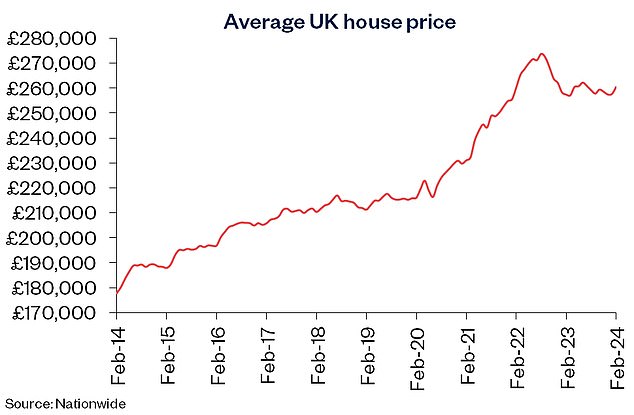

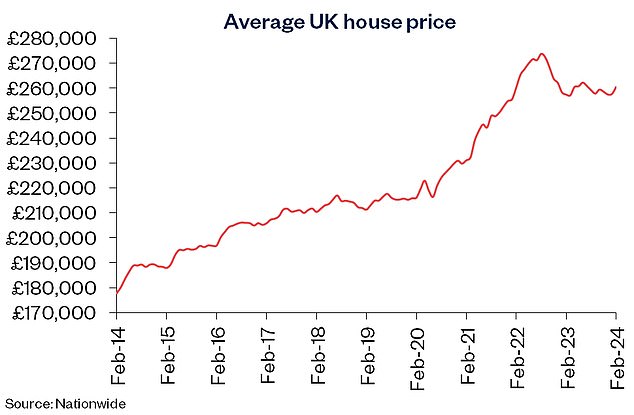

Property prices rose in February due to lower mortgage rates, according to the latest national house price index.

Britain’s largest building society recorded a 0.7 per cent rise in average house prices after taking into account seasonal effects.

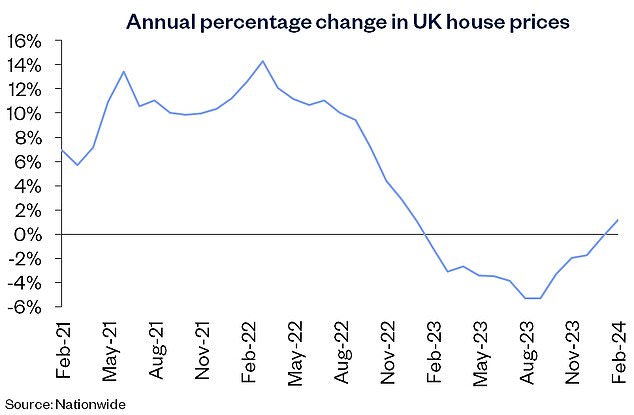

It means house prices have risen 1.2 per cent since this time last year, the first time Nationwide has recorded a positive annual reading since January 2023.

But prices are still about 3 percent below the record highs recorded in the summer of 2022.

Annual increase: nationally recorded a year-on-year increase in house prices for the first time in 13 months

Average house prices peaked at £273,751 in August 2022, according to Nationwide. They are currently at £260,420 in February.

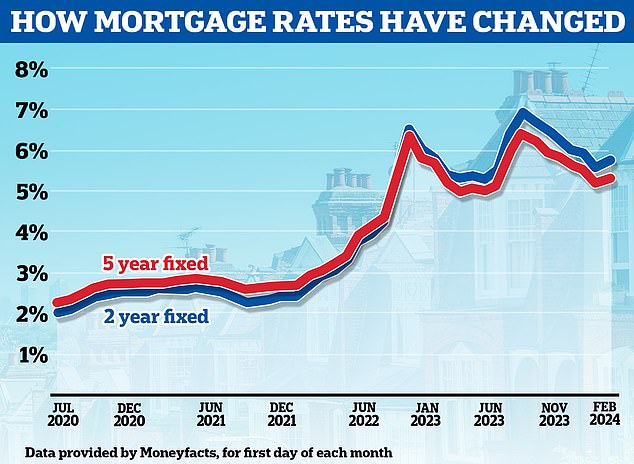

The recent price rally is attributed to lower mortgage rates. Although rates rose last month, this came after five consecutive months in which mortgage rates fell.

The average two-year settlement has fallen from a high of 6.86 percent to 5.75 percent, according to Moneyfacts, while the average five-year settlement has fallen from a high of 6.37 percent to 5.33 percent.

For homebuyers with the biggest deposits, it is now possible to secure a five-year fix of 4.09 per cent and a two-year fix of 4.39 per cent.

Robert Gardner, chief economist at Nationwide, said: ‘The decline in borrowing costs at the start of the year appears to have sparked a rebound in the housing market.

“Indeed, industry data sources indicate a notable increase in mortgage applications at the beginning of the year, while surveyors also reported an increase in inquiries from new buyers.”

More affordable? Mortgage rates have fallen from summer 2023 highs

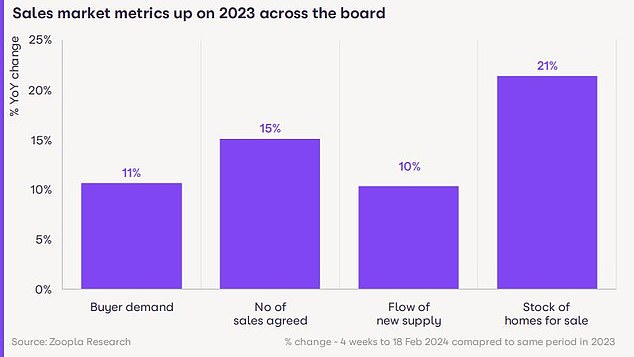

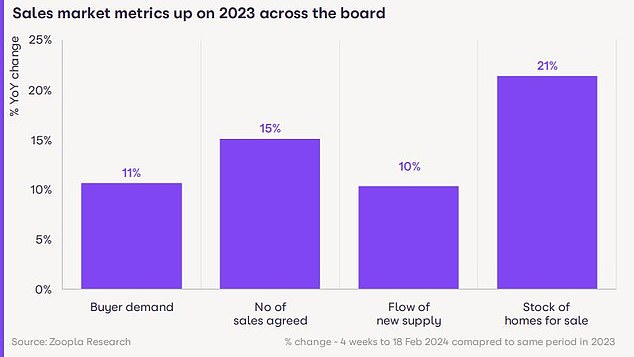

Yesterday, the Zoopla House Price Index reported an increase in the number of buyers and sellers on the market, resulting in more sales in early 2024.

Many in the property sector have welcomed Nationwide’s figures as evidence that the property market is recovering.

Nicky Stevenson, managing director of national estate agent group Fine & Country, said: “Positive signs for the housing market are moving from a trickle to a flood this year, with the annual change in house prices rising for the first time. in 13 months.”

‘Demand is rising as lower mortgage rates have encouraged buyers to restart their property search, and falling inflation suggests better news is to come.

“We are approaching one of the best seasons for home sales and sellers should consider this a good time to put their home on the market.”

Warming up? Zoopla reported that buyer demand is 11% higher than a year ago, while the number of agreed sales increases 15% year-on-year

Jonathan Hopper, chief executive of Garrington Property Finders, added: “It’s a recovery, not a problem.” Data from Nationwide shows that house prices have risen in four of the last five months, and the upward momentum is now so strong that prices are rising at this time last year.

‘The most important thing is that the market has also become more fluid. For sale signs are starting to appear on homes across the country, and real estate agents are reporting a steady increase in interest from both buyers and sellers.

“A growing number of buyers who stood by last year are deciding that now is the time to strike, before prices begin to accelerate upwards.”

On the rise: But Nationwide says house prices remain around 3% below record highs recorded in summer 2022.

New increases “will depend on mortgage rates”

Nationwide’s chief economist warned about future interest rates.

‘The near-term outlook remains highly uncertain, partly due to ongoing uncertainty about the future path of interest rates.

“Borrowing costs remain well below last summer’s peaks but, if the recent upward trend continues, it threatens to slow the pace of any housing market recovery.”

While house price indices show the general trend across the country, the picture varies depending on where you live in the UK.

Nationwide’s house price index relates to its own approved mortgage applications and therefore does not include cash buyers or mortgage data from other lenders.

Another lender that also tracks house prices based on its own mortgage applications is Halifax. It said average prices rose 2.5 per cent in the 12 months to January.

ONS house price figures are widely regarded as the most comprehensive and accurate index. This is because the report from the UK’s official statisticians uses data from the Land Registry and is based on average sales prices.

However, property transactions often take months to complete, meaning ONS figures do not necessarily reflect what is happening in the property market at the moment.

Earlier this month, the ONS revealed that the average UK house price fell by 1.4 per cent in the year to December 2023.

Another monthly index comes from Rightmove. This tracks newly listed sales prices each month, which can provide a more immediate picture of what’s happening in the market, but it doesn’t measure the final sale price of homes.

Rightmove reported that average selling prices rose 0.9 per cent in February to £362,839, according to the company’s latest data, following a 1.3 per cent rise in January.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.