House prices rose between April and May, according to the latest figures from Nationwide.

The building society said rising wages and falling inflation helped offset the impact of higher mortgage rates on buyers.

The value of the average UK home rose 0.4 per cent in May, following a 0.4 per cent fall in April, according to Nationwide, taking into account seasonal effects.

Nationwide uses seasonal adjustment to smooth out the months that are typically busiest and least active in the housing market, and without that adjustment the increase would have been 0.9 percent.

On the rise again? House prices rose 0.4% in May, taking into account seasonal effects. This led to a slight pick-up in the annual growth rate of house prices to 1.3%.

In real terms, the average house price rose from £261,962 in April to £264,249 in May, and year on year, Nationwide said house prices rose by 1.3 per cent.

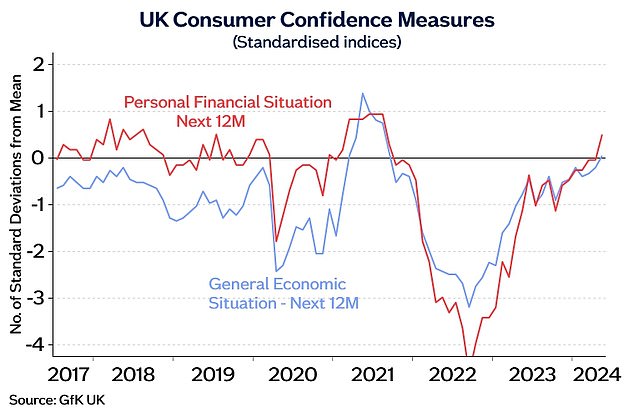

Robert Gardner, chief economist at Nationwide, said: ‘The market appears to be showing signs of resilience in the face of continued affordability pressures following the rise in long-term interest rates in recent months.

‘Consumer confidence has improved markedly in recent months, supported by solid wage gains and lower inflation.

Will house prices continue to rise?

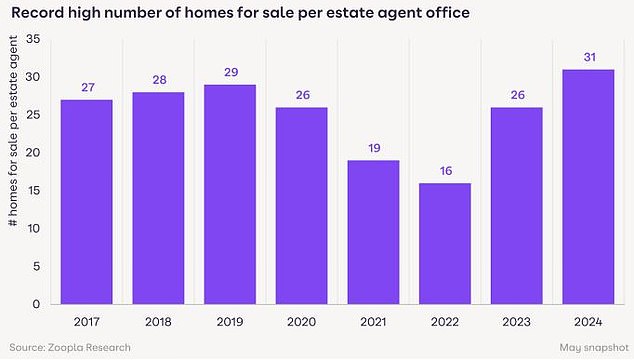

Zoopla reported yesterday that the number of homes on the market has reached the highest level in eight years.

The real estate portal said the average agent has 31 homes for sale, 20 percent more than this time last year.

In terms of value, Zoopla says there is £230bn of homes for sale, up 25 per cent on a year ago.

The average real estate agent has 31 homes for sale, the highest level in eight years, according to Zoopla

The greater variety of options available to homebuyers is believed to prevent home prices from rising further this year.

Richard Donnell, executive director of research at Zoopla, said: “The growth in available supply is welcome news, following several years in which tight supply limited sales volumes and drove up house prices.

“We expect this expansion in supply to keep house price inflation in check for the remainder of 2024.”

Will the elections affect the real estate market?

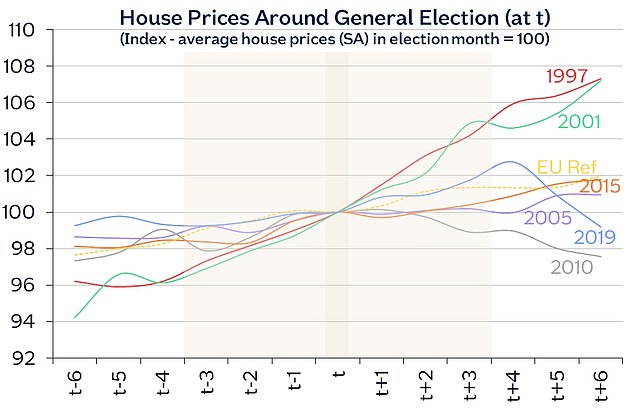

The recent announcement that the UK general election will take place on July 4 has many wondering what kind of impact – if any – this will have on the property market.

Nationwide says the past general election has not resulted in a significant change in house price trends.

Overall, he says the prevailing trends have held just before, during and after the UK general election.

No electoral changes in house price trends: at the national level, house price movements were compared in the six months prior to each election (t-6 to t-1) and after each vote (t +1 to t+6)

Anthony Codling, head of European housing at investment bank RBC Capital Markets, said: House prices rose in May, confirming that UK house prices are holding firm in the face of economic uncertainty.

‘It is too early to say whether the election will affect house prices, but Nationwide agrees with our view that the general election does not appear to affect house prices.

“Life goes on outside the ballet box and it seems that life in our own homes is more important than life inside 10 Downing Street.”

Many in the property industry predict that the Bank of England’s base rate cuts, when they arrive, will have more impact on the property market than the general election.

Verona Frankish, chief executive of online estate agency Yopa, said: “Despite a prolonged period of higher interest rates, we have yet to see any notable decline in property values and it appears the tide has well and truly turned. , as the market begins to gain momentum following a resurgence in market activity so far this year.

“The possibility of a base rate reduction in the coming months will only help boost current sentiment and we expect the market to move forward undeterred by the political noise generated from the impending election.”

Nationwide’s chief economist says confidence has improved markedly in recent months, supported by strong pay rises and lower inflation.

Nicky Stevenson, managing director of national estate agent group Fine & Country, added: “Previously hesitant homebuyers are feeling more confident in pulling the trigger on their moving plans as financial strains ease.”

“With inflation approaching the Government’s target of 2 per cent and interest rate cuts possible this summer, demand may increase further in 2024.

‘This will help stabilize or even drive up prices amid competition from buyers, which will be positive for sellers.

‘Lenders are also lowering rates in response to more favorable terms, making home ownership more affordable, especially for first-time buyers who were previously deterred by high monthly payments or excessively long mortgage terms.

“If current trends persist, the UK property market could see a steady rebound, with prices rising moderately in popular areas and hot markets.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.