a year or two

Will the general election affect house prices?

The announcement of the July 4, 2024 general election came sooner than many expected.

Elections typically cause greater uncertainty and some stagnation in market activity.

Donnell expects there to be a modest impact, although not as large as in the past because both parties have similar policies.

‘The election announcement is likely to slow the pace at which new sales are agreed in the coming weeks, as we approach the start of the summer slowdown.

‘Most buyers who are already in the home buying process and are close to agreeing a sale will ideally want to go ahead and agree the sale now.

“Those who are earlier in the process may try to delay decisions until the fall after the elections are over.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.